Bitget Daily Digest(September 29)|Ethereum Spot ETFs See Record $795 Million Single-Day Outflow; BTC Surges Past $110,000 Amid Market Volatility

Today’s Preview

- Agents Unleashed: The Next Wave will take place online at 10:00 (UTC+8) on September 30, 2025, focusing on AI agents and Web3. The event is organized by relevant developer communities.

- Web3 Gaming Labs will be held in Singapore on September 29, 2025, highlighting how blockchain empowers the next generation of gaming, connecting developers, investors, and players.

- Web3 Growth Guild will be hosted in Singapore on September 29, 2025, fostering collaboration among builders, founders, communities, and DAO leaders through discussion and networking in the Web3 sector.

Macro & Hot Topics

- The total cryptocurrency market cap is approximately $3.67 trillion, down 5.76% from last week. BTC has rebounded to over $110,000, while ETH has dropped below $4,000. The Fear & Greed Index stands at 34.

- Spot Ethereum ETFs saw record $795 million in outflows, raising concerns over institutional confidence.

- The CEO of Tether emphasizes that USDT’s technology and strategy have become the blueprint for other USD stablecoins, highlighting its leading position.

- Galaxy Digital’s CEO suggests the appointment of the next US Federal Reserve chair could be the biggest catalyst for Bitcoin’s next bull run, potentially pushing BTC to $200,000 in 2025.

Market Trends

1、BTC and ETH have been oscillating over the last 4 hours; market sentiment remains cautious. Roughly $126 million in liquidations over the past 24 hours—primarily short positions.

2、All three major US stock indices closed higher on September 26: Dow +0.65%, Nasdaq +0.44%, S&P 500 +0.59%—indicating optimistic market sentiment.

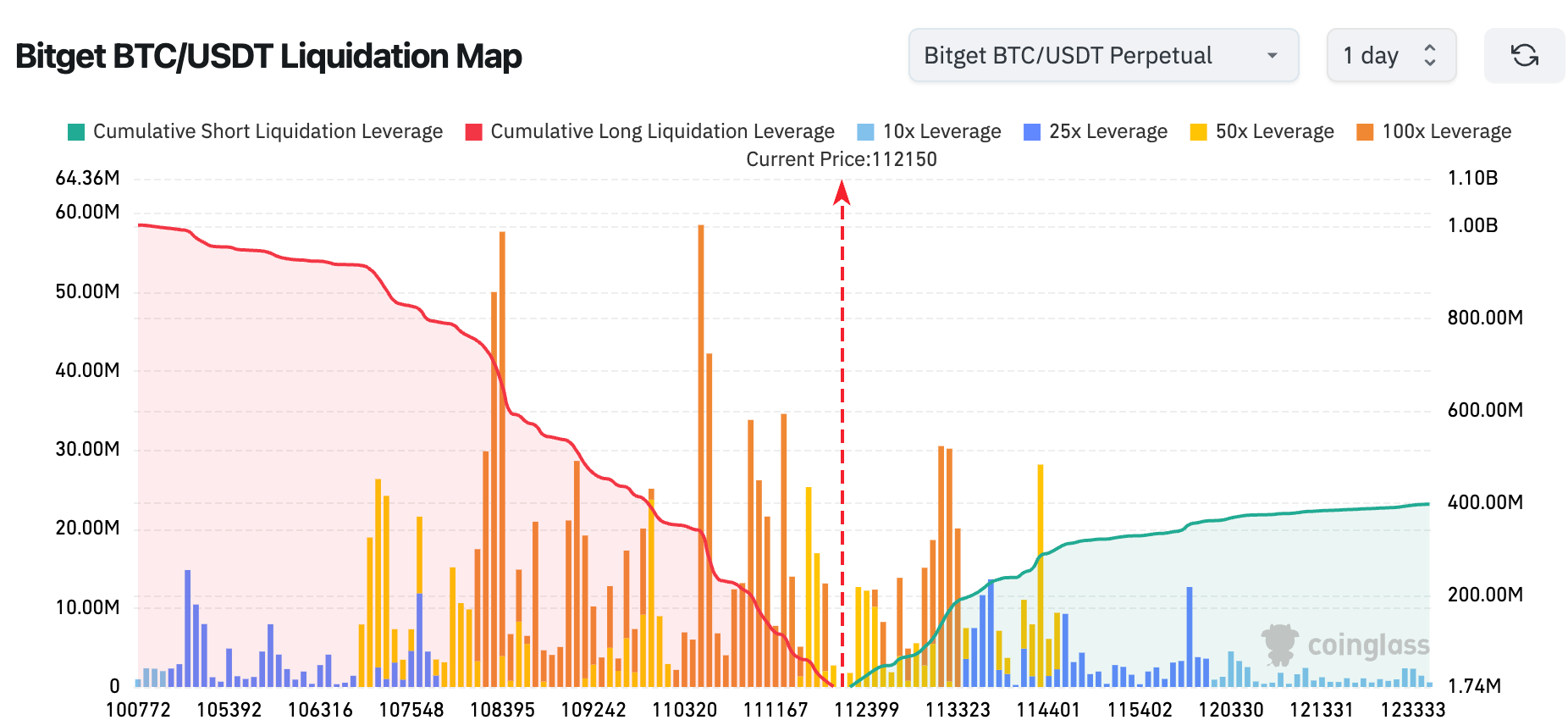

3、Bitget’s BTC/USDT liquidation map shows current price at $112,191, with significant long liquidation pressure. High-leverage (100x) longs are concentrated, and a price drop could trigger cascading liquidations—extreme volatility warning.

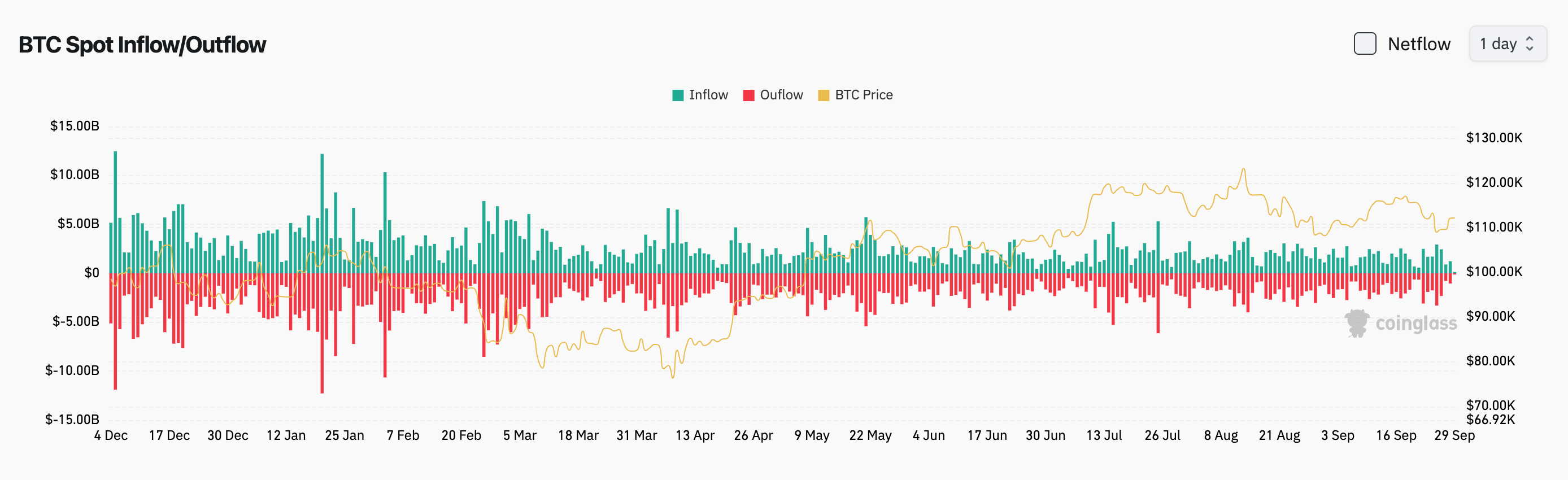

4、In the last 24 hours, BTC spot inflows totaled $165 million, outflows $189 million, for a net outflow of $24 million.

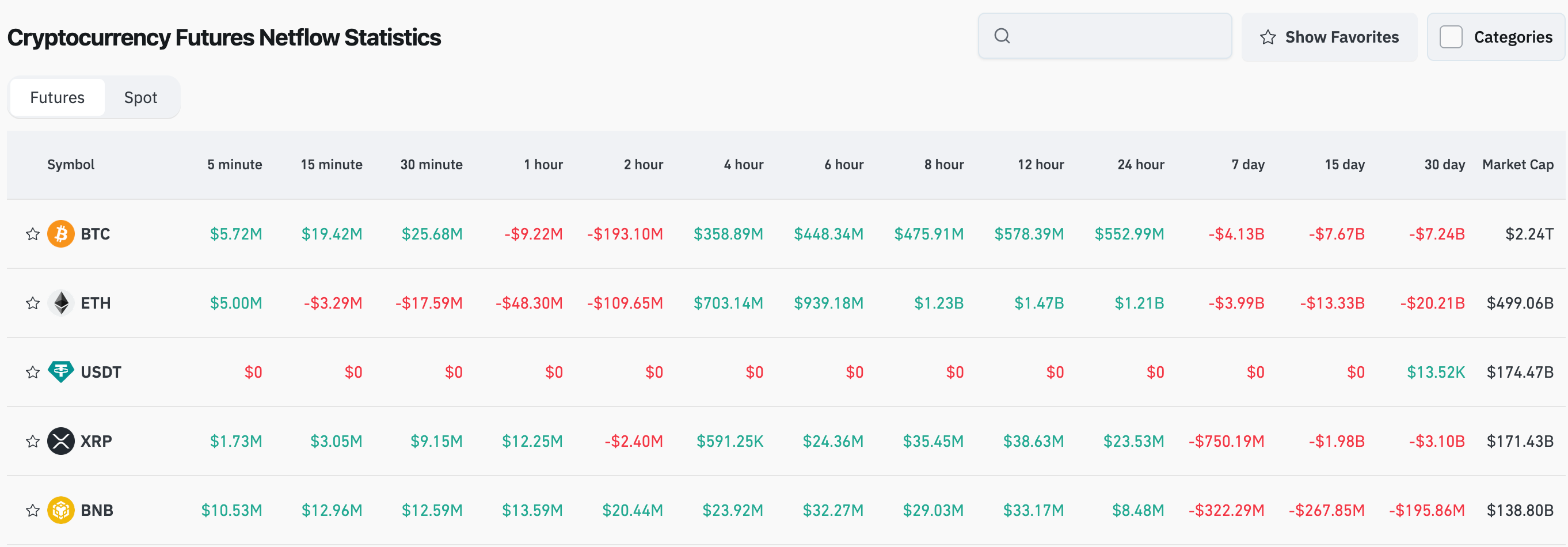

5、Over the past 24 hours, derivatives trading in BTC, ETH, XRP, and BNB saw leading net outflows—potential trading opportunities may emerge.

News Updates

- The US SEC and CFTC will hold a joint meeting on September 29 to coordinate crypto regulation and enhance US market competitiveness.

- The NASDAQ exchange submitted a proposed rule change to update the Hashdex Nasdaq Crypto Index US ETF.

- A wallet address dormant for nearly 12 years holding 400 BTC (about $44.32 million) was reactivated on September 29.

Project Developments

- Cyber Hornet Trust: Filed with the US SEC for three new ETFs tracking the S&P 500, as well as ETH, XRP, and Solana futures.

- Wormhole: Founder publicly criticized Tether and Circle’s revenue distribution structures, drawing industry attention.

- Aave: Total Plasma chain deposits surpassed $6.5 billion, with daily inflows exceeding $1.5 billion.

- Vitalik Buterin: Sold 150 billion Puppies meme tokens in exchange for 28.57 ETH.

- SUI/EIGEN/ENA: Each project faces token unlocks this week, with a combined value exceeding $100 million.

Disclaimer: This report is AI-generated and manually verified for information accuracy. It does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?