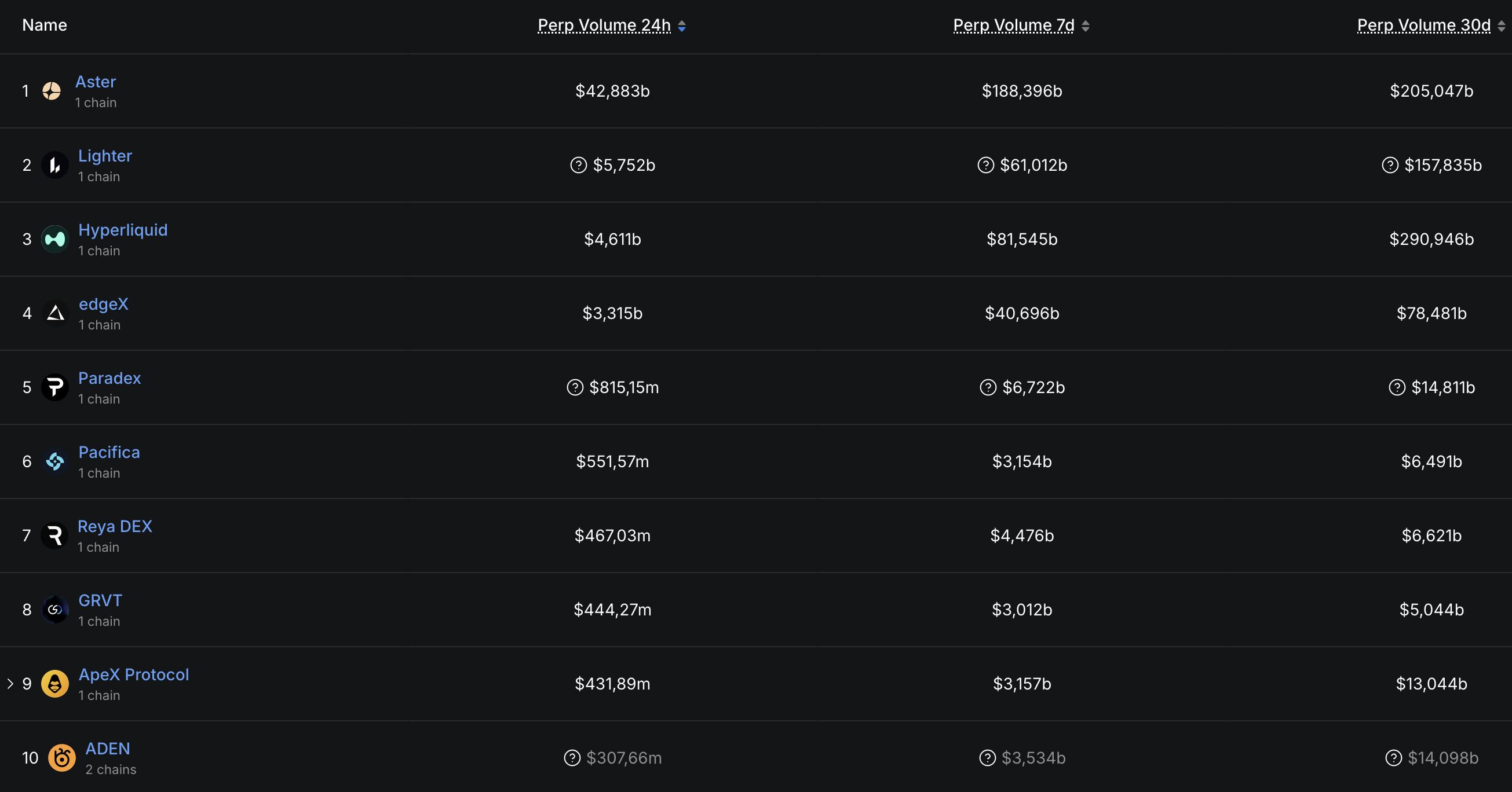

Aster has emerged as a frontrunner in decentralized perpetual futures platforms, recording the highest daily transaction fees according to DefiLlama data. Surpassing $25 million in fee revenue within the last 24 hours, Aster has overtaken formidable competitors, including Hyperliquid.

Aster’s Ascension

According to DefiLlama’s latest data, Aster has claimed the top position in daily transaction fees, while securing the 13th spot in spot trading volume with $199.96 million. In contrast, its competitor Hyperliquid reported a $477.3 million trading volume, positioning itself ahead of Aster in this sector. Notably, Aster’s absence from the daily revenue rankings draws attention.

A distinguishing feature of the platform is its stealth orders capability, enabling users to place limit orders that are not visible in the market. This unique offering differentiates Aster from many decentralized exchanges reliant on transparent order books. Additionally, its provision of high leverage and multi-blockchain support has significantly aided its rapid adoption.

The backing from YZi Labs, formerly known as Binance Labs, has played a crucial role in Aster’s growth. Following its merger with Astherus in March, the platform transitioned from the APX Finance brand to Aster, prominently advancing a multi-blockchain approach with a focus on the BNB Chain.

Impressive Performance of ASTER Coin

The platform’s recognition further surged with the coin launch on September 17. During this event, ASTER coin’s fully diluted valuation (FDV) leaped from $560 million to a remarkable $15.1 billion. Binance co-founder and former CEO Changpeng Zhao’s public endorsement through X on September 17 further fueled this momentum, asserting that while Aster competes with Binance, it also contributes positively to the BNB ecosystem.

In terms of price performance, ASTER experienced a 1.76% decline in the last 24 hours, trading at $1.89. Despite this short-term pullback, the attained market valuation of the altcoin indicates sustained investor interest.