Yearn Finance proposes allocating 90% of protocol revenue to YFI token stakers

ChainCatcher News, according to DLNews, anonymous contributor 0xPickles recently submitted a comprehensive reform proposal aimed at reshaping the development trajectory of the DeFi protocol Yearn Finance.

The three plans in the proposal attempt to revitalize the project through income distribution reform, strengthened contributor accountability, and token value sharing. The core change of the proposal is that 90% of the protocol's revenue will be directly distributed to holders of locked YFI tokens.

Under the new mechanism, users can participate in revenue distribution by staking YFI to obtain stYFI certificates. Specifically, this includes: · Staking model replaces vote escrow: eliminating complex mechanisms and adopting direct staking for income distribution · DAO governance restructuring: establishing a profit-centered decision-making mechanism, requiring contributor budget applications to be accompanied by on-chain financial reports · Institutionalized contributor incentives: allocating 1,700 YFI (approximately $500,000) for strategic incentives, setting capped performance bonuses and a long-term contributor retention pool.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Juventus shares surge nearly 14% after rejecting Tether's acquisition offer

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

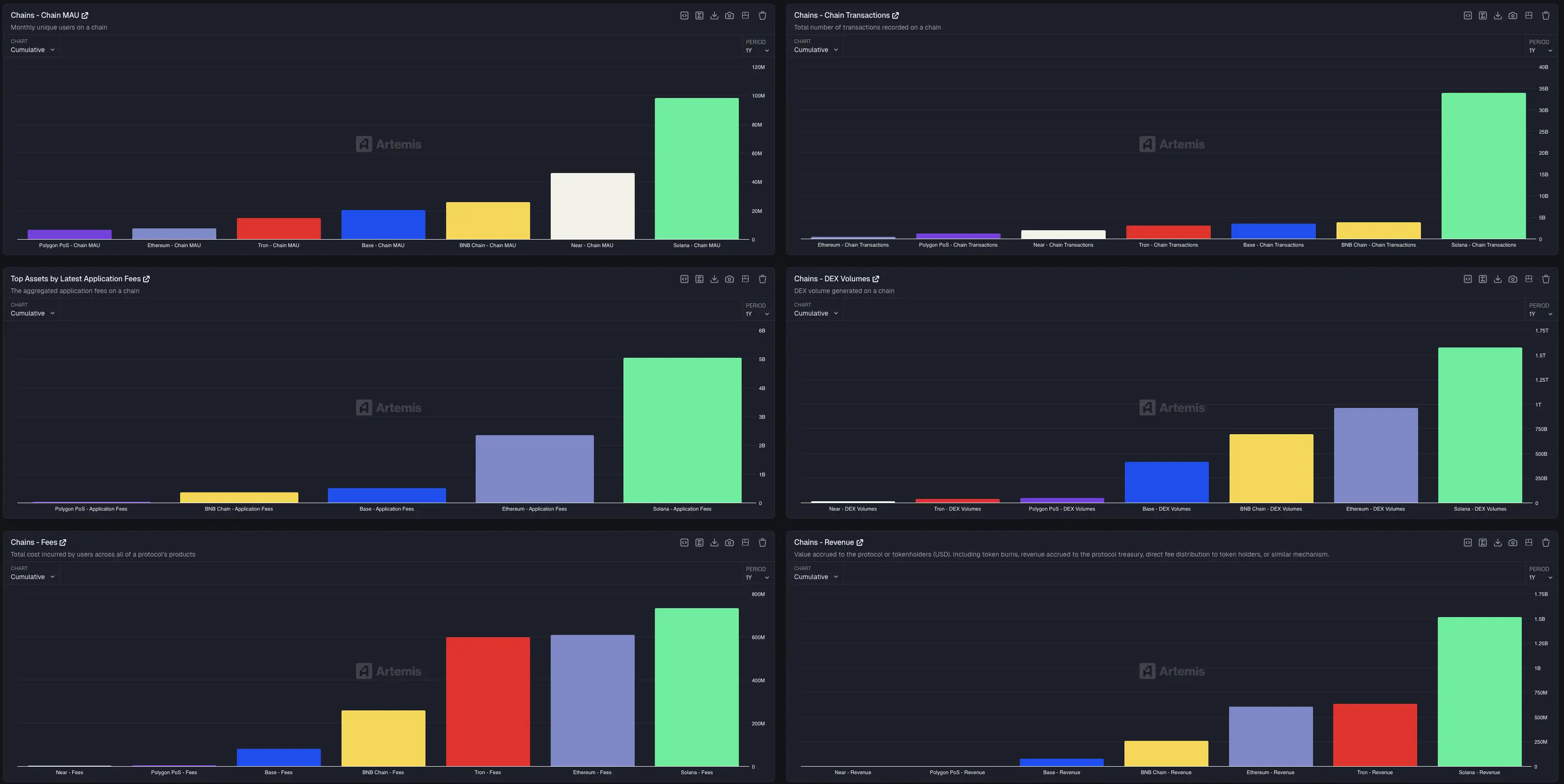

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB