From ETF Buzz to Rising Network Activity: Why Litecoin Could Lead in Q4

Litecoin’s Q4 prospects strengthen as ETF optimism grows, large transaction volumes rise, and payment adoption surges, hinting at undervaluation.

Litecoin (LTC), an altcoin that uses the proof-of-work consensus mechanism and was once called “digital silver,” is working to regain its former glory. Fundamental factors strengthen the network’s resilience and utility, but the price does not reflect those underlying values.

A few signals suggest that Litecoin’s momentum is reviving and growing in the year’s final quarter.

Average Transaction Value, Litecoin ETF, and More

According to expert Nate Geraci, the US Securities and Exchange Commission (SEC) will soon issue final decisions on spot crypto ETF applications in the coming weeks.

The Canary Litecoin ETF application is the first in line. A decision is expected this week on October 2, followed by rulings on other altcoins such as SOL, DOGE, XRP, ADA, and HBAR.

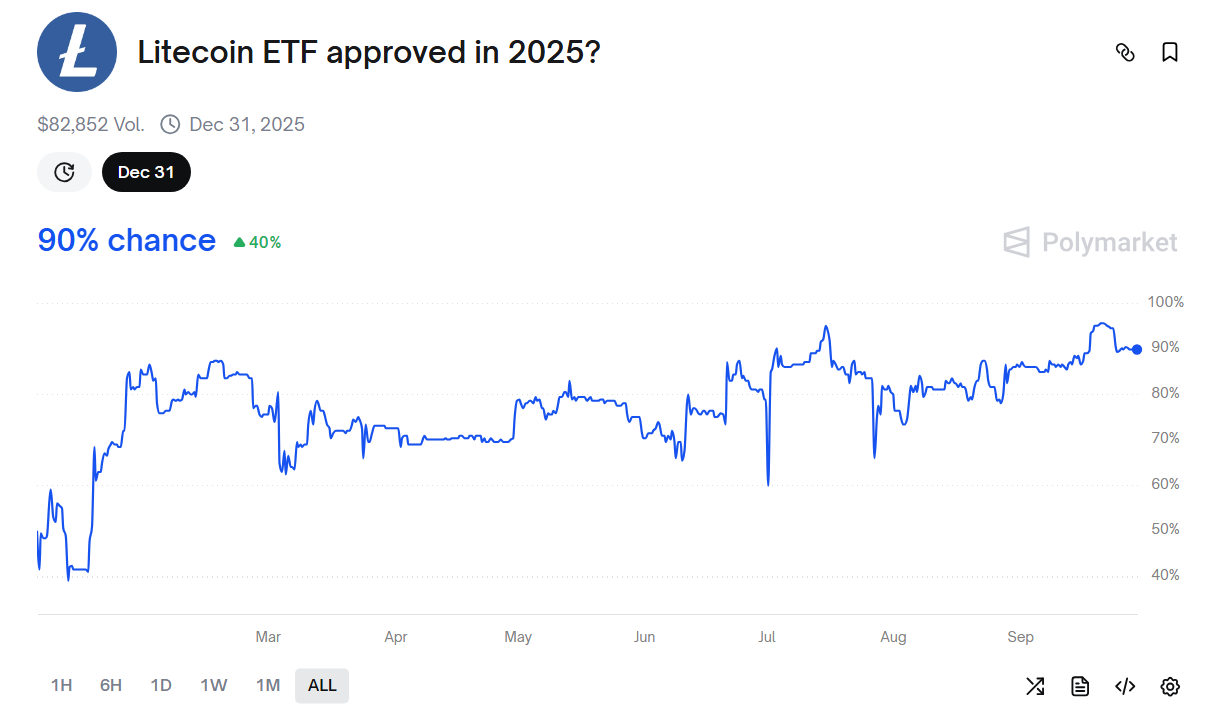

Prediction platform Polymarket currently assigns a 90% probability that regulators will approve a Litecoin ETF in 2025. Investors show strong confidence in this outcome.

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

Litecoin ETF Approval Possibility in 2025. Source:

Polymarket

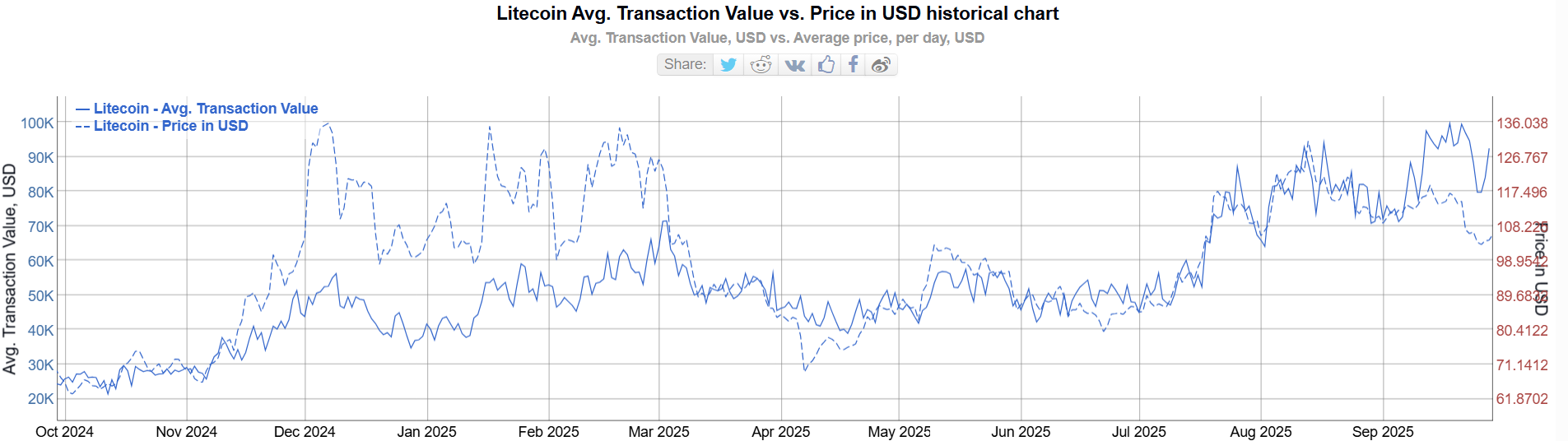

Second, Litecoin’s average transaction value has reached a two-year high, signaling a surge in large transactions across the network.

Data from BitInfoCharts shows that the average transaction value (solid line) climbed from $25,000 at the end of 2023 to nearly $100,000 in September 2025, four times higher and the highest level in two years.

Average LTC Transaction Value. Source:

Bitinfocharts

Average LTC Transaction Value. Source:

Bitinfocharts

The rise is noteworthy because LTC’s price remained stable at around $100 without hitting new highs. This suggests more LTC is moving across the network. These could be payment transactions or accumulation moves.

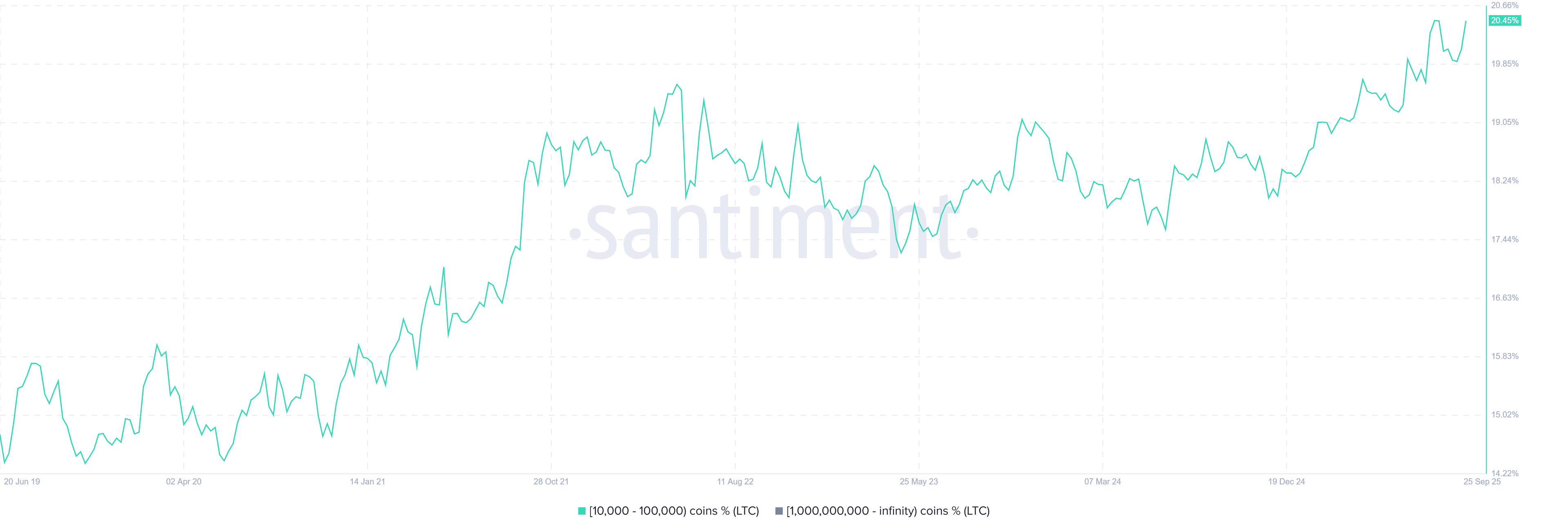

Recent Santiment data support the accumulation thesis. Wallet addresses holding between 10,000 and 100,000 LTC have grown steadily over the past five years, accounting for more than 20% of the supply.

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

Share of Supply Distribution of Wallet Addresses Holding Between 10,000 and 100,000 LTC. Source:

Santiment

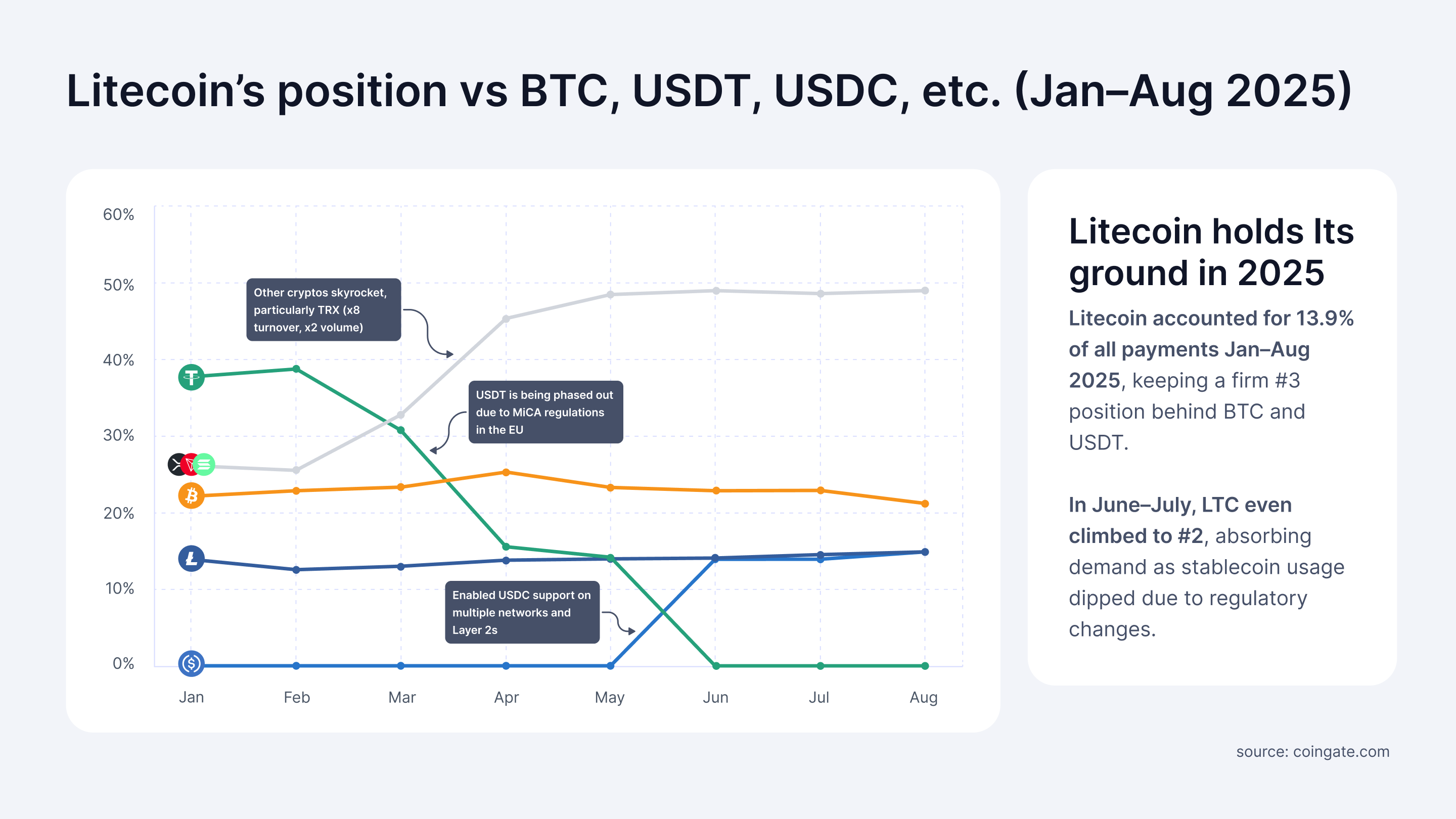

Third, a report from CoinGate highlights Litecoin’s dominance in consumer payments on its platform. From January to August 2025, LTC represented 13.9% of all transactions, ranking third behind Bitcoin (23%) and USDT (21.2%).

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

Litecoin’s Dominance in Consumer Payments. Source:

Coingate

“Litecoin payments remain steady across the year, with higher usage when competing assets face headwinds. Rather than being a marginal alternative, Litecoin has proven it can capture meaningful share when circumstances change, which is a clear sign of resilience and user trust,” CoinGate reported.

These positive signs of adoption lead many analysts to argue that LTC is undervalued compared to the utility its network delivers.

“Litecoin is at least 50x undervalued… it’s actually more once price goes vertical and it catches the next wave of adoption, likely sending it another 10x… so 500x undervalued,” analyst Master predicted.

However, competition remains fierce. Other altcoins, such as ETH, SOL, XRP, and XLM, are also cementing their roles in the growth of DeFi and global payments. Investors, therefore, may find strong alternatives for their portfolios beyond LTC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Saylor’s Bitcoin Bet—Genius Move or Risky Venture?

- MicroStrategy's $835M Bitcoin purchase (8,178 BTC) raises questions about its strategy amid a 56% stock price drop and $61B BTC holdings. - Critics like Peter Schiff call the model unsustainable, while Arca's Jeff Dorman disputes forced sale risks as Bitcoin ETFs see outflows. - Bitcoin's $94K price and MicroStrategy's $8.1B debt amplify risks, with shares trading at a 19% premium to NAV amid bearish altcoin trends. - Regulatory support for Bitcoin tax payments contrasts with market volatility, as Saylor

Polkadot News Update: Dalio: Federal Reserve's Support Sustains AI Market Surge, Withdrawal Remains Too Soon

- Ray Dalio warns AI-driven stock market nears bubble territory but advises against premature exits, citing Fed's accommodative policy as a key deflationary delay. - His proprietary bubble indicator at 80% capacity highlights AI speculation risks, yet rate cuts until 2025 could prolong the rally before any correction. - Nvidia's $57B Q3 revenue and S&P 500 record highs underscore AI's market dominance, while energy/software sectors show AI's expanding systemic impact. - Dalio urges investors to monitor Fed

Solana News Update: Abu Dhabi Commits $54 Billion—Blockchain Innovation and Strategic Alliances Drive Global Hub Aspirations

- Abu Dhabi secures Solmate-Solana blockchain partnership during Finance Week, aligning with $54B infrastructure and global innovation goals. - Five-year infrastructure plan combines government funding and public-private partnerships to boost connectivity across key regions. - Indian firms show 38.4% CAGR growth in Abu Dhabi (2019-2024), driven by business-friendly policies and strategic market access advantages. - Bitcoin Munari integrates Solana blockchain for token operations, highlighting UAE's role in

Bitcoin News Update: MSCI Index Removal Threatens to Topple MSTR's Fragile Structure

- MSCI's potential removal of MicroStrategy (MSTR) from major indices risks triggering $8.8B in passive outflows, worsening its fragile financial position. - JPMorgan warns index exclusion would damage MSTR's valuation credibility and hinder capital raising amid Bitcoin's 30% drop and collapsing stock premium. - MSTR's reliance on high-yield preferred shares has backfired as yields rise to 11.5%, while MSCI's recalibration of float metrics sparks sector-wide uncertainty. - The January 15 decision could res