Wisconsin bill to exempt crypto businesses from money licenses

Wisconsin lawmakers have introduced a bill on Monday that, if enacted, would exempt individuals and businesses in the state from requiring money transmitter licenses to participate in mining, staking and exchanging digital assets.

According to a document from the Wisconsin Legislative Reference Bureau, the bill seeks to clearly define exemptions from requiring a license from the Department of Financial Institutions for money transmission-related activities.

Under the proposed exemptions of Wisconsin Assembly Bill 471, individuals or businesses would not need DFI licences for crypto mining, staking and developing blockchain software.

It also exempts the exchanging of digital assets if the transactions don’t involve the “conversion to legal tender” or bank deposits.

“Under the bill, neither a state agency nor a political subdivision may prohibit or restrict a person in accepting digital assets as a method of payment for legal goods and services or in taking custody of digital assets using a self-hosted wallet or hardware wallet,” the document reads, adding that:

“The bill also specifies that a person in this state may 1) operate a node for the purpose of connecting to a blockchain protocol and participating in the blockchain protocol’s operations; 2) develop software on a blockchain protocol; 3) transfer digital assets to another person utilizing a blockchain protocol; and 4) participate in staking on a blockchain protocol.”

The bill marks another attempt to reduce some of the legal gray area surrounding state-based crypto regulation. There is still a lack of clear rules across the country for crypto despite increasing adoption.

Wisconsin bill still has hurdles to pass

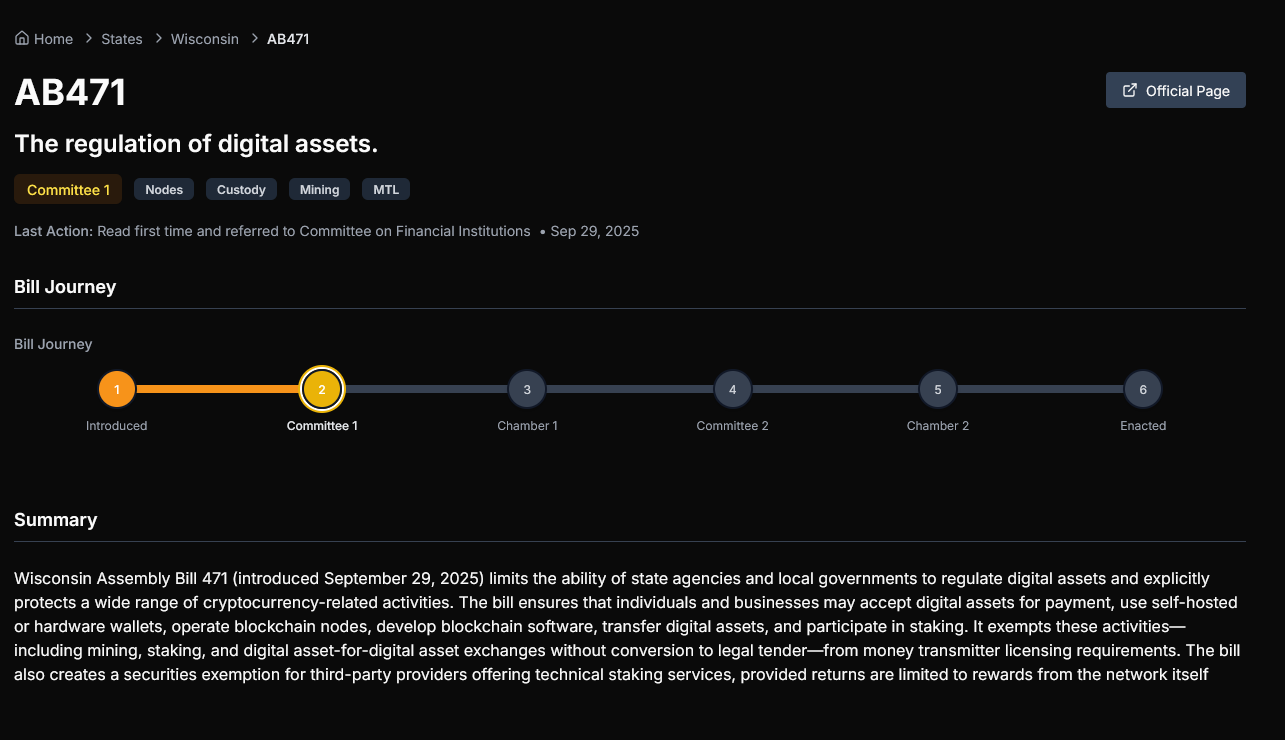

The bill is sponsored by seven Republican members at the House level, and two Republican co-sponsors from the Senate, and has since been referred to the Committee on Financial Institutions.

According to Legiscan, the bill has a current progression rate of 25%, as it still has to pass through one chamber and two more committees before it could potentially be enacted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SCOR partners with Edison Chen to launch "The 888 Continuum"—a phased on-chain campaign where in-game "superpowers" unlock exclusive CLOT sneaker drops, gear, and digital collectibles.

SCOR announced today a major strategic partnership with creative director, cultural icon, and CLOT founder Edison Chen.

Saylor continues Bitcoin purchases despite the storm: His plan becomes clearer

Trending news

MoreBitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest

SCOR partners with Edison Chen to launch "The 888 Continuum"—a phased on-chain campaign where in-game "superpowers" unlock exclusive CLOT sneaker drops, gear, and digital collectibles.