Full Text of Arthur Hayes' Speech in South Korea: War, Debt, and Bitcoin—Opportunities Amid the Money Printing Frenzy

This article summarizes Arthur Hayes' key viewpoints at the KBW 2025 Summit, stating that the United States is heading towards a politically driven “money-printing frenzy.” It details the mechanisms of financing reindustrialization through Yield Curve Control (YCC) and commercial bank credit expansion, emphasizing the potentially significant impact this could have on cryptocurrencies.

Original Translation|angelilu, Foresight News

On September 23, Arthur Hayes attended the KBW 2025 Summit in South Korea and delivered a keynote speech. His speech outlined the potential phenomenon of "crazy money printing" that may occur in the United States in the future, analyzing its historical roots, political drivers, and possible specific mechanisms for implementation. He also discussed why, as crypto investors, we should care about these issues. The following is the full text of Arthur Hayes' speech:

Opening and Background: Heading Toward Crazy Money Printing

Alright, this is going to get a bit technical, talking about who votes on what and so on. But I think it's crucial to understand where we currently are on the path toward the United States ultimately embarking on crazy money printing. This actually started when Donald Trump was elected and appointed a Treasury Secretary, whom I call "Buffalo Bill." But they're not really in place yet. They're sending all the right signals, and the mainstream financial media is talking about how terrible Trump is, like how he calls Jerome Powell "Mr. Too Late" every day on social media (Truth Social).

But at the end of the day, the Federal Reserve has already made a permanent rate cut, which isn't bad, but they could have done more. How do we get to crazy? How do we get bitcoin to a million or even higher, and any "altcoin" in your portfolio to go up 100 times, even without leaders, revenue, or customers? I know that's what you want to hear from me.

How do we get there? It starts with understanding how the Fed votes, which committee is responsible for what, and how we move toward the ultimate outcome of yield curve control. That's why the article I published after stepping off stage, and the subsequent speech, discuss these issues. So, to understand where we're headed, let's go back to history, because history can predict the future.

Historical Review: War Financing in the 1940s

Back to the 1940s, what was happening then? There was a world war. The United States got involved in 1942. Obviously, when you get involved in a war, what do you do? You print a lot of money. How do you do it? You tell the central bank to lower the price of funds and increase their quantity, so the central government can crowd out everyone else and borrow money to make things that kill people. So, how did the US government finance its participation in World War II?

The Federal Reserve basically reached an agreement with the Treasury to manipulate the bond market so the US government could issue debt at extremely low costs. Here's a photo of the Tuskegee Airmen. They're preparing to go to war, buying war bonds. What were the Treasury bond rates at the time? For nearly a decade, Treasury bills with maturities of less than one year were capped at 0.675%. For long-term Treasuries, 10- to 25-year bonds were capped at 2.5%. This was yield curve control in the US.

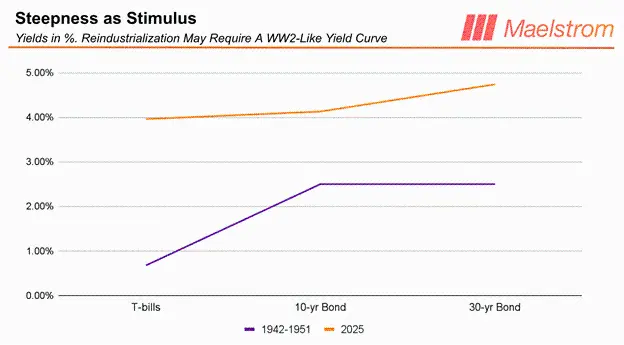

Yield Curve Comparison and Future Speculation

Here's a chart of the yield curve. The orange line represents roughly where we are today—this is a chart I made over the weekend. As you can see, 1- to 3-month Treasury bill rates are about 4%, 10-year Treasuries are about 4.5%, and 30-year Treasuries are about 4.75%. This is our current yield curve, contrasted with the yield curve during the late 1940s World War II period.

In Trump's view, this is what he wants to create. He wants to turn the orange line into the purple line. As investors, we have to answer how we can reach this goal, and we have to make some bold assumptions and guesses. I might have to delve into the realm of bureaucratic politics, which is obviously very messy, because we're dealing with people, and people are strange—they do things we don't expect.

So, I'll outline a possible path, but I don't know if it will really happen. However, given my current thinking about the Maelstrom (the investment company I manage) portfolio, the probability is high enough that I'm confident to push risk levels almost to the maximum, even though bitcoin has already risen from about $3,000 to $12,000 and is now experiencing a weak period.

The Mechanism of Yield Curve Control and the Fed's Third Mandate

So, what is the mechanism of yield curve control? As you know, Federal Reserve Board member Steven Moran declared the Fed's third mandate, which is actually written in the 1913 Federal Reserve Act: the Fed is responsible for "maintaining moderate interest rates on government bonds." What does "moderate" mean? It means whatever they want it to mean. So when I say the Fed's third mandate is to print money to help us best finance the national debt, that's what I mean.

Now, why is it so critical for the US to finance large-scale fiscal spending and credit generation? The reason is as always. The US is at war, or more importantly, the US has basically lost its last two wars. They lost the war against Russia in Ukraine, and were forced to stop intervening in Iran after 12 days because they ran out of missiles to help Israel defend itself.

It turns out the US industrial base is completely gone. Over the past forty years, it was moved to China. Now, the US can't produce enough shells to defeat Russia, nor enough missiles to help allies bomb where they want. And that's what Trump really wants to fix, or at least try to fix as quickly as possible. This requires credit. And this credit will be provided by the banking system and the US Treasury.

Controlling Short- and Long-Term Interest Rates

So, specifically, how do you control the Treasury bill market? You can lower the interest rate on excess reserves. Excess reserves are reserves that banks hold at the Fed, and currently, these reserves earn interest at the lower end of the federal funds rate. They can also lower the discount rate. When banks are in trouble, like during the 2023 regional banking crisis, banks borrow from the Fed's discount window at a certain rate. If I can lower these two rates to whatever level I want, I can effectively cap Treasury bill yields.

A key committee I'll discuss later is the Federal Reserve Board of Governors. They are responsible for controlling the short end of the curve, i.e., the interest rate on excess reserves, and influencing the rate at which banks borrow from regional Fed discount windows. So, how do you manipulate the long end of the Treasury market?

The first thing we need to focus on is the System Open Market Account (SOMA). When the Fed conducts quantitative easing (QE) by creating reserves and buying bonds from banks, these bonds ultimately go into the SOMA account. They publish the balance of this account weekly. This is the indicator we can use to monitor whether they are really conducting yield curve control—whether they are buying bonds in unlimited quantities at a specific price to manipulate yields to a certain level.

The Shift in Credit Generation: From Central Banks to Commercial Banks

If you study how yield curve control works in Japan, you'll find that the Bank of Japan sets a target rate and keeps buying bonds until the rate reaches that level. So, if you want to profit, you'll sell bonds to me until the rate falls, bond prices rise, the balance sheet expands, credit demand in the system expands, and then crypto naturally rises. This expanding balance sheet is managed by a key Fed committee, the Federal Open Market Committee (FOMC), which we'll explain in detail later.

The second thing is the generation of credit growth. I wrote an article called "Black and White" about nine to twelve months ago. In that article, I delved into the difference between credit generated at the central bank level and at the commercial bank level.

Since the 2008 global financial crisis, we've been in an era of globally central bank-led credit generation. When central banks are in charge of issuing credit, what kind of activities do they fund? Central banks favor large companies and financial engineering. So, if you're a private equity investor in London, New York, Hong Kong, or Beijing, you use a lot of debt to acquire a company, take out operating profits as dividends, then sell it again at a higher EBITDA multiple, and you make money. You haven't created new capacity; you're just leveraging existing capacity.

This is why the US doesn't have more industry—because since the 1980s, you've been doing leveraged buyouts. You acquire companies, take on a lot of debt, because you can access the large corporate bond market, and big companies can issue money outside the banking system. Because the Fed paid a lot of money, all the rich people want to buy this institutional risk-free capital. That's why MicroStrategy succeeded. He was able to issue debt to these markets. So we issue cheap debt and then buy bitcoin. That's basically how MicroStrategy became a big company.

Now, does this help President Trump make more bombs? No. They need more capacity in the US industrial sector. They need small and medium-sized enterprises to get credit and hire workers to make batteries and produce goods. They need bank loans. When the Fed keeps "cranking the handle" (printing money), crowding out space, small and regional banks can't operate. They need a steep yield curve. They need to be able to lend to these industries and make money from it. There was a great article in The Wall Street Journal recently, calling the Fed's policy "gain of function," which is a criticism of COVID policy. The article basically said the Fed is responsible for destroying US industry and exacerbating US inequality. He's 100% right, but he's also a two-faced hypocrite because he also goes to make money.

So this economy is interesting. But his point is, he will empower regional banks to lend. And regional banks need a steep yield curve. So what Trump wants to see is a "bull steepening" of the yield curve, which means a general decline in interest rates and a steepening of the curve, i.e., banks borrow deposits at low rates on the short end and lend at higher rates on the long end, which is a spread based on 10- or 30-year US Treasury rates.

If you look at the current situation, in the 1940s, this spread was close to 2%, which was very profitable for banks. Now, this spread is only 20 basis points. A few years ago, it was even negative. So, by killing small banks, you've basically killed the nation's credit production and industrial production. Therefore, Trump not only wants to steepen the yield curve, but also wants to remove all those "bad" regulations that prevent small banks from lending to small and medium-sized enterprises. By making banks more profitable, they will do what the government wants them to do.

How Trump Controls the Fed

Now we need to understand two committees, because Trump has his goals. He's the "ambassador" of the Treasury, and he'll tell you exactly what they want to do. So, how do they turn the Treasury and the Fed, two independent entities, into a cooperative body to achieve these goals?

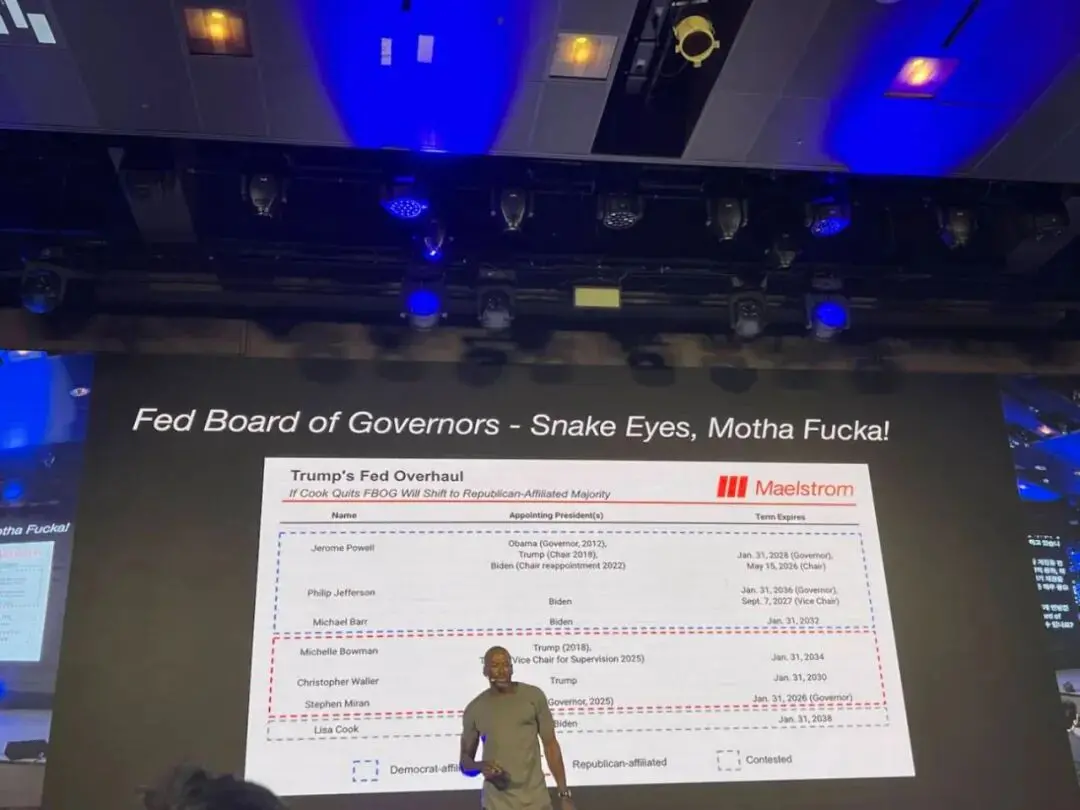

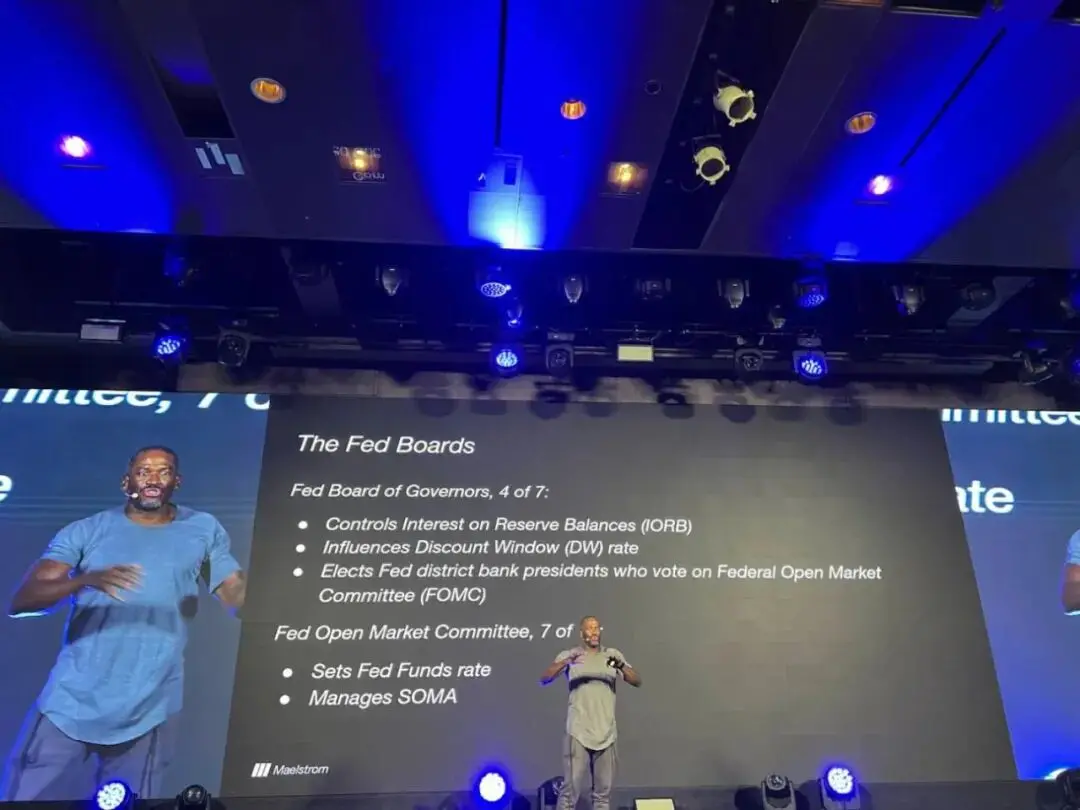

First, let's talk about the Fed Board of Governors. It has seven governors, all nominated by the President and confirmed by the Senate. This is very important. Trump currently controls the Senate, and we'll see after the midterm elections in November 2026 if he can maintain control. But if there's any indication, it's that his nominees are having a very hard time getting through. Steven Moran, who was recently appointed to the Fed Board by Trump, was approved by just one vote last week. So the situation is very tense. If Trump can't get his nominees through in the next 12 months or so, he's done, because the opposing Democrats won't approve his Fed Board nominees. So he needs more votes. This board controls the interest rate on excess reserves and influences the rate at which banks borrow from the 12 regional Fed discount windows. Most importantly, regional Fed presidents are all approved by a simple majority vote of the Fed Board. So the first step is for Trump to get four votes on this board to control the short end of the yield curve and get more people onto the Federal Open Market Committee (FOMC), so they can ultimately control the balance sheet.

The FOMC has 12 members, seven of whom are board members, and five are rotating presidents from regional Feds, with the New York Fed president having a permanent seat due to their huge influence on the US financial ecosystem. So what does the FOMC do? We know they set the federal funds rate, meet monthly or almost monthly, and manage the System Open Market Account (SOMA). They decide the scale of quantitative easing, the speed of bond purchases, and which bonds to buy—this is extremely important.

So, how does Trump gain control of the Fed Board? You need to roll "snake eyes" and "loaded dice." Here's a very interesting chart. We basically see this situation: Trump has two senators, Bowman and Waller, who we know want to be Fed governors. They were dissenters at the July meeting, wanting to cut rates, while Jerome Powell and the majority wanted to hold rates. They've publicly pledged allegiance to Trump.

Cook is the most recent person to leave the Fed. She suddenly resigned in August. There are rumors that her husband engaged in unethical insider trading during Fed meetings, and she resigned herself to avoid being forced out by an angry Trump. That's how Steven Moran got in. Now Trump has three out of seven votes. The fourth is Lisa Cook. If you've been following the media, she's a recent Biden appointee. There are allegations she was involved in mortgage fraud, falsely reporting her primary residence to get a lower mortgage rate. Her case has been referred to the Justice Department and may be criminally investigated. Currently, she's very stubborn, refusing to leave or resign. But I think by the end of the year, she'll get some kind of political guarantee she wants, and then she'll step down. That way, Trump will have four votes and control the board.

The first thing they want to do is accelerate the decline in short-term rates. There's an interesting arbitrage that can force the FOMC—even if Trump doesn't have full control yet—to cut rates faster than expected. If the board lowers the interest rate on excess reserves and the discount window, a lot of money will flow into the federal funds market. This opens up an arbitrage opportunity for large commercial banks. What will they do? Commercial banks will pledge assets to the discount window, borrow at a rate below the federal funds rate, and then lend at about 4%, which is a great arbitrage for parking funds. This arbitrage is basically done on the Fed, and the Fed now has to print money and hand it to the banks, which is completely absurd, and that's why it essentially forces the FOMC to cut rates.

I saw Steven Moran's recent interview—I think it was yesterday or this morning on Bloomberg. He said the Fed's monetary policy is too tight by 2%. That basically gives you the direction they want to go. They want the federal funds rate to fall to around 2%, and they want it yesterday. In fact, if Trump can get Lisa Cook out, he can execute this arbitrage by the end of the year and possibly get the federal funds rate below 2% very soon.

How Does Controlling the Fed Board Lead to Control of the FOMC?

As I said, all Fed Board members are permanent voting members of the FOMC. And the board approves regional Fed presidents as rotating voting members of the FOMC. I believe, besides the New York Fed, Philadelphia, Cleveland, and Minneapolis will be the other four regional Fed presidents with voting rights in 2026. And all 12 regional Fed presidents will face "re-election" in February next year.

How does this happen? Each regional Fed bank (there are 12 in total) has its own board of directors. This setup dates back to when each region of the US mainland had different rate needs for agricultural taxes. Each regional Fed board has three classes of members. There are six Class B and C board members, who jointly elect the bank's president. So, what kind of people are these regional Fed board members? Here's a list, and all this information will be published online later. You'll notice that the chairs of these Fed banks are either bankers or industrialists. What do bankers and industrialists always want? They want cheap money. They want lots of money. So how would these people oppose Trump's policy of lowering rates and increasing the money supply? It would increase their wealth. Because we're all self-interested, I think they're very likely to vote for presidents who will follow Trump's wishes, i.e., adopt looser monetary policy. If they don't, the Trump-controlled board will basically hint that if you don't vote for a dovish president, we won't approve him.

So now Trump has seven votes, and he will gain control of the FOMC sometime in the first half of 2026. So, once they have a majority on the FOMC, what can they do? They can return to quantitative easing. They can stop participating in…

We're currently in a period of quantitative easing because the Treasury has a lot of debt to issue. And now, the Treasury doesn't dare issue long-term debt. They're afraid, just like during the Great Depression, afraid of long-term debt. So now, all the issuance is short-term debt, which is why the clever action of overregulation is so important, because they need a price-inelastic buyer who will buy these Treasuries or Treasury bills at any time. But if they control the FOMC, and the FOMC agrees that yield curve control is necessary to achieve the Trump administration's political industrial goals, they will invest trillions of dollars in debt. The Fed will buy most of these bonds because the FOMC members have restarted quantitative easing.

Therefore, through this control of the board and the FOMC and the advancement of the timeline, Trump can basically create the yield curve I showed from 1942 to 1951.

Why Should We as Crypto Investors Care?

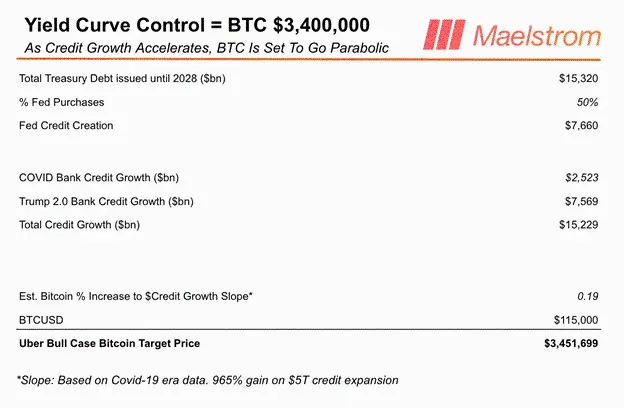

Of course, I have a question—there are a lot of mathematical issues about the money market here. I know this is a bit like a money market map, and you can look at Japan's situation. But guys, this is what we're here for. So, with the upcoming yield curve control in the US, how high can bitcoin's price go? That number, you know, is obviously ridiculous—$3.4 million. Standing here before you today, do I believe we'll get $3.4 million per bitcoin by 2028? I'd probably say no. But I'm interested in the direction it's going and the potential scale it could reach. So I hope we can reach a million, and others hope so too, which is great, but I'm very skeptical about it.

This isn't just based on some adaptive number in terms of thinking dimensions, but on the amount of Treasuries to be issued. What will the situation be like when Trump and his team leave office at the end of 2028? I checked my Bloomberg terminal and studied how many Treasuries will mature in order for these people to lower rates, then I added the estimated $2 trillion federal deficit from now to 2028. That's about the Congressional Budget Office's estimate for the fiscal deficit. That gives us a number: $15.3 trillion in new Treasuries must be issued over the next three years.

How much did the Fed buy during the COVID pandemic? The Fed bought about 40% to 45% of Treasury issuance. I think during this period, the proportion will be even higher, because foreigners are less likely to buy US Treasuries than before, especially considering what Trump is doing. He tends to add debt for US reindustrialization by devaluing the dollar, which makes others uneasy. So, why would I do that? I don't know, I wouldn't do that. So we effectively get $7.6 trillion in credit creation. That's the amount our balance sheet will grow from now to 2028.

The second part is "fake" credit creation. How many loans will be made to small and medium-sized enterprises across the US? That's a hard number to predict. Estimating bank credit growth isn't easy. A more prudent approach is to use the COVID-19 period as a reference. During the pandemic, Trump launched what he called "QE 4 Poor People." According to weekly Fed data, the "other deposits and liabilities" item in bank accounts rose sharply, corresponding to an increase in bank credit of $2.523 trillion during that period. If Trump has about three more years to continue stimulating the market, that's equivalent to an additional $7.569 trillion in new bank loans.

So, adding it up, the incremental credit from the Fed plus commercial banks totals $15.229 trillion. The biggest uncertainty in this model is the assumption of how much bitcoin will rise for every $1 of new credit. I still use the COVID period as a reference: at that time, the slope of bitcoin's percentage increase relative to each $1 of credit growth was about 0.19.

You multiply this slope by $15.229 trillion in credit growth, then multiply by bitcoin's benchmark price of $115,000. That's how we arrive at the conclusion that bitcoin's price could be about $3.4 million by 2028. I'm almost 100% sure this won't happen. But I think this is the mental framework for understanding the credit creation flowing from the Fed to the Treasury, and then from the banking system to fund US reindustrialization. We know what happened during the COVID pandemic when this policy was pursued for just one year. What if it lasts three years? When the Fed and the Treasury work together, print money, and, in their words, send the US economy into "Valhalla" (the mythical hall of the slain), we'll see bitcoin prices exceed a million dollars.

That's why I'm very confident that the four-year cycle doesn't apply in this particular cycle. We're in the midst of a "military-religious" realignment, and if they can control all the leadership of monetary policy, and I believe they're highly motivated, that's what's going to happen. Thank you all.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Base-Solana Bridge Dispute: "Vampire Attack" or Multichain Pragmatism?

The root of the contradiction lies in the fact that Base and Solana occupy completely different positions in the "liquidity hierarchy."

Stable TGE tonight: Is the market still buying into the stablecoin public chain narrative?

According to Polymarket data, there is an 85% probability that its FDV will exceed 2 billion USD on the day after its launch.

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.

Discover How ZKsync Fast-Tracks Blockchain Security

In Brief ZKsync Lite will be retired by 2026, having achieved its goals. ZKsync team plans a structured transition, ensuring asset security. Future focus shifts to ZK Stack and Prividium for broader application.