Bitcoin Core v30 will remove the 80-byte OP_RETURN limit, allowing larger arbitrary data in transactions. This change reopens a decade-old debate about onchain data, miner incentives, and Bitcoin’s rules—impacting fees, layer-2 use cases, and node policy enforcement.

-

OP_RETURN limit removal announced in Bitcoin Core v30.

-

Miners may continue to include fee-paying non-standard transactions regardless of client defaults.

-

January 2024 reviews showed major miners (e.g., F2Pool) already including non-standard, oversized OP_RETURN data.

Meta description: OP_RETURN limit removal in Bitcoin Core v30 explained — impacts on miners, fees, and onchain data. Read analysis and key takeaways from COINOTAG.

The Bitcoin community is split over Bitcoin Core v30’s plan to drop the 80-byte OP_RETURN limit, a dispute started by Nakamoto’s arbitrary data restrictions.

The Bitcoin community is split over Bitcoin Core developers’ decision to remove a limit on arbitrary data stored in transactions, a move that traces back to a debate first raised by Bitcoin creator Satoshi Nakamoto in 2010.

Bitcoin Core v30’s expected release next month will remove the 80-byte cap on OP_RETURN, an opcode used for saving arbitrary data (any non-financial data) onchain. The decision has proved controversial, with some accusing developers of bowing to corporate influence and others arguing that arbitrary data storage is outside Bitcoin’s intended scope.

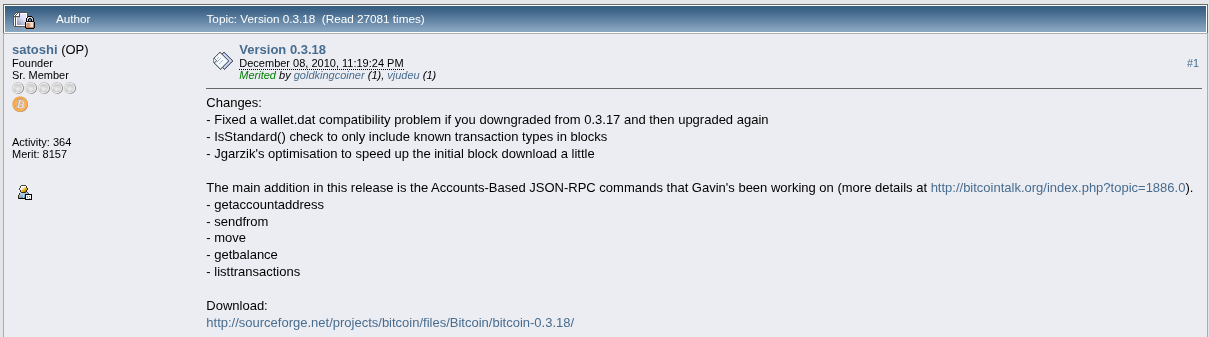

However, this debate is much older than OP_RETURN itself, which was introduced in Bitcoin Core 0.9.0 in March 2014. Back in 2010, when Bitcoin (BTC) was barely a year old, the protocol’s pseudonymous creator, Satoshi Nakamoto, sparked the same debate by introducing checks to ensure that transaction data complied with the intended standards.

Satoshi’s post on Bitcoin Forum. Source: Bitcoin Forum

Satoshi’s post on Bitcoin Forum. Source: Bitcoin Forum

What is the OP_RETURN limit change in Bitcoin Core v30?

The OP_RETURN limit removal in Bitcoin Core v30 deletes the default 80-byte cap on arbitrary data stored in transactions, enabling larger non-financial payloads onchain. This shifts policy enforcement from client defaults to miner choice and may increase non-standard transaction inclusion and fee revenue dynamics.

How does removing the OP_RETURN cap affect miner incentives and fees?

Removing the OP_RETURN cap means miners decide whether to include larger arbitrary-data transactions. Historically, miners have included non-standard transactions when fee incentives exist. A January 2024 review showed miners like F2Pool were already accepting oversized OP_RETURN data, suggesting economic incentives often outweigh client-enforced limits.

Key perspectives:

-

Some community members argue the change opens Bitcoin to unwanted onchain data and centralizing pressures from commercial projects.

-

Others point out that enforcing arbitrary caps at the client level is ineffective when miners can modify software to accept fee-bearing transactions.

Why did this debate start with Satoshi Nakamoto?

Satoshi introduced early checks in 2010 to limit arbitrary data for network health and node resource reasons. That principle influenced the later 80-byte OP_RETURN cap adopted in 2014. The current debate revisits Satoshi’s trade-off between keeping Bitcoin lean and enabling novel onchain use cases.

“It seems pointless for the official Bitcoin client to attempt to ‘legislate’ any restrictions of this type when all miners have an interest in including any and all fee-carrying transactions.” — Jeff Garzik (Bitcoin Core developer)

When did miners begin including non-standard OP_RETURN data?

Miners began including larger non-standard OP_RETURN payloads in practice well before the v30 change. A January 2024 network review recorded major pools, including F2Pool, carrying non-standard data above traditional limits. This demonstrates miner economic incentives often determine policy in practice.

Comparison: 80-byte OP_RETURN vs No Cap (v30)

| Node resource impact | Lower | Potentially higher |

| Developer-enforced policy | Yes | No (miner choice) |

| Incentive alignment | Mixed | Miner-driven by fees |

| Layer-2 / application support | Constrained | Expanded |

Frequently Asked Questions

Will removing the OP_RETURN cap let corporations write large data to Bitcoin?

Potentially yes. Removing the cap makes it easier for commercial projects to embed larger payloads onchain, which is part of the concern about corporate pressure influencing developer decisions. Storage costs still apply via fees.

How will full-node operators be affected?

Full-node operators could see higher storage and bandwidth demands if larger arbitrary data becomes common. Operators may need to choose stricter policies or prune data to manage resource use.

Can miners still enforce their own limits?

Yes. Miners control what they include in blocks and can choose to reject non-standard transactions. In practice, many miners prioritize fee-paying transactions and may accept larger OP_RETURN data.

Key Takeaways

- Policy shift: Bitcoin Core v30 removes the default 80-byte OP_RETURN cap, shifting enforcement toward miners.

- Miner incentives: Fee incentives have historically driven inclusion of non-standard transactions; miners may continue this trend.

- Resource trade-offs: Larger onchain data can enable new applications but raises node resource and censorship-resilience concerns; watch miner behavior and fee markets.

Conclusion

The removal of the OP_RETURN limit in Bitcoin Core v30 revives a long-running debate about onchain arbitrary data, miner incentives, and Bitcoin’s resource policy. Bitcoin Core v30 places practical policy decisions in the hands of miners, not client defaults. Monitor miner inclusion patterns and fee dynamics as the network adapts.

Published: 2025-09-30 | Updated: 2025-09-30 | Author: COINOTAG