Base Leads the NFT Market with 1.27 Million Transactions in a Month

In September, the Base network (Coinbase’s Ethereum solution) made an unexpected breakthrough in the NFT universe. Fueled by the game DX Terminal, the ecosystem surpassed its rivals in number of sales. A sign that a mix of creativity, AI and fun can awaken a market generally losing momentum.

In brief

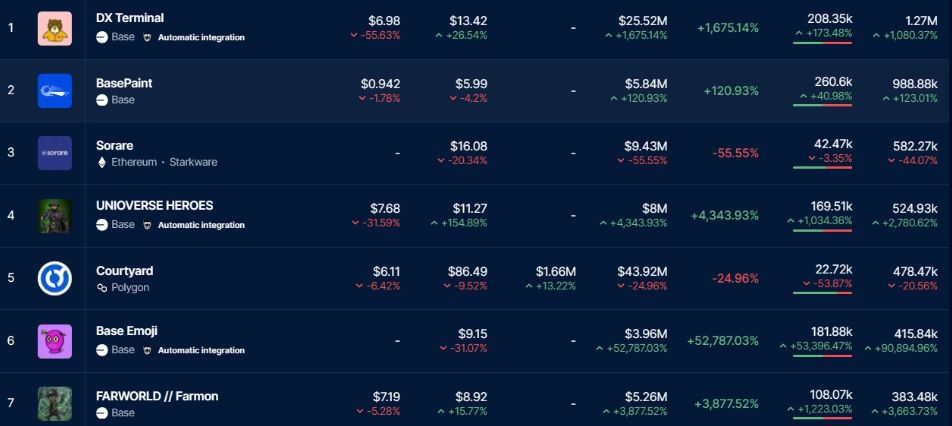

- DX Terminal propelled the Base network to the top of NFT sales in September with more than 1.27 million transactions, an increase of over 1000% in one month.

- While the overall NFT market falls sharply, only projects related to gaming like DX Terminal and Guild of Guardians show growth, unlike major traditional collections such as BAYC or CryptoPunks.

Base takes the lead with DX Terminal

With 1.27 million sales, DX Terminal climbed to first place in the ranking. That’s over 1,000% growth in one month. Alongside it, other projects like BasePaint allowed Base to place five collections in the Top 10. Clearly, this is no longer just a one-off success.

However, in terms of financial volumes, Polygon and Ethereum maintain the NFT advantage. Courtyard (Polygon) leads with $43.9 million, followed by Moonbirds and CryptoPunks (Ethereum). DX Terminal, despite its success, ranks fourth with $25.5 million but marks a record 1,700% increase. Base is making noise in sales, even if the big money still flows elsewhere.

DX Terminal’s success mainly comes from its concept. Each NFT is an autonomous character controlled by an AI, immersed in a sort of retro-futuristic simulation. These characters interact, battle, and evolve based on players’ choices. It’s lively, unpredictable, and above all, entertaining.

The top NFT collections sold in September. Source: DappRadar

The top NFT collections sold in September. Source: DappRadar

Unlike classic NFT games, there’s no promise of financial gains. No “play-to-earn” where you earn tokens to resell. Here, the game currency, called WEBCOIN, is off-chain and has no real value. The team insists: any external token claiming to be official is a scam.

This choice changes everything. Players stay for fun and curiosity, not for speculation. The AI creates unique stories, making the experience more engaging than the repetitive mechanics of many P2E projects.

A declining NFT market, except for games

September was tough for major NFT collections . CryptoPunks, BAYC, and Pudgy Penguins saw their trading volume plunge by 50 to 60%. Even Courtyard and Moonbirds, though leading in volume, fell about 25% and 13% respectively.

In this context, only two projects stand out positively: DX Terminal and Guild of Guardians Heroes (an RPG on Immutable). Both are linked to video gaming, proof that the gaming sector resists general fatigue better.

Interest is shifting. There’s less attraction for mere prestige images but more desire to participate in interactive experiences. And that’s exactly where DX Terminal hits the mark.

Base emerges as a new creative scene for NFTs. Thus, DX Terminal proves it is possible to attract audiences without promising financial gain, simply with a fun experience driven by AI.

The overall market remains dominated by Ethereum and Polygon in terms of volumes, but the trend is clear. Interactive and playful projects attract attention while “blue chips” stagnate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou