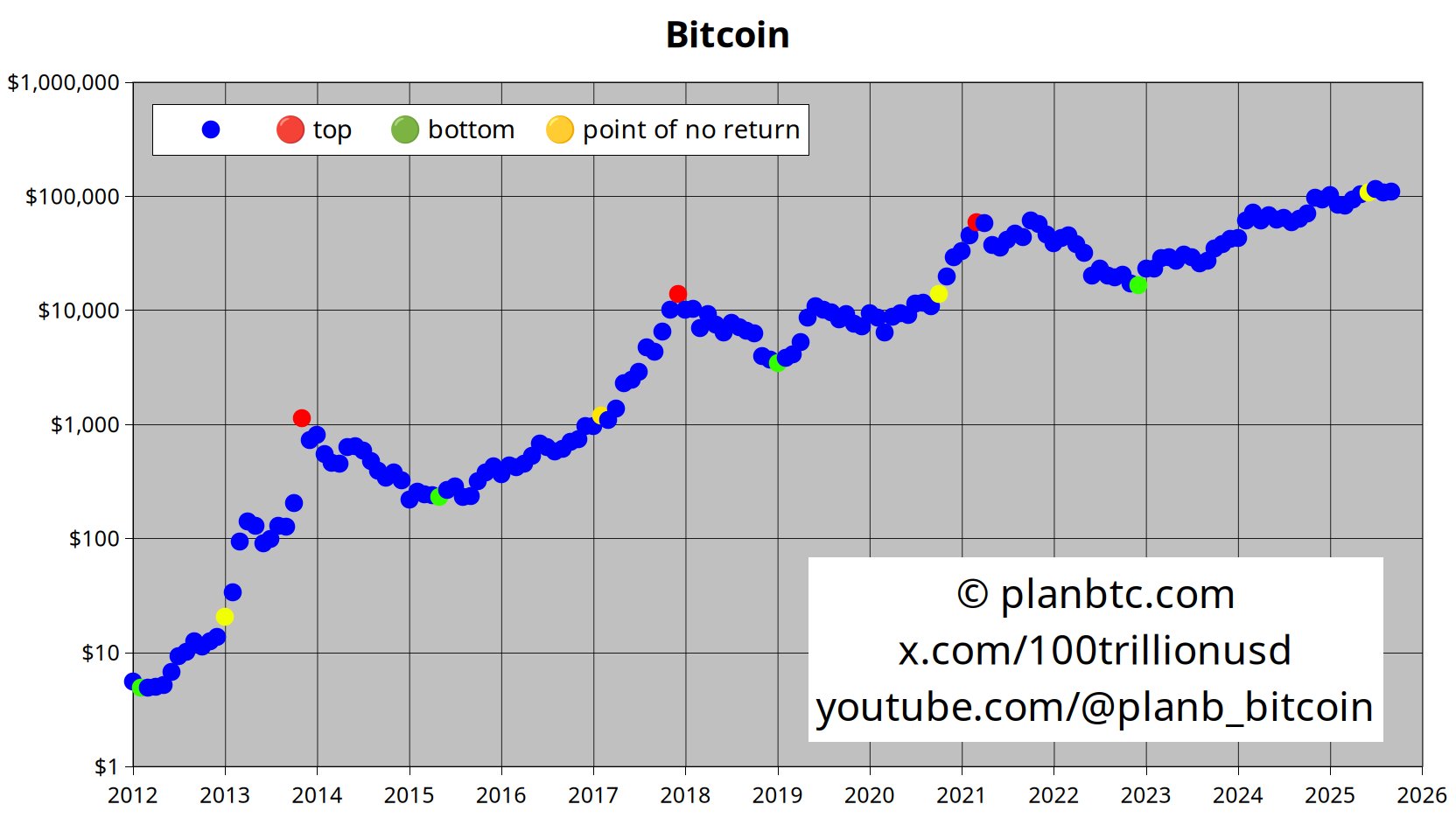

Quant Analyst PlanB Says Bitcoin Now at Point of ‘No Return,’ Similar to 2020, 2017 and 2013 Bull Markets

A popular crypto analyst thinks the Bitcoin ( BTC ) bull market isn’t over yet.

The pseudonymous trader PlanB tells his 2.1 million X followers that BTC has passed the “point of no return.”

“I think [the] Bitcoin bull market has not ended and will continue. I don’t know until when, or how high. It could also be a long, steady uptrend, without FOMO+crash. IMO, we passed the point of no return (yellow dots) in June 2025, similar to October 2020, February 2017 and January 2013.”

Source: PlanB/X

Source: PlanB/X

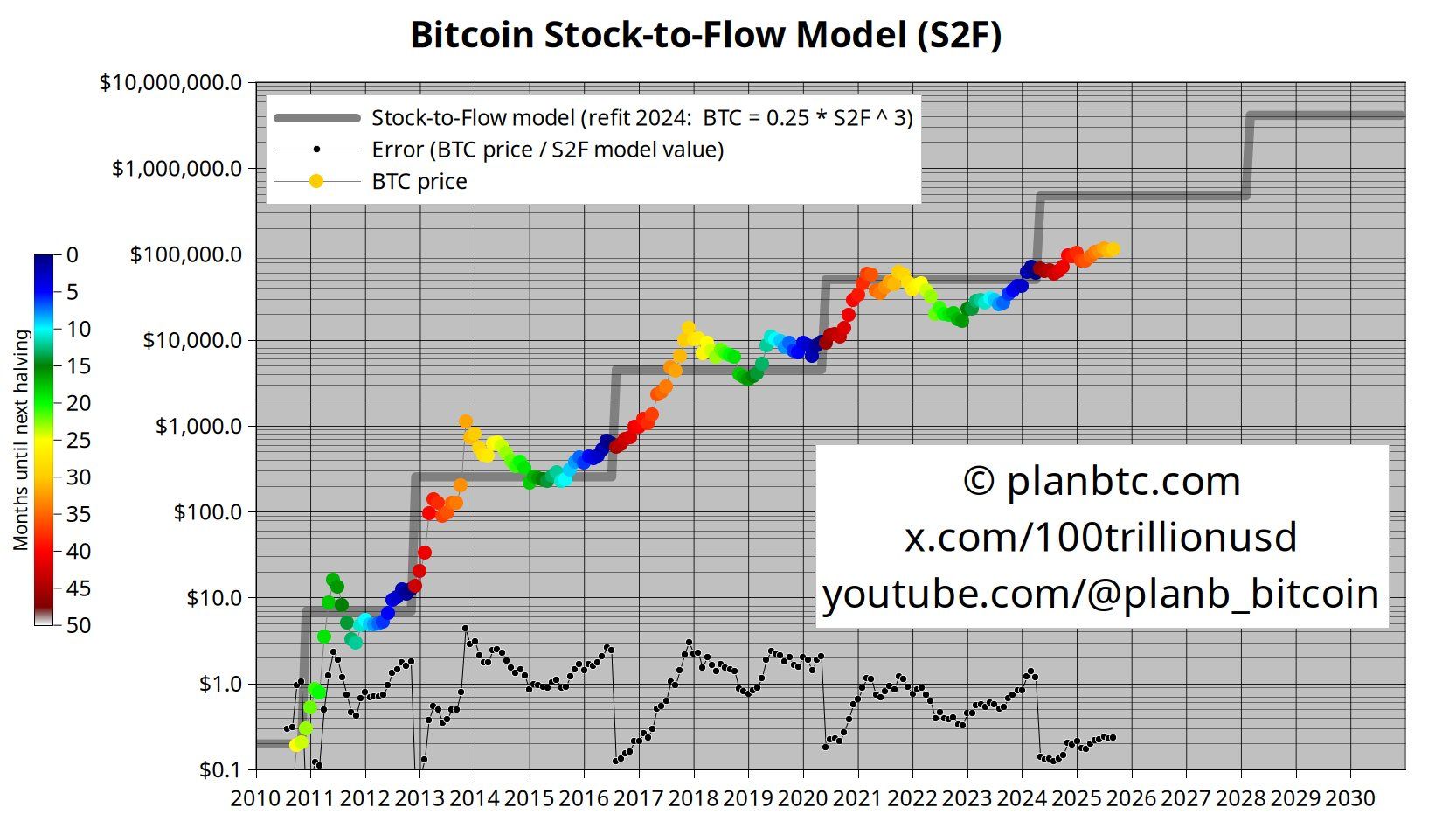

PlanB also shares a graph of the stock-to-flow model, a predictive tool that assumes the scarcity of a commodity drives its price.

“Whether you like it or not, Bitcoin’s value is very much linked to its scarcity. Fiat will be printed, Bitcoin will rise.”

Source: PlanB/X

Source: PlanB/X

While the stock-to-flow model was originally created to track traditional commodities, PlanB was one of the first analysts to apply it to Bitcoin.

Earlier this month, the crypto analyst argued that all asset prices – including gold, BTC, and the S&P 500 – have been rising during the last decade due to the Fed printing money.

“How will there be diminishing returns when debasement is exponential? All asset prices increased exponentially last 10 years (driven by money printing): -Gold 3x (~$1,000 to ~$3,000) -S&P 3x (~$2,000 to ~$6,000) -Bitcoin 250x (~$400 to ~$100,000). In my opinion, it is a unit of account phenomenon.”

BTC is trading at $114,471 at time of writing. The top-ranked crypto asset by market cap is up nearly 2% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo