Balchunas says tokenized stocks unlikely to disrupt ETFs as SEC gears up for rule change

Bloomberg senior ETF analyst Eric Balchunas said tokenized stocks are unlikely to pose a major threat to exchange-traded funds, even as the SEC considers a rule change that could bring shares of companies such as Tesla and Nvidia onto crypto exchanges.

Balchunas framed the potential change as more of a convenience for digital asset investors than a disruption of traditional markets. He likened it to how ETFs gave retail investors exposure to cryptocurrencies in a familiar wrapper.

He added that tokenized stocks would give crypto-native traders access to conventional equities in their preferred format but are unlikely to erode ETF market share in a meaningful way.

Balchunas wrote on social media:

“This is just allowing crypto natives to buy regular person investments in a format they prefer. Only this side of the equation has way more money, which is why tokens likely won’t dent ETF market share much.”

The rumored regulatory shift highlights how U.S. regulators are beginning to test the intersection of Wall Street and blockchain technology.

Tokenized equities would represent traditional shares on-chain, offering near-instant settlement, fractional trading, and global accessibility, features long touted as advantages of blockchain-based markets.

Globally, tokenization has gained momentum as banks and financial infrastructure providers pilot blockchain-based trading and settlement systems.

UBS and JPMorgan have launched tokenized bond and fund offerings, while Hong Kong and Singapore have introduced regulatory sandboxes to test tokenized securities platforms. Meanwhile, in Europe, Deutsche Börse has made significant progress in digital bond issuance and settlement using DLT.

Supporters argue that tokenization could eventually modernize capital markets by reducing intermediaries, cutting costs, and opening access to a wider pool of investors. However, critics have raised persistent questions regarding custody, compliance, and investor protection.

In the U.S., regulators have historically been cautious, often citing the need to ensure that new technologies don’t undermine financial stability or market integrity.

If approved, tokenized stocks on crypto exchanges would represent one of the most significant steps by the SEC to bridge traditional securities with blockchain-based trading venues. However, the scope and structure of such a program remain unclear, and the commission has not yet issued a formal statement.

The post Balchunas says tokenized stocks unlikely to disrupt ETFs as SEC gears up for rule change appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How does the leading player in perpetual DEX view the future trend of HYPE?

If you believe that the trading volume of perpetual DEXs will continue to grow, then HYPE is one of the purest and most leveraged ways to capitalize on this trend.

Privacy Meets Social Trust: How UXLINK and ZEC Are Building the Next Generation of Web3 Infrastructure

As ZEC advances compliant privacy and UXLINK builds real-world social infrastructure, the industry is moving towards a safer, more inclusive, and more scalable future.

Market Prediction and Emerging Parataxis: What is the current major challenge?

The prediction market project is experimenting with new primitives and mechanisms, including a prediction derivatives market, advanced automated market makers and liquidity mechanisms, interoperability primitives, and more.

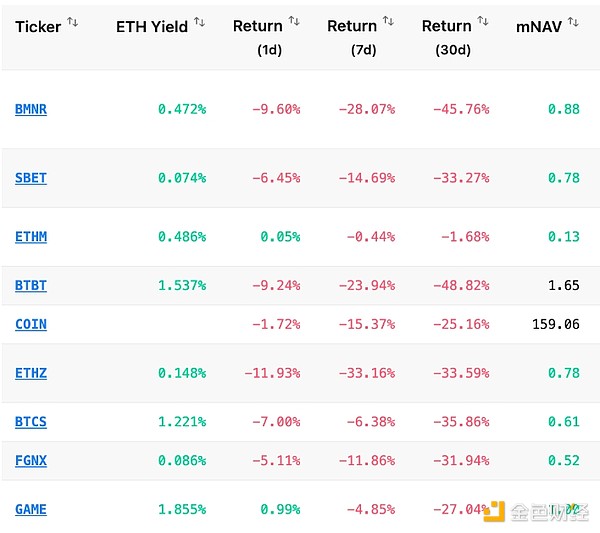

With the market continuing to decline, how are the whales, DAT, and ETFs doing?