Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

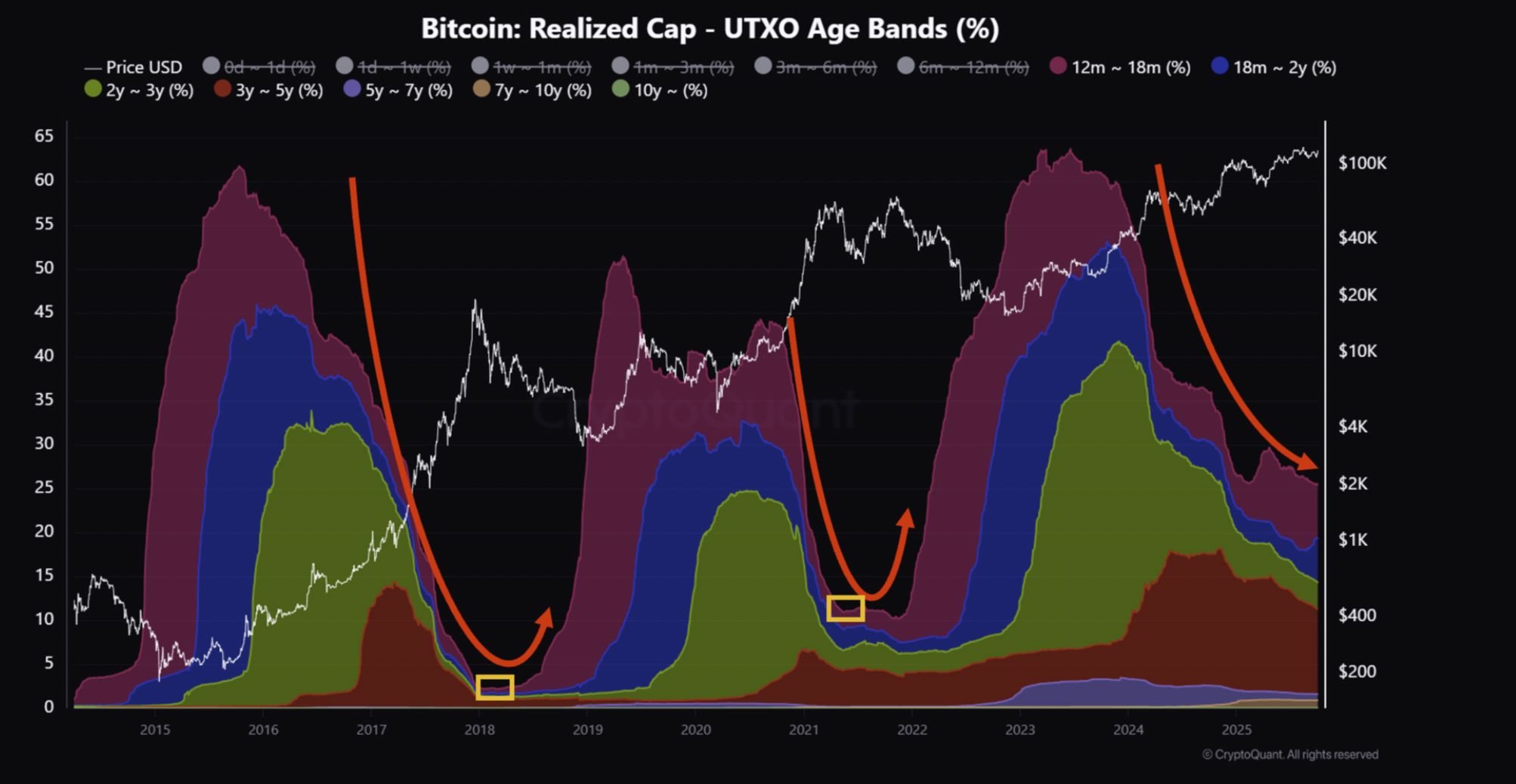

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Need for Financial Services Focused on Wellbeing

- Financial services are integrating nine wellness dimensions into financial planning to align well-being with economic outcomes. - Studies show only 38% of individuals achieve ideal financial wellness, linking health and financial resilience. - AI tools and wellness programs boost productivity and retention, with 52% growth in AI coaching since 2020. - Wellness-focused real estate and cultural investments reflect rising demand for holistic prosperity. - The $2 trillion wellness industry drives sustainable

Bitcoin Price Fluctuations: Optimal Entry Strategies Amid Changing Macroeconomic Conditions

- Bitcoin's volatility offers high returns but poses psychological risks, requiring disciplined risk management and emotional resilience. - Social media and behavioral biases like FOMO and loss aversion exacerbate impulsive trading during market swings. - Strategic frameworks (position sizing, DCA) and financial literacy help investors navigate volatility while avoiding overleveraging. - Case studies show predefined plans and diversification reduce panic selling during crashes like the 2024 "Black Friday"

Investing in Sectors Focused on Wellness in 2026: Strategically Aligning with Enduring Human-Centered Trends

- Global wellness market to grow from $6.87T in 2025 to $11T by 2034 at 5.4% CAGR, driven by preventive health, mental wellness, and financial well-being integration. - Wearables (Apple Watch, Oura Ring) and AI platforms (Calm, Headspace) are reshaping physical/emotional wellness, with corporate programs boosting productivity and reducing healthcare costs. - Financial wellness emerges as critical axis, with companies like CHC Wellbeing linking health incentives to economic stability through gamified reward

The Growth and Evaluation of Investments in AI-Powered Educational Technology

- The global AI-driven EdTech market is projected to grow from $7.05B in 2025 to $112.3B by 2034 at 36.02% CAGR, driven by personalized learning and AI-powered tools reducing educator workloads by 25%. - However, 50% of students report reduced teacher connections, 70% of educators fear weakened critical thinking, and 63% of specialists cite AI-related cybersecurity risks, highlighting ethical and systemic challenges. - Anthropology and interdisciplinary approaches address AI biases and cultural gaps, exemp