Small Image "Rejuvenation"? NFTStrategy "Perpetual Motion Machine" Attracts $200 Million

Against the backdrop of a long absence of breakout hits in the NFT market, a new ecosystem called NFTStrategy has unexpectedly drawn attention. In just a few days, its token's total market cap surpassed $210 million, with daily trading volume reaching $10.7 million, becoming a new model for the integration of NFT and DeFi.

TokenWorks’ “Perpetual Motion Machine” Model: NFT + Automated Trading + Token Burn

NFTStrategy, launched by the team TokenWorks, is dubbed “a perpetual motion machine that every NFT collection can own.”

Its core logic is a closed-loop model of trading fees → buying NFTs → reselling NFTs → buyback and burning of tokens, so that every transaction injects momentum into the ecosystem.

Specifically:

-

Each NFTStrategy token (such as PUNKSTR, PUDGYSTR) corresponds to a well-known NFT collection (such as CryptoPunks, Pudgy Penguins).

-

Every token transaction charges a 10% fee: 8% is used to accumulate ETH for automatically purchasing NFTs from the corresponding collection, 1% rewards creators, and 1% is allocated to the team or supporters.

-

When the ETH in the pool is sufficient, the system automatically buys NFTs at the floor price and lists them for sale at 1.2 times the purchase price.

-

After the NFT is sold, the ETH obtained is used to buy back and burn NFTStrategy tokens, achieving supply contraction and price support.

According to TokenWorks, this mechanism will form a “perpetual loop”—a self-reinforcing system driven by trading activity that can theoretically continue indefinitely.

Why did it explode so quickly?

Simply put, NFTStrategy’s rapid rise is the result of multiple forces working together.

The most crucial is, of course, the flywheel model mentioned above by TokenWorks.

In addition, the NFT market has started to recover, with NFT trading volume in July surging to $530 million.

TokenWorks seized the window on September 20 and launched five major projects in one go, including $APESTR for BAYC, $PUDGYSTR for Pudgy Penguins, and $BIRBSTR for Moonbirds.

These established NFT collections come with their own traffic, and their communities respond enthusiastically. The trading of new tokens also feeds back into the burning and appreciation of $PNKSTR, and cross-project linkage has revitalized the community.

On September 30, TokenWorks simultaneously launched eight NFTStrategy tokens on OpenSea and set up a 20 ETH reward pool distributed across each asset to incentivize trading. OpenSea’s rapid listing essentially allows novice users to enter the market with one click. ETH also rose 2.4% that day, providing additional momentum to the market.

The community has also been actively “calling the shots.”

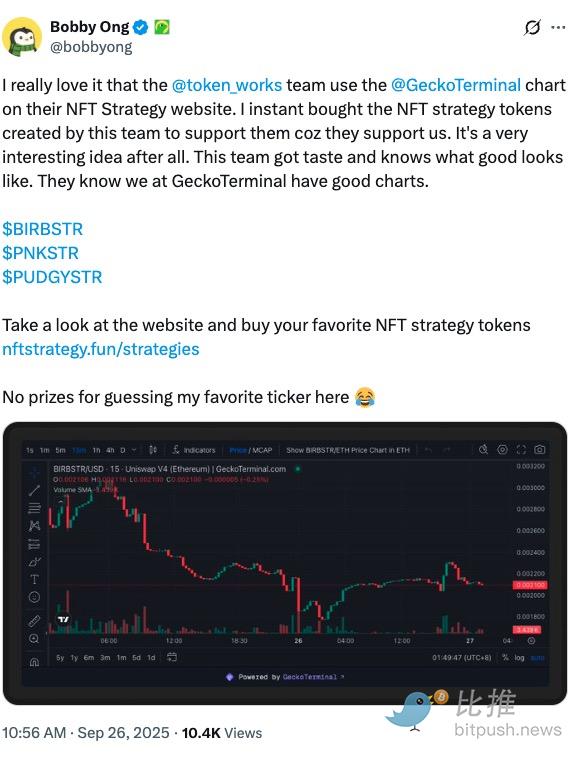

CoinGecko co-founder and CEO Bobby Ong tweeted his appreciation for the NFTStrategy project. Bobby Ong said he has been an entrepreneur in the crypto space since 2013, and he believes the token.works team “has great taste” and understands the importance of quality products. Bobby Ong said he immediately bought some tokens.

The results are indeed impressive. NFTStrategy started from scratch and, in just a few weeks, surpassed Autoglyphs in market cap, with the ecosystem’s total value soaring toward $200 million.

As of October 2, NFTStrategy’s ecosystem market cap has firmly stood at $213 million, surging 73.1% in 24 hours. The leading token $PNKSTR surged 22.7% in a single day, with a market cap of $161 million and trading volume exceeding $9.7 million. Other projects: $PUDGYSTR skyrocketed 65.9% to a market cap of $13.4 million, and $APESTR was even more aggressive, jumping 74.3% to $12.2 million. Even the more stable $BIRBSTR contributed $4.55 million in 24-hour trading volume.

The chart below shows the latest performance of each token (data from CoinGecko, October 2):

Ranking

Token Name

Price (USD)

24h Change

24h Trading Volume (USD)

Market Cap (USD)

| 1 | PunkStrategy ($PNKSTR) | 0.1652 | +22.7% | 9,734,693 | 160,647,555 |

| 2 | PudgyStrategy ($PUDGYSTR) | 0.01343 | +65.9% | 1,700,556 | 13,496,888 |

| 3 | ApeStrategy ($APESTR) | 0.01219 | +74.3% | 1,283,530 | 12,248,029 |

| 4 | BirbStrategy ($BIRBSTR) | 0.01121 | +2.4% | 4,552,644 | 10,625,621 |

| 5 | DickStrategy | 0.005550 | +0.6% | 578,975 | 5,417,041 |

| 6 | MeebitStrategy | 0.005103 | +14.0% | 586,247 | 4,870,318 |

| 7 | SquiggleStrategy | 0.004543 | +19.8% | 629,694 | 4,499,045 |

| 8 | ToadzStrategy | 0.003965 | +25.3% | 708,925 | 3,873,615 |

Potential Concerns

However, NFTStrategy’s “perpetual motion machine” model is not without flaws.

-

Over-reliance on trading volume: The system depends on the continuous accumulation of trading fees. Once trading cools down, the pool will be unable to continue buybacks or NFT purchases, and the loop will be broken.

-

Price bubble risk: Token price increases are mainly driven by market sentiment rather than intrinsic asset returns, making it easy to form a “self-reinforcing” bubble.

-

Mechanism loopholes and attack risks: The complex logic of smart contracts increases the potential attack surface, and hackers could exploit the buy/sell logic or trigger conditions for arbitrage.

-

The NFT market itself is unstable: If the overall market floor price declines, the accumulated NFT assets may depreciate, triggering systemic risk.

In short, whether it will become the next successful innovation or just another round of high-risk speculative bubble remains to be seen. As one investor said in the community:

“This is not just the second spring for NFTs, but another attempt to find a reason for NFTs to exist.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.