7 hundred million shorts liquidated in two days, is bitcoin's "Uptober" coming true?

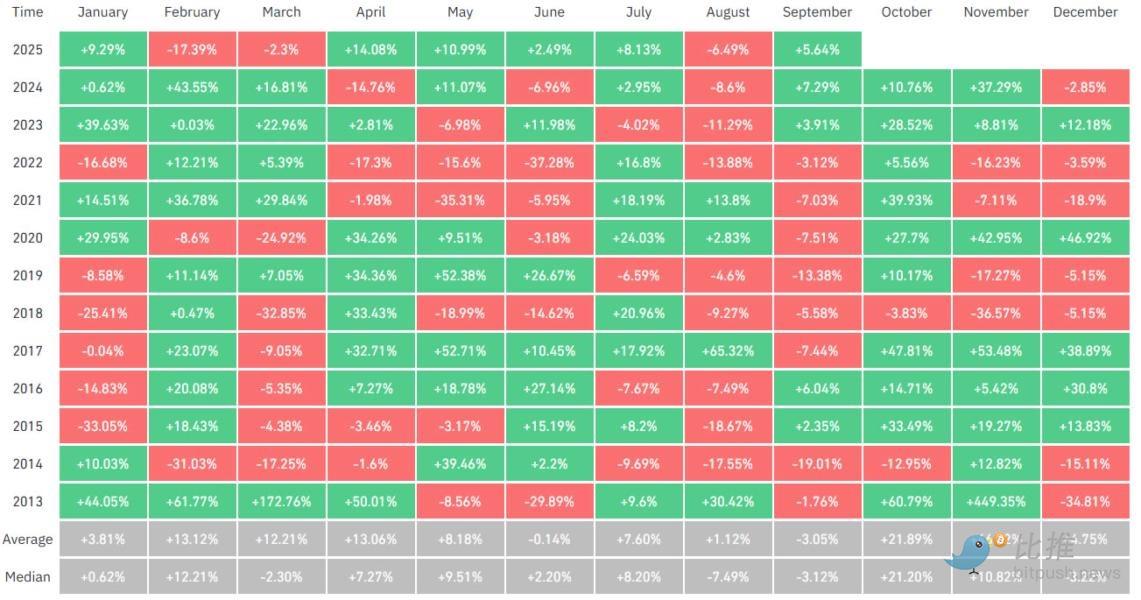

At the very start of October, the crypto market has seen a strong rebound. Multiple key indicators show that this month, dubbed “Uptober” by investors, seems to be fulfilling the historical pattern of “October always rises.”

Market Sentiment Reversal

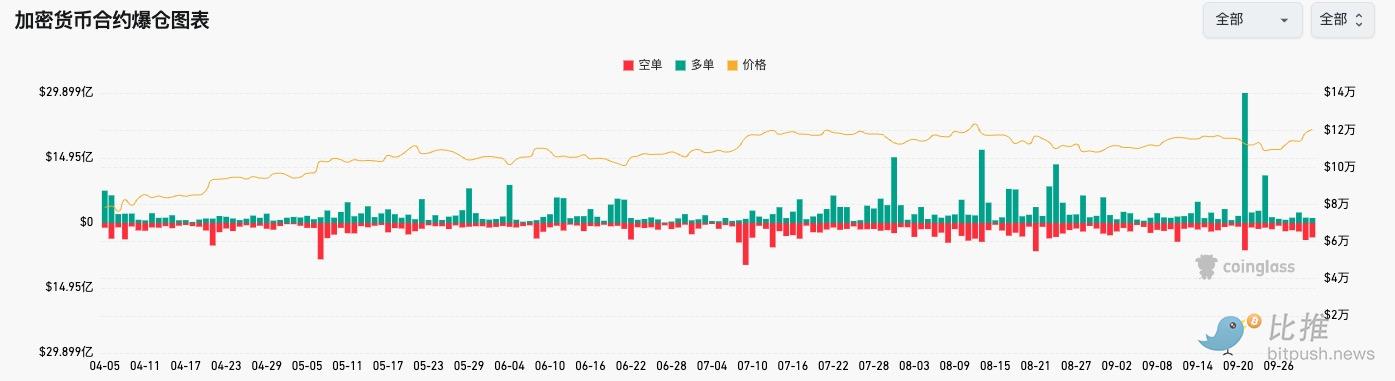

Within the first two days of October, the crypto market experienced a large-scale short squeeze. According to CoinGlass data, over $700 million in global short positions were liquidated, including a single $11.61 million Ethereum short on Hyperliquid.

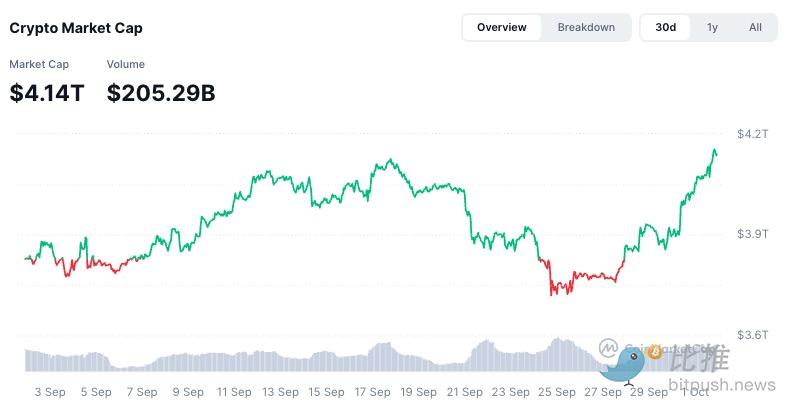

This round of short covering swept across the entire market, with the top 100 cryptocurrencies all rising. The total crypto market capitalization has increased by more than 6% since the end of September, surpassing $4.14 trillion on October 2, marking a new high since mid-August.

This surge not only swept away the sluggishness of September but also reignited investors’ expectations for the year-end rally.

As a market bellwether, Bitcoin (BTC) led this round of rebound, surging 10.3% in the past four days and now trading at $120,500, a 40-day high.

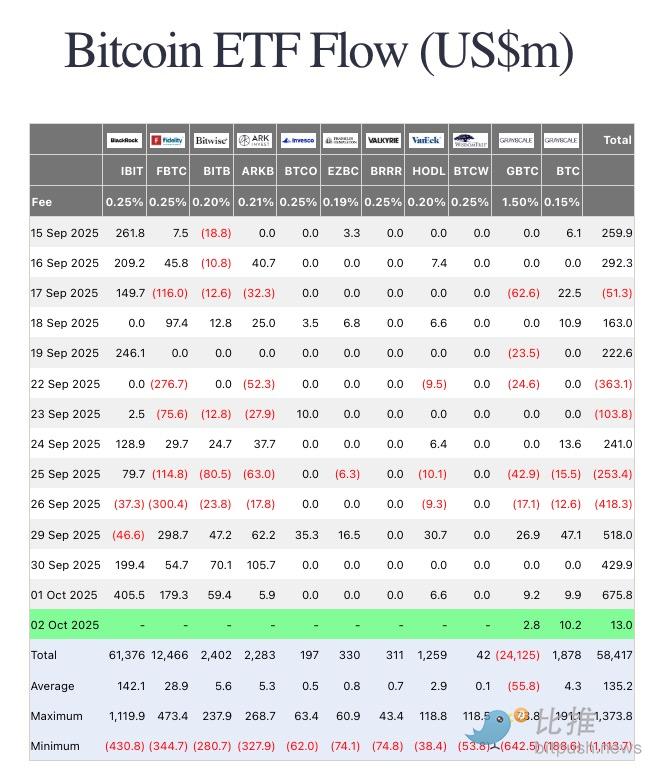

Meanwhile, Bitcoin ETF inflows have hit their highest level since mid-September. According to Farside Investors data:

-

Bitcoin ETFs attracted $675.8 million in net inflows on Wednesday;

-

Among them, BlackRock’s IBIT fund alone drew in $405.5 million in a single day;

-

Fidelity’s FBTC fund attracted $179.3 million;

-

Bitwise’s BITB fund attracted $59.4 million.

It is worth noting that this marks the third consecutive trading day with over $100 million in daily Bitcoin ETF inflows. In just the first three days of this week, cumulative inflows have exceeded $1.6 billion, whereas on September 26, the market saw a single-day outflow of $418 million.

Rate Cut Expectations Rise, Funds Shift from “Safe Haven” to “Value Growth”

The latest ADP non-farm employment data shows that the US lost 32,000 jobs in September, far below the market expectation of +52,000. Weak employment is seen as a sign of economic slowdown, leading the market to generally expect the Federal Reserve to cut rates again at the October 29 FOMC meeting. The current CME FedWatch tool shows a 97.3% probability of a 25 basis point rate cut by the Fed in October.

This means the global liquidity environment is likely to ease further, and the combination of “rate cut expectations + falling US Treasury yields + a weakening dollar” is the perfect soil for assets like Bitcoin and gold to strengthen.

Dovile Silenskyte, Head of Digital Asset Research at WisdomTree, stated: “Bitcoin combines both ‘safe haven attributes’ and ‘growth asset potential’—it hedges inflation like gold and has growth potential like tech stocks.”

On-chain Data: Selling Pressure from Long-term Holders Weakens, Bottom Range Forming

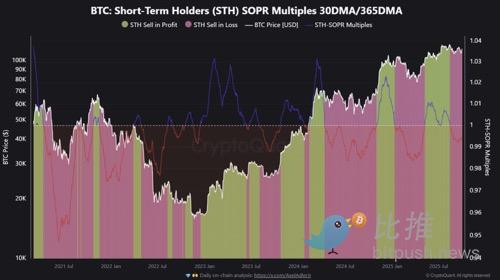

According to Glassnode data, the Short-Term Holder Realized Value Ratio (STH-RVT) has continued to shrink since May, indicating a cooling of short-term speculation and that the market is entering a “healthy accumulation phase.”

Meanwhile, the Long-Term Holder Net Position Change (LTH Net Position Change) has turned to a neutral range, meaning the wave of large-scale profit-taking is nearing its end.

These two data points together point to one conclusion: Bitcoin is building new structural support in the $115,000 to $120,000 range, similar to the consolidation phase in March-April this year.

If the current supply and demand structure remains stable, the market is highly likely to see a breakout rally in mid-October.

JPMorgan Calls: Bitcoin May Target $165,000

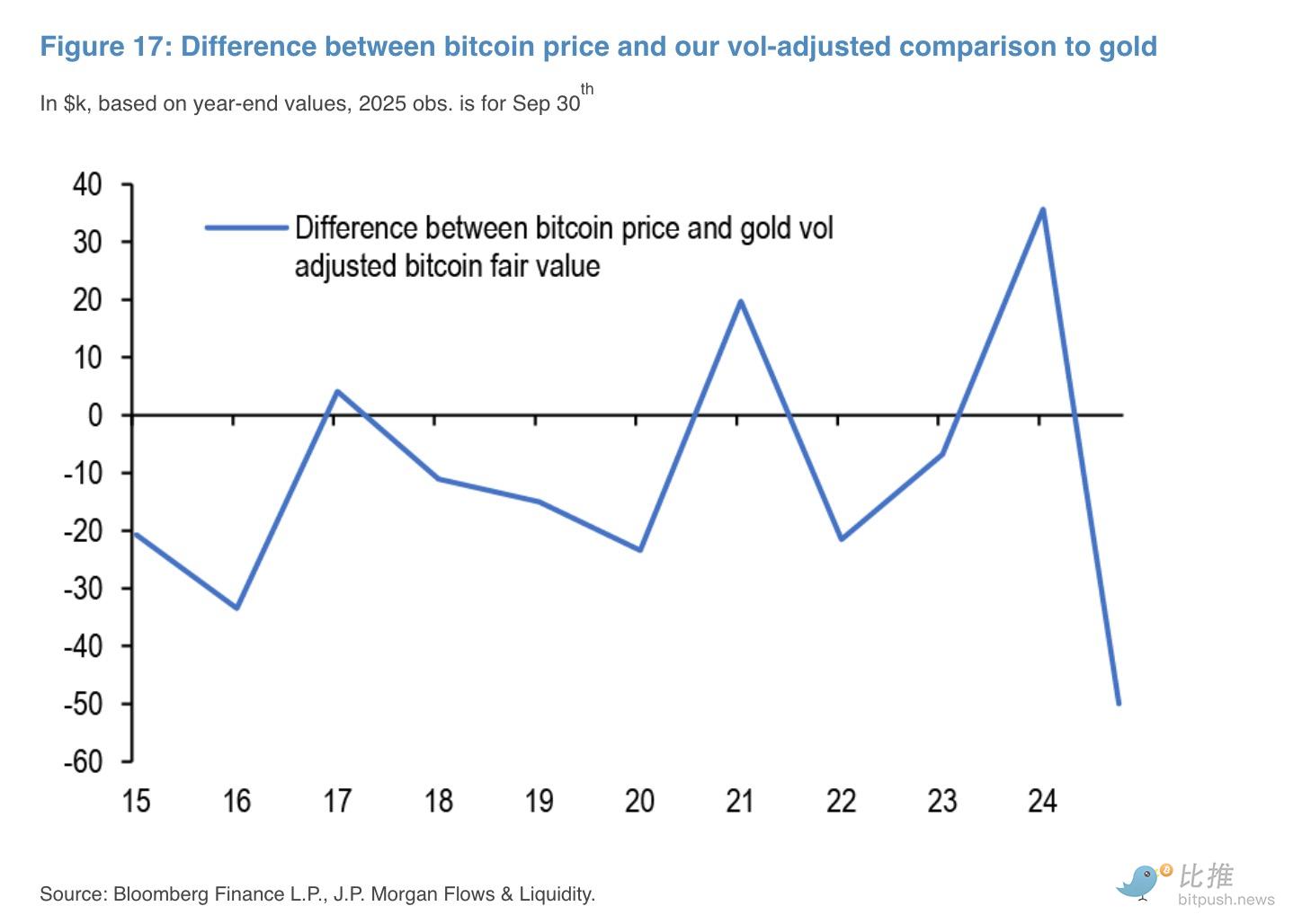

JPMorgan’s latest report points out that Bitcoin is currently significantly undervalued relative to gold.

According to the report’s calculations: based on volatility-adjusted valuation, Bitcoin should have about 42% upside; this means its theoretical price should be around $165,000; if it matches gold ETFs and physical gold investments, Bitcoin’s total market cap would reach about $3.3 trillion.

The report’s author, JPMorgan Managing Director Nikolaos Panigirtzoglou, noted: “Since the end of 2024, the valuation gap has shifted from Bitcoin being overvalued by $36,000 to being undervalued by $46,000.”

In other words, investors are once again embracing the “Debasement Trade”—in the face of fiscal deficits, inflation, and geopolitical risks, they are putting funds into scarce assets like gold and Bitcoin. If historical patterns continue, October is often the most sustained upward window of the year. As supply-side pressures ease, capital returns, and policy inflection points converge, Bitcoin may be poised to challenge a new target range of $160,000 to $200,000.

Author: Bootly

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.