SEC silent on Canary Litecoin ETF amid gov shutdown

Canary Capital’s spot Litecoin exchange-traded fund is in limbo after the US Securities and Exchange Commission took no action on Thursday, the original deadline for it to make a decision.

The SEC’s silence has left the crypto community uncertain about how the regulator will function amid a federal government shutdown and how its new generic listing standards would affect the timelines of dozens of crypto ETF applications awaiting approval.

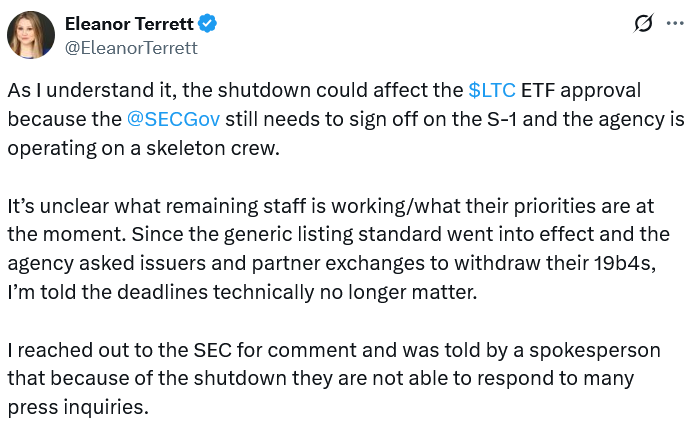

Bloomberg ETF analyst James Seyffart and FOX News reporter Eleanor Terrett noted that the old 19b-4 deadlines for crypto ETF applications may no longer be relevant, as the SEC has asked applicants to withdraw them, leaving the S-1 registration statement as the sole document requiring regulatory approval.

However, overshadowing that is another layer of uncertainty surrounding the government shutdown.

In August, the SEC posted an “Operation Plan” in the event of a government shutdown, stating it would “not review and approve applications for registration.” This includes new financial products, self-regulatory organization rule changes, and reviewing or accelerating the effectiveness of registration statements.

It is unclear whether the SEC’s silence on Canary’s spot Litecoin ETF is solely due to the government shutdown or whether it is also a result of the new generic listing standards, which would render the 19b-4 deadline irrelevant.

Canary withdrew its 19b-4 last week, complicating the matter

Canary withdrew its 19b-4 application on Sept. 25 at the SEC’s request, which may have been a contributing factor to the SEC not deciding on Thursday. It is unclear what impact the 19b-4s will have on applicants who haven’t withdrawn that document.

pic.twitter.com/FmbMfWWaqe

— Litecoin (@litecoin) October 2, 2025

Cointelegraph reached out to the SEC and Canary for comment, but didn’t receive an immediate response.

SEC still open, but in limited capacity

In light of the government shutdown on Wednesday, the SEC stated that it would continue to operate, but with a “very limited” number of staff members available.

The SEC said its Electronic Data Gathering, Analysis and Retrieval (EDGAR) database would remain operational.

Altcoins look to add to $75 billion spot crypto ETF market in US

The market has been bracing for potential approval of several new spot crypto ETFs — including LTC and Solana (SOL) to XRP (XRP), Avalanche (AVAX), Cardano (ADA), Chainlink (LINK) and Dogecoin (DOGE).

Any approval would add to the US spot Bitcoin (BTC) and Ether (ETH) ETFs currently available, which have attracted $61.3 billion and $13.4 billion in inflows since their launch last year.

Despite the setbacks, Bloomberg ETF analyst Eric Balchunas said on Monday that the SEC’s new listing standards have bumped the odds of some spot crypto ETF approvals to 100%.

The listing standards are expected to streamline the process under Rule 6c-11, significantly reducing approval timelines, which typically take up to 240 days.

SEC Chair Paul Atkins said the new listing standards will reduce barriers to accessing digital asset products and offer investors more choice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Daily Morning Report: The Federal Reserve Maintains Interest Rates Unchanged at 4.25%-4.50%

Solana, Aptos Move to Harden Blockchains Against Future Quantum Attacks

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence

Revolutionary aPriori Chainlink Partnership Unlocks Seamless Cross-Chain Trading