2Z Token Tanks Despite SEC Green Light, Sparking Backlash Over Tokenomics

DoubleZero’s 2Z token collapsed 40% after launch, as insider allocations and unclear tokenomics overshadowed regulatory approval and promising tech.

DoubleZero (2Z) recently made headlines after receiving a No-Action Letter from the SEC, marking a significant regulatory milestone for the blockchain infrastructure project.

However, instead of strengthening market confidence, the controversial token allocation mechanism sparked skepticism within the community. It also sent the token’s price to the ground right after listing.

SEC’s “No-Action Letter” Fails to Calm Community Outrage

In late September 2025, a major development occurred for DoubleZero (2Z). The SEC issued a No-Action Letter concerning 2Z’s token distribution mechanism. This rare move was seen by many in the industry as an encouraging sign of collaboration between infrastructure projects and regulators.

“Today’s no-action letter exemplifies how performing that role can help infrastructure providers spend their time deep in the weeds of building out infrastructure, not knee-deep in parsing the nuances of securities laws,” the statement noted.

On the product side, DoubleZero has also been highly regarded by industry experts. It aims to tackle bandwidth and latency issues in distributed systems by providing dedicated fiber-optic connections, tokenizing rewards for bandwidth providers, and acting as a foundational layer to “accelerate” high-performance blockchains.

If successful, the project could transform how data is transmitted across nodes and validators, potentially becoming “bigger than just blockchains.”

“DoubleZero is one of the most ambitious projects we’ve ever invested in. Their technology will make all high performance blockchains faster and more performant. This is the innovation we need if we want on-chain price discovery for all of the world’s assets,” shared the Co-founder of Multicoin Capital.

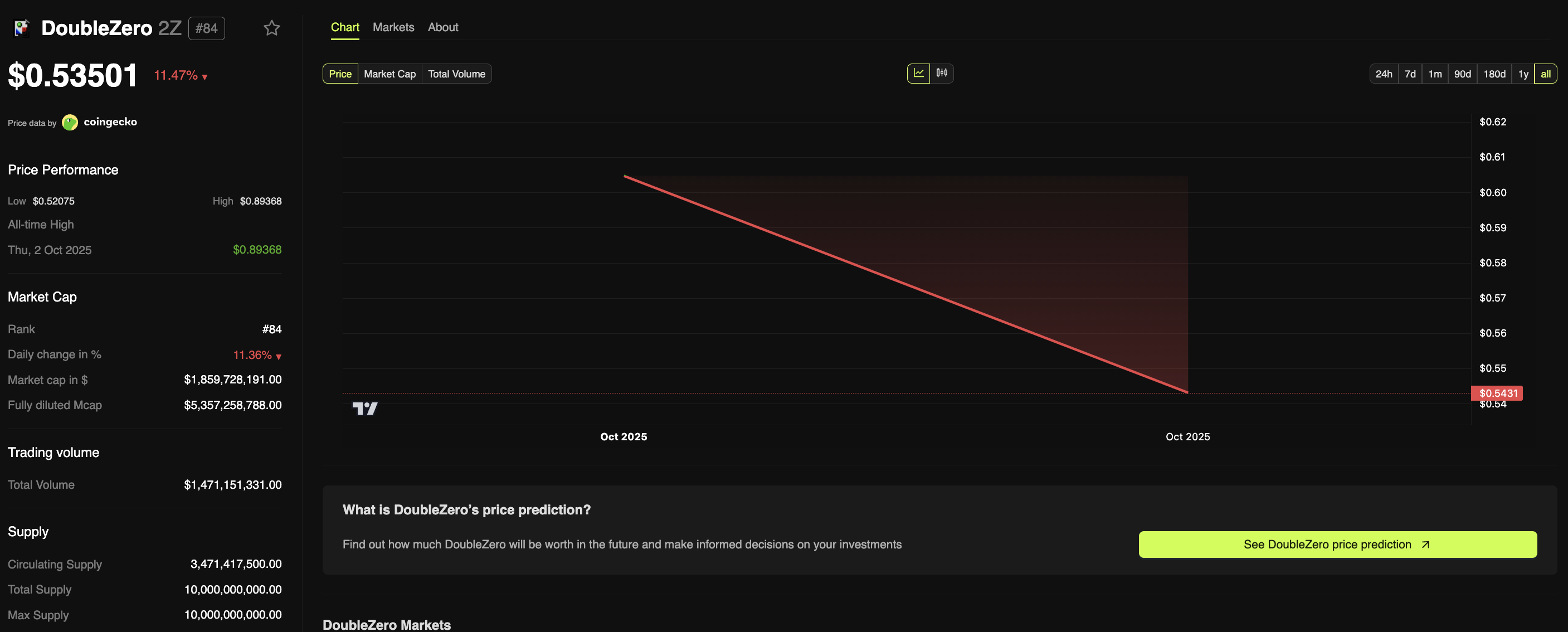

Yet, despite these positive signals, DoubleZero’s 2Z token saw a sharp decline after an initial surge post-listing. At the time of coverage, 2Z was trading at $0.53501, down 40% from its recent ATH.

2Z token price chart. Source:

BeInCrypto

2Z token price chart. Source:

BeInCrypto

Many Problems with Tokenomics

The main issue lies not in the technology but in tokenomics and unlock mechanisms. A sudden influx of supply into the market and large token transfers by major stakeholders exerted downward pressure on the price.

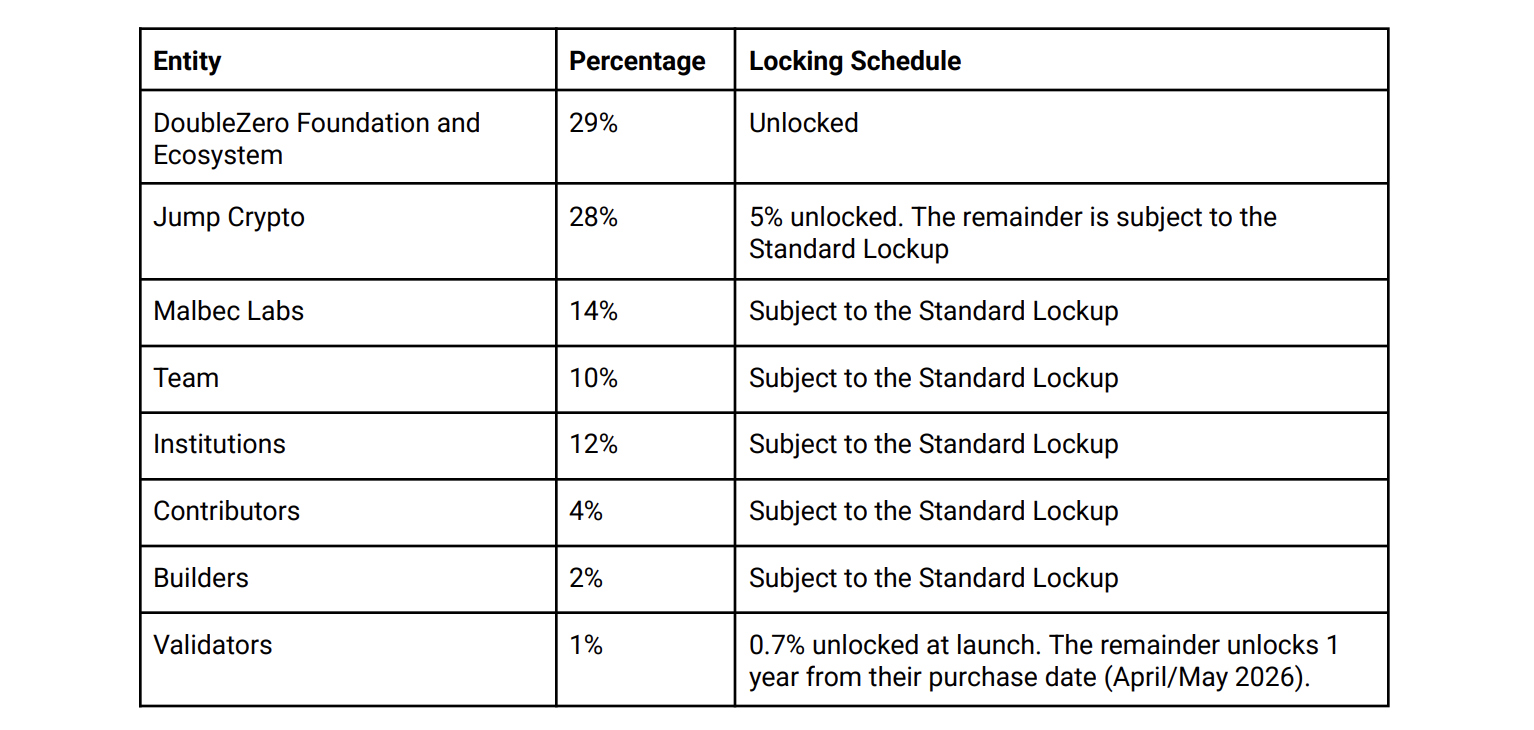

Tokenomics reveals a total initial supply of 10 billion tokens distributed across groups (Foundation & Ecosystem ~29%, Jump Crypto ~28%, Malbec Labs ~14%, Team ~10%, and others), with varying vesting schedules. Many critics argue that the project only allocated tokens to VCs without any meaningful distribution to the community.

2Z token allocation. Source:

DoubleZero tokenomics

2Z token allocation. Source:

DoubleZero tokenomics

“A lot of questionable things in the DoubleZero tokenomics… Only the insiders were allocated tokens!” emphasized one X user.

Arkham data also showed that Jump Crypto received $42.8 million worth of 2Z tokens, of which $20.9 million had been deposited to Binance and Bybit. This suggests potential sell-offs by market makers, contributing to the decline in price.

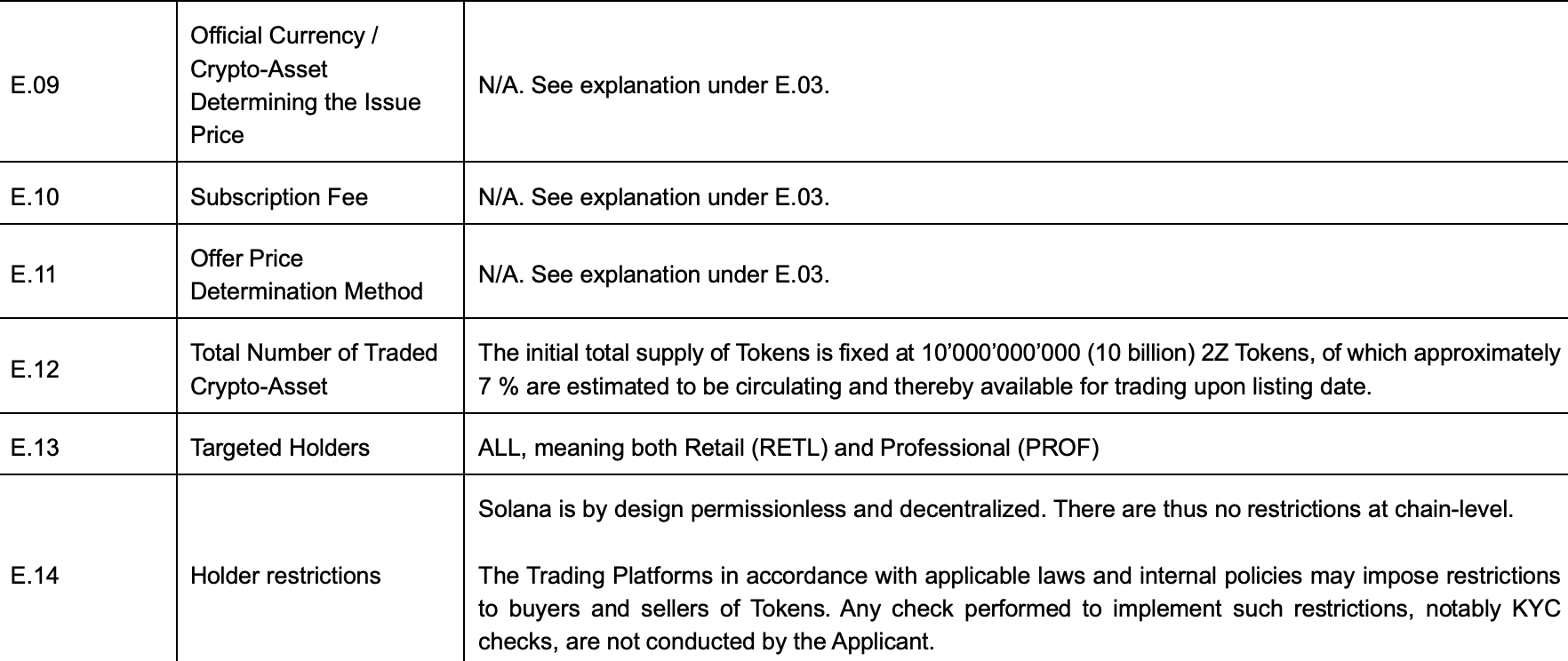

Not only is there a suspicion of dumping from MM, but another thing worth noting is that some parts were in “unlocked” status at launch. Data recorded that the total circulating supply of 2Z tokens at launch was about 3.47 billion.

This number is much larger than the announcement in the project’s MiCA whitepaper of 7% or 700 million 2Z. The origin of these tokens is still unclear, creating an information gap and increasing negative sentiment online.

Initial circulating supply of 2Z. Source:

DoubleZero

Initial circulating supply of 2Z. Source:

DoubleZero

While the No-Action Letter represents a regulatory win for DoubleZero’s infrastructure model, risks stemming from concentrated supply and unclear vesting schedules remain the key factors behind the token’s price volatility and shaken community trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Government Shutdown While the White House is Being Renovated: Who is Paying for Trump's $300 Million "Private Banquet Hall"?

U.S. President Trump has approved the demolition of the White House East Wing to build a large banquet hall funded by private donors, including Trump himself and several companies from the technology, defense, and crypto industries. This move has sparked controversy and criticism for allegedly using power to raise funds. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Powell Turns Hawkish: December Rate Cut Far from Certain, Government Shutdown May Force Fed to Hit the Brakes | Golden Ten Data

The Federal Reserve has cut interest rates by another 25 basis points and announced the end of quantitative tightening in December. During the press conference, Powell emphasized the necessity of "slowing the pace of rate cuts," prompting the market to quickly adjust its expectations and causing risk assets to decline across the board.

Bloomberg: $263 million in political donations ready as the crypto industry ramps up for the US midterm elections

This amount is nearly twice the maximum SPAC Fairshake invested in 2024, and slightly exceeds the total spending of the entire oil and gas industry in the previous election cycle.

PEPE Price Chart Signals Oversold Zone Reversal as RSI Turns Upward