Institutions Diverge on Bitcoin and Ethereum Investments

- Leadership shifts highlight strategic institutional divergence.

- New ETH-focused strategies mark a turning point.

- Market dynamics influenced by Ethereum’s growing utility.

Institutions are increasingly favoring Ethereum over Bitcoin, highlighted by a $136 million rebalancing in BlackRock’s ETFs and surging ETH trading volumes on OKX. Ethereum’s appeal lies in its role as a backbone for programmable finance.

Institutional investors are re-evaluating crypto allocations, impacting market dynamics and strategy directions.

The Institutional Landscape

The institutional landscape shows a notable divergence between Bitcoin and Ethereum strategies highlighted by Hong Fang . Hong Fang of OKX notes the increasing significance of Ethereum in programmable finance, citing a surge in trading volumes. BlackRock demonstrates a strategic rebalancing by increasing its positions in Bitcoin and Ethereum ETFs. Both cryptocurrencies are recognized for their distinct roles: Bitcoin as a value anchor and Ethereum as a backbone for programmable finance.

Recent data reveals a substantial flow of $4 billion into Ethereum-based products, contrasting with a $600 million outflow from Bitcoin. This reflects a shift in investor sentiment. Institutional investors are increasingly viewing Ethereum’s ecosystem as vital for new financial products, fostering more strategic moves and allocations.

Recent growth in ETH trading volumes on OKX shows that more customers now see Ethereum as the backbone of programmable finance and next-generation financial applications. — Hong Fang, President, OKX

Impacts on Global Markets

These key shifts in investment strategies affect global markets, with notable impacts on Bitcoin and Ethereum. Institutional interests have driven Bitcoin’s market dominance down from 65% to 57%, while Ethereum saw significant growth. Trends in institutional adoption contribute to these evolving dynamics, marking a new phase in crypto’s institutional adoption.

OKX and BlackRock’s initiatives underscore the financial sector’s adaption to crypto assets as key strategic components. The evolving divergence between Bitcoin and Ethereum is indicative of broader financial industry trends, signaling a shift towards recognizing cryptocurrency as essential to future financial infrastructures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

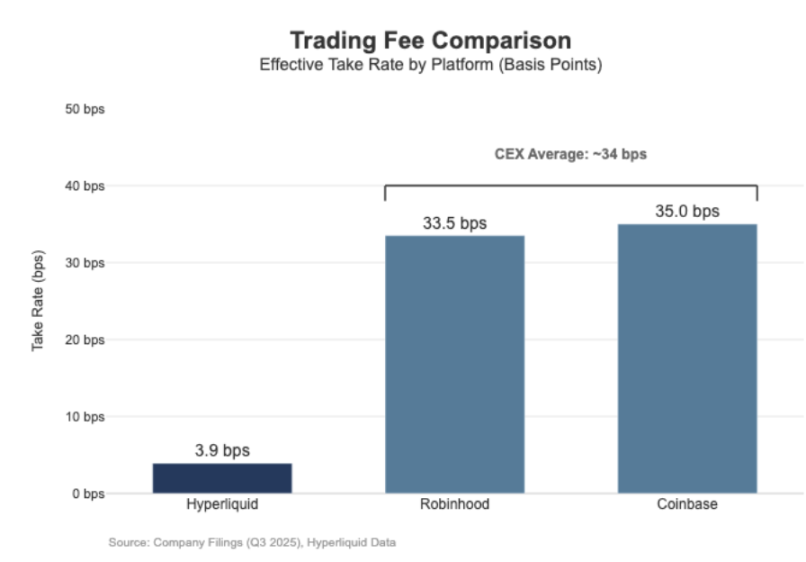

Hyperliquid at a Crossroads: Follow Robinhood or Continue the Nasdaq Economic Paradigm?

Superform Closes Token Sale with $4.7M in Commitments, as SuperVaults v2 Launches

Uniswap vote may soon tie the value of UNI tokens to its multi-billion dollar trading engine

Digital Asset Treasuries Draw In $2.6B Amid Crypto Market Uncertainty