Fresh Bitcoin Demand Emerges As Price Claims $120,000; Up Next – New ATH

Bitcoin has regained $120,000 with fresh demand boosting momentum. A breakout above $122,000 could propel BTC to a record high soon.

Bitcoin has reclaimed the $120,000 mark, signaling renewed bullish momentum that is pushing the crypto king closer to its all-time high.

The sharp rise in price reflects improving investor sentiment as fresh capital flows into the market. Mid-sized holders and ETF inflows appear to be playing a crucial role.

Bitcoin Has Strong Backing

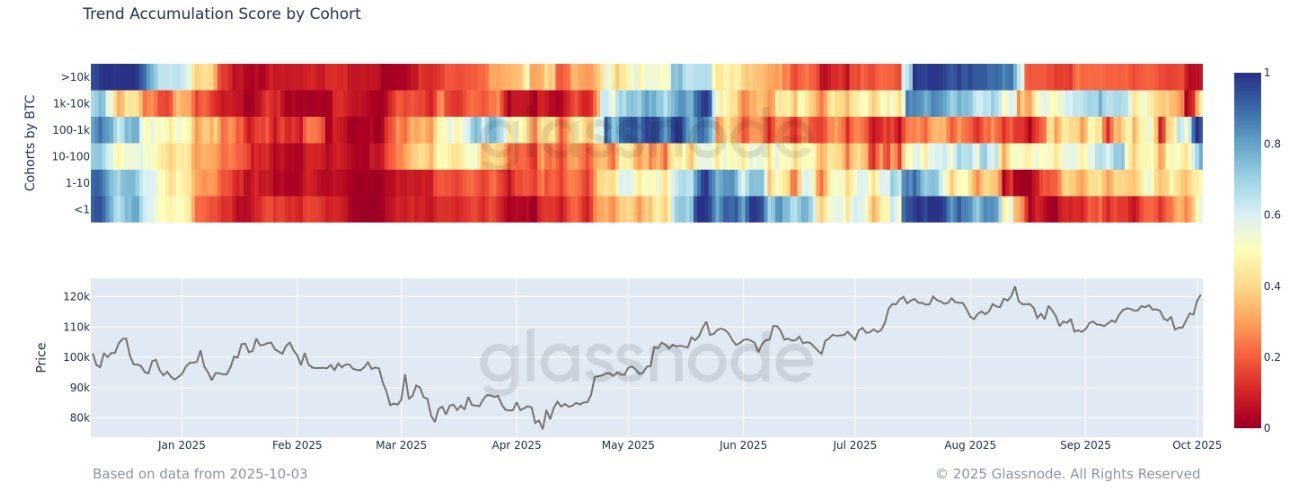

The Trend Accumulation Score highlights a notable shift in market conditions. Mid-sized Bitcoin holders are accumulating strongly, counterbalancing continued selling by larger entities. This fresh wave of demand signals structural support for BTC’s current uptrend, creating a more stable foundation for future gains.

Whale distribution has slowed, while smaller investors remain largely neutral. This balance reduces the risk of aggressive selling and reinforces the market’s resilience. The change in investor behavior suggests a healthier environment for Bitcoin’s growth.

Bitcoin Trend Accumulation Score. Source:

Glassnode

Bitcoin Trend Accumulation Score. Source:

Glassnode

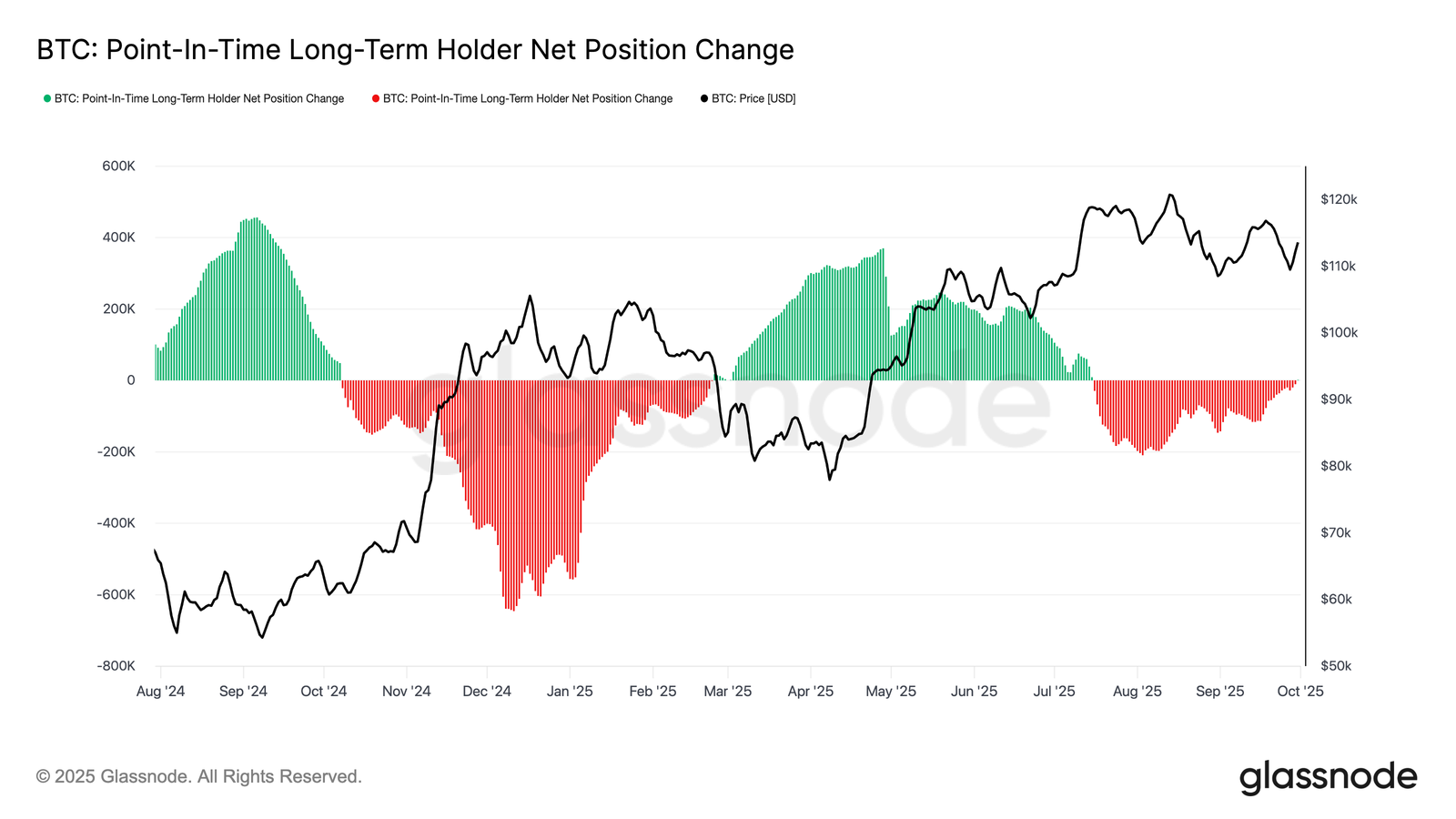

The Long-Term Holders Net Position Change (3D) has shifted toward neutral after months of heavy distribution. This suggests that profit-taking by long-term holders is cooling, leaving the market less vulnerable to sharp selling pressure. Reduced distribution is an encouraging sign for sustained price strength.

With supply pressure easing, external factors such as ETF inflows and institutional demand could now take the lead in driving momentum. If these inflows remain consistent, they will provide Bitcoin with the necessary backing to continue its rally and challenge its previous all-time high.

Bitcoin HODLer Net Position Change. Source:

Glassnode

Bitcoin HODLer Net Position Change. Source:

Glassnode

BTC Price Is Aiming High

At the time of writing, Bitcoin is trading at $120,290, attempting to secure $120,000 as a support floor. Holding this level is critical for sustaining momentum and preventing a short-term reversal.

The immediate challenge for BTC lies at $122,000, which stands as the final resistance before the all-time high of $124,474. A successful breakout above this barrier would open the door for Bitcoin to chart a new ATH, reinforcing bullish conviction across the market.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if market conditions weaken and selling pressure rises, Bitcoin risks losing $120,000 as support. In such a scenario, the price could slip to $117,261. This would invalidating the bullish thesis and signaling a temporary pause in the rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?