Polymarket returns to the United States—where is the next opportunity for prediction markets?

For prediction markets to achieve scale, they require high leverage, high-frequency trading, and high-value market outcomes.

Original Title: Prediction Markets: A Differentiated Hedging Tool

Original Author: Noveleader, Castle Labs

Translated by: Ismay, BlockBeats

Editor's Note: As Polymarket is about to reopen to US users, prediction markets are rapidly emerging in the crypto space, evolving from a niche play into an important tool for hedging risk and capturing event outcomes. This article delves into the operational logic, liquidity challenges, and potential scaling paths of prediction markets through concrete cases, while also exploring their application value in high-impact events such as elections and drug approvals.

The article points out that prediction markets not only provide professional investors with a new hedging tool, but also open a new gateway for ordinary users to participate in the crypto world, covering diverse trading scenarios from pop culture to new tech products. For readers interested in crypto financial innovation, market structure evolution, and risk management, this article offers highly valuable insights.

The following is the original content:

Prediction markets are developing rapidly and have become one of the hottest narratives today. The more I read, the more I realize that prediction markets could be an excellent tool for hedging certain global or local events, depending on the direction of my exposure in a trade. Clearly, this use case has not yet been widely utilized, but I expect that as liquidity improves and prediction markets reach a broader audience, this application scenario will explode in popularity.

Vitalik also mentioned prediction markets in his recent article on low-risk DeFi. In this regard, "hedging event risk" is the most important use case for prediction markets. It not only helps maintain the liquidity cycle but also creates more opportunities for ordinary prediction market participants.

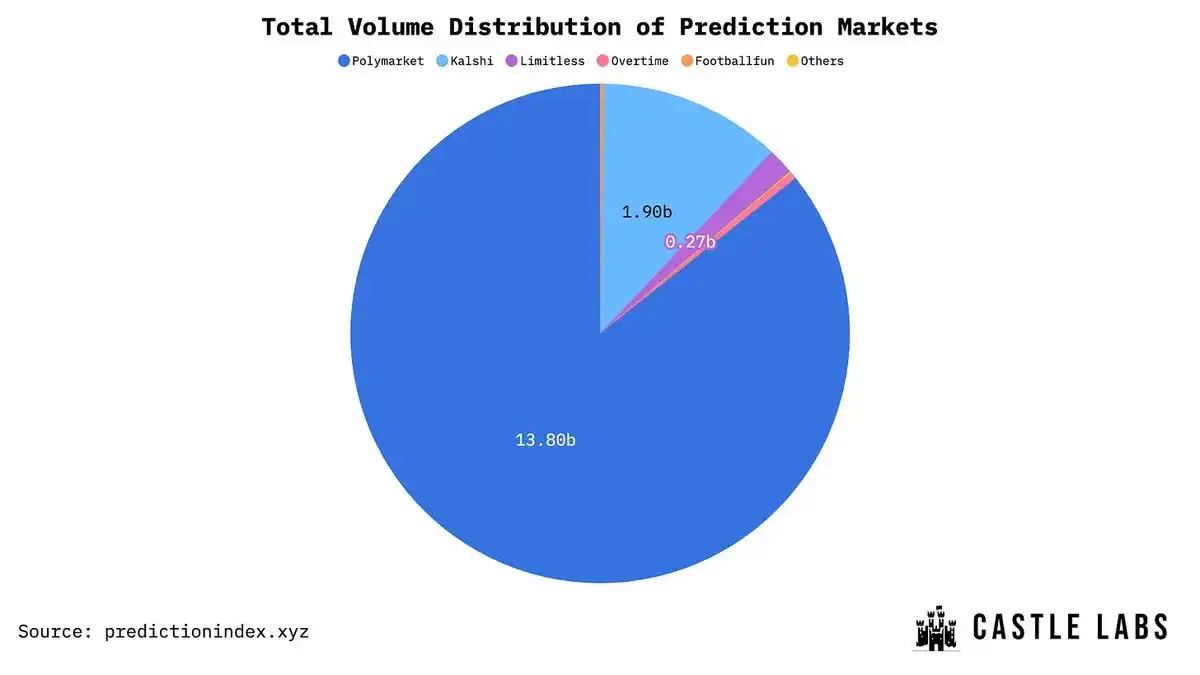

We already know that more and more new companies are entering the prediction market track, increasing the number of projects being built in this field to 97. Although these projects serve different directions and will grow with their respective industries and user groups, from the trading volume data, only a few products stand out.

In addition, it should be noted that prediction markets, as a niche track, are still in the exploratory stage. In the future, new winners will continue to emerge, developing alongside mature projects such as @Polymarket, @Kalshi, and @trylimitless, which already hold significant shares of prediction market trading volume.

The Evolution of Prediction Markets

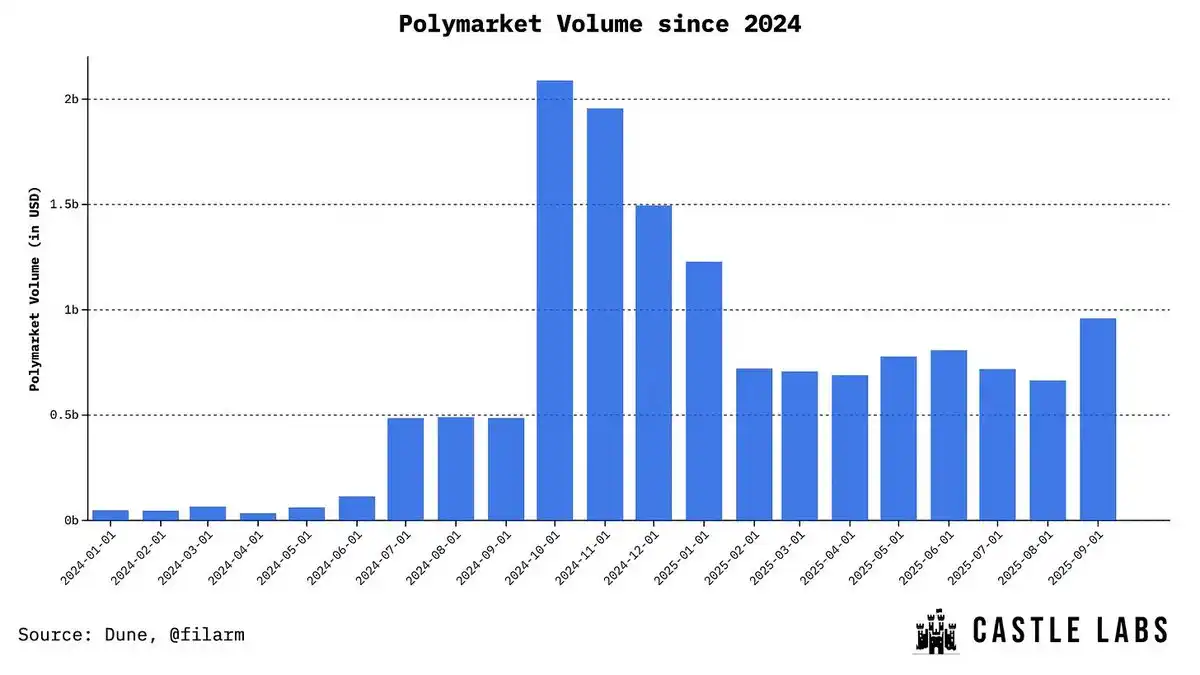

Here I will briefly review the history of prediction markets (which is not that long ago). Prediction markets have only gradually entered the mainstream in recent years, especially during the 2024 US presidential election, when Polymarket's trading volume surged significantly, earning prediction markets the attention they needed.

Since that peak, although trading volume has not remained at 2024 levels, it has stayed within a relatively high range. Recently, as shown in the monthly trading volume chart above, volume has started to grow again. As this trend develops, companies like Kalshi and Limitless have also achieved higher trading volumes, becoming strong competitors capable of rivaling Polymarket.

In addition, different types of prediction markets are constantly emerging, targeting different user groups and application scenarios, and opening up their own niche tracks. A good example is @noise_xyz (currently still in the testnet phase), which allows users to leverage trade on the "attention" of a specific project.

Prediction Markets as a Hedging Tool

Now let's get to my core point.

In the future, prediction markets will become more efficient and liquid, thus becoming valuable hedging tools. I'm not saying they are not used for hedging at all now, but rather that the current scale is not enough to play a role on a larger level.

If we look at existing use cases, an article by @0xwondr illustrates this well. He gave an example of how he used prediction markets to hedge when the Trump Token launched earlier this year. On one hand, he bought $TRUMP tokens, and at the same time, he bought "Yes" shares in the prediction market for the event "Will Trump be hacked?" In this way, if a hack did occur, he could offset his losses with the "Yes" shares; conversely, if no hack happened, the token itself had great upside potential (and we did see it rise significantly in the end).

Let me try to illustrate the "hedging" opportunity with another example. Suppose an investor's portfolio has a significant portion invested in a particular pharmaceutical company. The company is awaiting FDA approval for a new product. If approved, the company's stock price will likely soar; if rejected, the price may plummet. If there is a prediction market for the same outcome, this pharmaceutical investor could hedge their stock position by buying "No" shares.

Of course, there are different views on this approach: some believe there are better, more liquid channels for such hedging. Investors could simply short the stock and wait for the approval result. But the question is, can investors strictly maintain a hedge based solely on an uncertain FDA approval result? The answer is obviously no.

With prediction markets, hedging decisions that are unknown to anyone become smooth and feasible. Perhaps in the long run, prediction markets will become a hedging tool that complements existing channels. If used efficiently, prediction markets can indeed be a very effective hedging tool.

Similar examples include election results, macroeconomic events, interest rate adjustments, etc. For these event-based risks, there are almost no other feasible hedging avenues.

What Does It Take for Prediction Markets to Scale?

The evolution of prediction markets and the new liquidity brought by users help them become liquid venues for hedging specific events or markets. But the question is, do these markets have enough liquidity for large-scale hedging?

A simple answer is: not enough, at least for most markets.

You may have seen some impressive trading volume data at the beginning of the article. Polymarket's trading volume last month was close to $1 billion, which is already quite impressive for a binary market that does not offer leverage and is based on a relatively new narrative. However, this trading volume is spread across different markets and themes, not focused on a single event, but the platform's total trading volume. In fact, only a few events contribute the majority of the trading volume.

Putting trading volume aside, the core issue we need to discuss is liquidity, because the growth of trading volume depends on deeper liquidity.

Deeper liquidity ensures that prices are not easily manipulated, that a single trade does not significantly impact the entire market, and that slippage is minimized during trading.

Currently, prediction markets mainly obtain liquidity in two ways:

1. Automated Market Makers (AMM): In the classic AMM structure, users trade with a liquidity pool. This is suitable for the early stages of the market but not for large-scale expansion. At this point, order books have more advantages.

2. Orderbook: Order books rely on active traders or market makers to maintain liquidity, making them very suitable for market scaling.

I recommend reading this article by @Baheet_ for a deeper understanding of how prediction markets operate:

Since we are focusing on the issue of scale here, I will focus on the orderbook. In an orderbook, liquidity can be provided by traders or market makers (MM) actively placing orders, or a combination of both. Structures involving market makers are usually more efficient.

However, due to significant differences between traditional markets and event contracts (prediction markets), market making in binary markets like Polymarket or Kalshi is not easy.

Here are some reasons why market makers may be reluctant to participate:

1. High inventory risk: Prediction markets can experience sharp swings due to specific news. A market may be running well in one direction, but can quickly reverse. If a market maker's pricing is opposite to the market direction at that time, they may face huge losses. While this can be mitigated by hedging, these tools usually do not have convenient hedging options.

2. Lack of traders and liquidity: The market lacks sufficient liquidity. This sounds like a "chicken or the egg" problem, but the market needs frequent traders or counterparties to generate profits for market makers through bid-ask spreads. However, if the trading volume and frequency in a specific market are too low, market makers are not incentivized to participate actively.

To solve this problem, some projects are actively exploring solutions, such as Kalshi, which uses third-party market makers and also has an internal trading department to maintain liquidity. Polymarket mainly relies on the natural supply and demand in the orderbook.

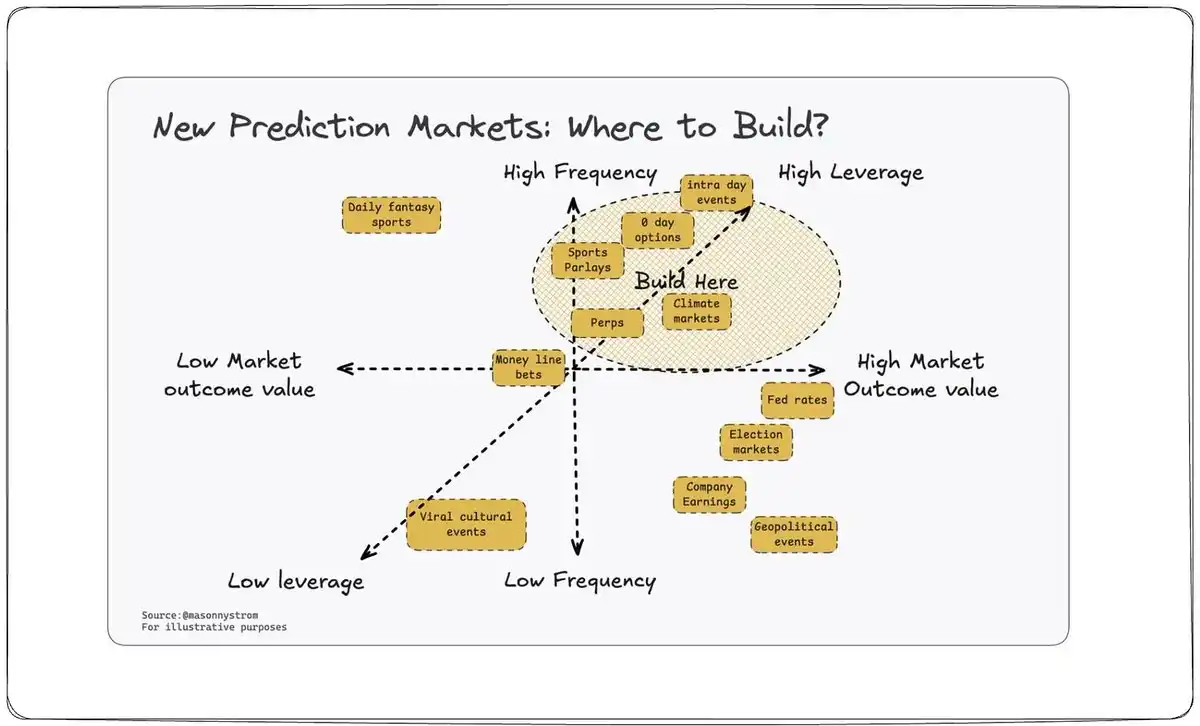

Ultimately, to attract trading volume and users, a market that everyone wants to participate in must be built, and such a market should have three characteristics:

1. High leverage: Not easy to achieve in binary Yes/No markets, as users cannot pursue higher returns through leverage. Some platforms like @fliprbot offer leveraged trading in prediction markets, but usually with low trading volume. In addition, Limitless offers daily and weekly settlement markets, allowing users to participate in faster-settling markets and potentially increase returns.

2. High-frequency markets: The more markets users can choose from, the more likely they are to trade on the same platform. More markets mean more trading volume.

3. High market outcome value: If the outcome of a market has a major impact, it will bring significant trading volume. This is especially evident in election or drug approval-related markets, as the results of these events will significantly affect broader market reactions.

Summary and Thoughts

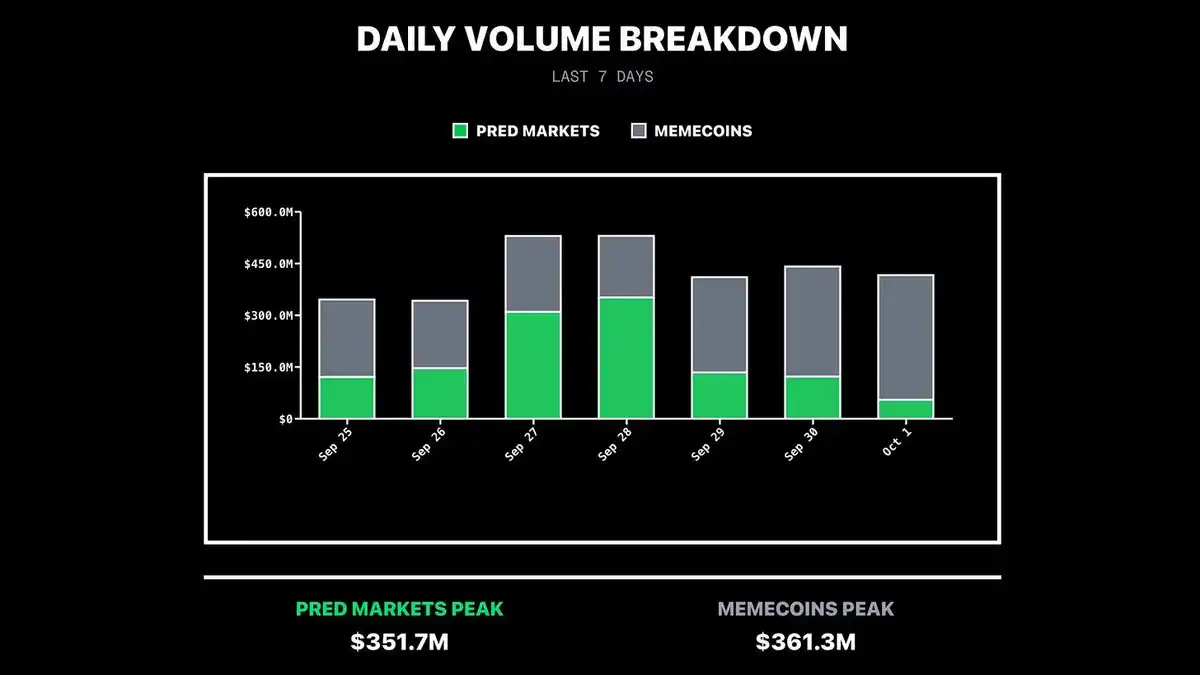

Prediction markets have undoubtedly left a deep mark on the industry. Just this week, their trading volume has surpassed meme coins, showing a clear growth trend and signs of widespread adoption.

I also want to point out that prediction markets have indeed fueled a state of "hyperfinancialization." Frankly, as long as people don't lose large sums of money, this state itself is not a problem. I even wrote an article discussing how we are moving toward a state where "everything can be marketized," and why this trend is both beneficial and problematic.

If you want to read it, you can find the article here:

Finally, I truly believe that prediction markets are an excellent way to bring new users into crypto, as these markets are often aimed at audiences outside the CT (crypto trader) circle. Almost everything and every topic has a corresponding market, including pop culture, celebrity gossip, new Apple product launches, and almost anything you can think of. Allowing anyone to trade on things they are interested in is a powerful force with great potential, and it's an area I am very excited to observe and participate in.

So, it can be said that prediction markets are alpha.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitwise Files Spot SUI ETF With SEC, Offering Direct Exposure and Staking Yield to Tap a $5B Token Market

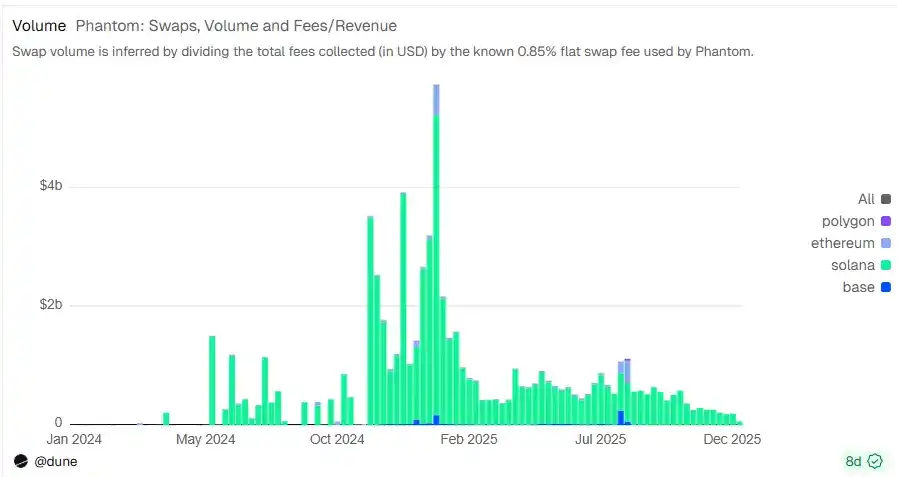

Behind the $3 billion valuation: Phantom's growth anxiety and multi-chain breakout

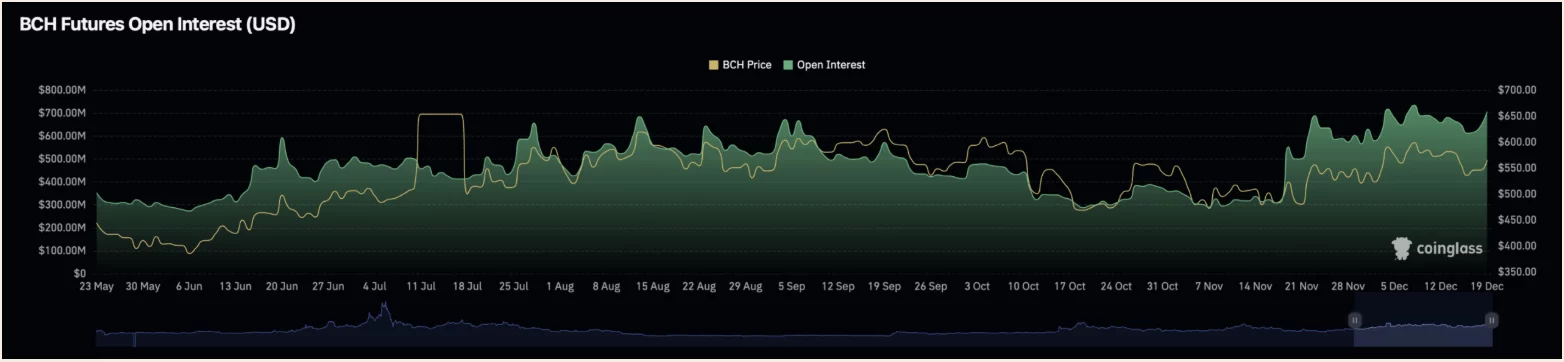

Bitcoin Cash Surges: BCH’s Mixed Market Reaction

Pepecoin (PEPE) vs $0.035 DeFi Coin: Which Has the Cleaner Long-Term Setup as Market Conditions Shift?