Date: Thu, Oct 02, 2025 | 12:05 PM GMT

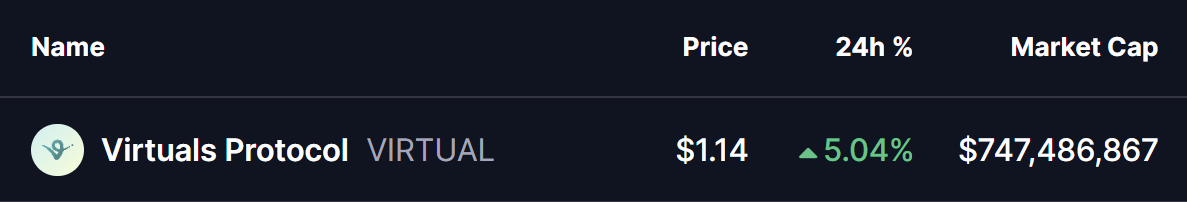

As the much anticipates Q4 kicks off, the cryptocurrency market is showing strength as the prices of both Bitcoin (BTC) and Ethereum (ETH) surged over 2% in the past 24 hours, turning true on the historical bullish October month. Riding this resilience, several altcoins are starting to flash bullish signals — and Virtuals Protocol (VIRTUAL) is one of them.

VIRTUAL is back in green with 5% gains, but what makes it more interesting is its technical structure, which could be gearing up for a bullish breakout in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge in Play

On the daily chart, VIRTUAL is forming a Falling Wedge — a pattern widely recognized as a bullish reversal setup, often appearing at the end of extended downtrends.

Recently, the token faced rejection from the wedge’s descending resistance, which dragged its price lower toward the support zone near $0.98. However, buyers stepped in aggressively, defending this level and sparking a rebound.

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

Currently, VIRTUAL trades around $1.14, sitting just below the wedge resistance line. The tightening structure suggests that pressure is mounting for a breakout attempt.

What’s Next for VIRTUAL?

If VIRTUAL can break above the wedge resistance and reclaim its 100-day moving average at $1.3537, it would likely confirm bullish momentum. Such a move could open the doors for further upside, with the next technical target sitting at $2.44, based on the wedge’s measured move projection.

On the flip side, a failure to confirm the breakout could see VIRTUAL revisit its wedge support before another attempt higher.