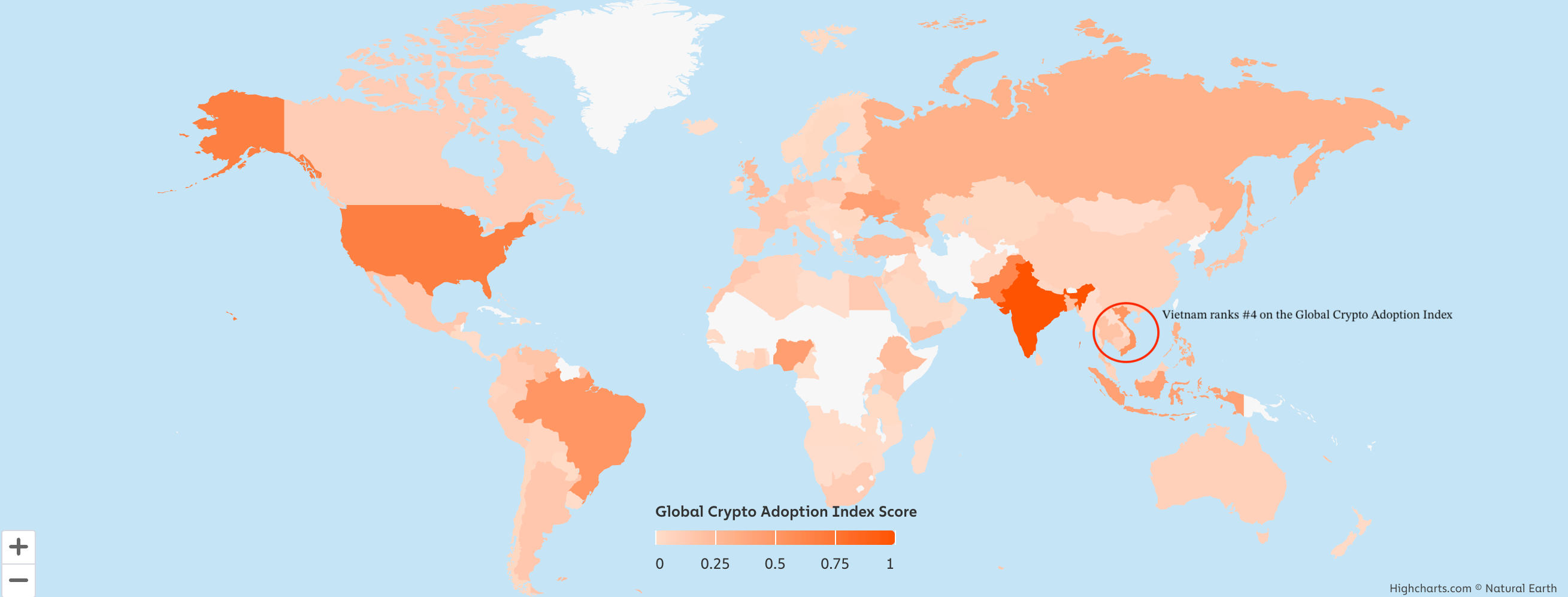

Vietnam crypto adoption is rising rapidly: the country ranks fourth globally on Chainalysis’ 2025 Global Crypto Adoption Index, with recent legalization of cryptocurrencies and a national blockchain rollout positioning Vietnam as a Southeast Asia crypto hub.

-

Vietnam ranks #4 globally for crypto adoption (Chainalysis 2025)

-

New regulation legalizes crypto while banning on‑chain fiat-backed stablecoins and securities issuance.

-

State Bank of Vietnam signals ~20% credit growth in 2025, potentially increasing liquidity to digital asset markets.

Vietnam crypto adoption leads APAC; new regulation legalizes crypto but bans on‑chain fiat-backed assets. Read the latest policy and market implications.

Vietnam is one of the leading countries for crypto adoption in the Asia-Pacific (APAC) region and ranks number four globally, according to Chainalysis.

The State Bank of Vietnam expects credit growth near 20% in 2025, a move that could channel additional liquidity into global crypto markets as domestic adoption accelerates.

Pham Thanh Ha, deputy governor of the central bank, said Friday that interest rates should be cut further to support growth and mitigate uncertainty stemming from U.S. tariffs, as reported by mainstream financial news providers.

In June, Vietnam legalized cryptocurrencies under a new regulatory framework, categorizing tokens as either virtual assets tied to real‑world tokenized products or crypto assets like Bitcoin (BTC) and Ether (ETH).

The regulation explicitly prohibits issuance of on‑chain fiat‑backed assets, including stablecoins and tokenized securities, and establishes a 5‑year sandbox pilot program launched in September to test market infrastructure and compliance models.

The global ranking of each country in the Chainalysis Crypto Adoption Index. Source: Chainalysis

Vietnam’s regulatory stance and technology initiatives — combined with a young population and strong retail adoption — position the country to become a regional crypto hub in Southeast Asia. Chainalysis’ 2025 index places Vietnam fourth globally for adoption.

What is the State Bank of Vietnam’s stance on crypto and monetary policy?

The State Bank of Vietnam supports broader adoption of digital technologies while prioritizing macroeconomic stability. Vietnam cryptocurrency regulation now allows crypto assets but restricts on‑chain fiat instruments; monetary policy shifts (including rate cuts) aim to boost credit and economic activity.

How will the 20% projected credit growth affect crypto markets?

Higher credit growth can increase domestic liquidity available for investment. Short term, this can lift trading volumes; over time, deeper local capital flows may support institutional services and product development in Vietnam’s crypto ecosystem.

Why did Vietnam ban on‑chain fiat‑backed assets?

Regulators cited financial stability and consumer protection concerns. Banning on‑chain issuance of fiat‑backed stablecoins and securities aims to control monetary risk and ensure existing financial infrastructure remains resilient during the sandbox testing period.

What is NDAChain and how will it support adoption?

NDAChain is Vietnam’s national layer‑1 blockchain launched for identification and public records. It uses 49 nodes run by public‑private partnerships and combines permissioned and decentralized elements to secure personal data and enable regulated interaction with on‑chain services.

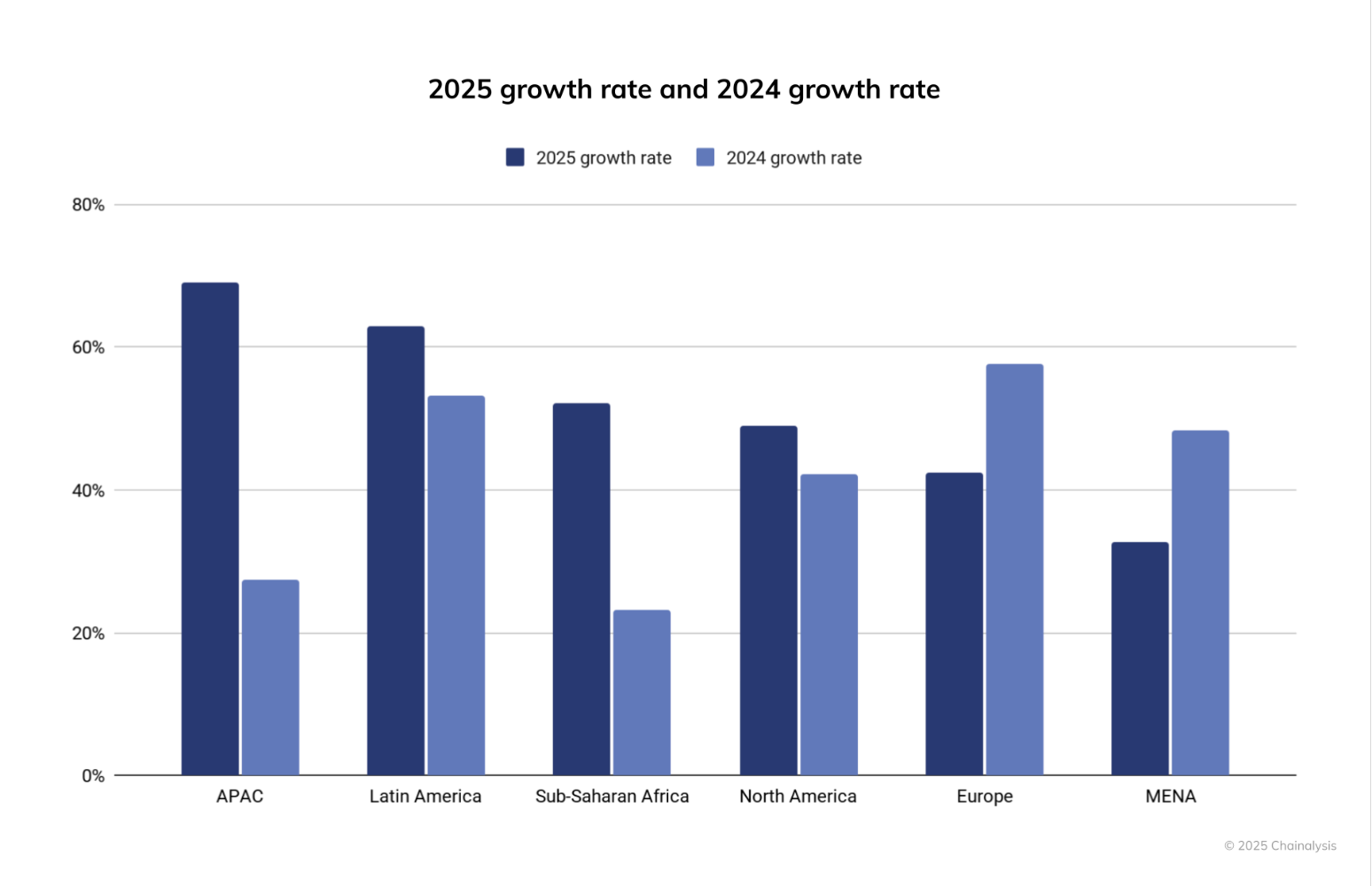

APAC leads all other regions in crypto adoption. Source: Chainalysis

When did Vietnam change its crypto rules and what follows next?

Legalization occurred in June 2025, followed by the September launch of a regulated 5‑year sandbox. Next steps include pilot projects under NDAChain, monitoring by the central bank, and phased policy updates based on sandbox outcomes and international developments.

Frequently Asked Questions

Is cryptocurrency legal in Vietnam now?

Yes. Vietnam legalized cryptocurrencies in June 2025, classifying crypto assets and tokenized real‑world products while banning on‑chain fiat‑backed asset issuance during the sandbox phase.

Can banks and institutions issue stablecoins in Vietnam?

No. Current regulation prohibits issuance of on‑chain fiat‑backed assets, including stablecoins and tokenized securities, within the sandbox and prevailing legal framework.

How does NDAChain protect personal data?

NDAChain stores identity and records across a permissioned layer‑1 network governed by 49 nodes, reducing single‑point centralization risks and enhancing resiliency against cyberattacks.

Key Takeaways

- Adoption leadership: Vietnam ranks #4 globally on Chainalysis’ 2025 index, driven by retail growth and regional momentum.

- Regulatory clarity: June 2025 legalization creates a controlled environment; on‑chain fiat issuance is prohibited.

- Infrastructure push: NDAChain provides a government‑backed layer for identity and public records, enabling compliant digital services.

Conclusion

Vietnam crypto adoption is accelerating under a deliberate regulatory approach that legalizes crypto assets while restricting on‑chain fiat instruments. The State Bank’s monetary easing and NDAChain’s rollout could deepen market participation. Watch sandbox outcomes and policy updates to assess investment and infrastructure opportunities.

Published: 2025-10-03 | Updated: 2025-10-03 | Author: COINOTAG