Trader Says Large-Cap Ethereum Competitor Could Explode 2x After Overcoming Major Resistance Level, Unveils Targets for XRP, Dogecoin and Sui

A widely followed crypto analyst says that one large-cap rival of Ethereum ( ETH ) is poised to double up in price if it can break through a crucial resistance level while updating his outlook on other altcoins.

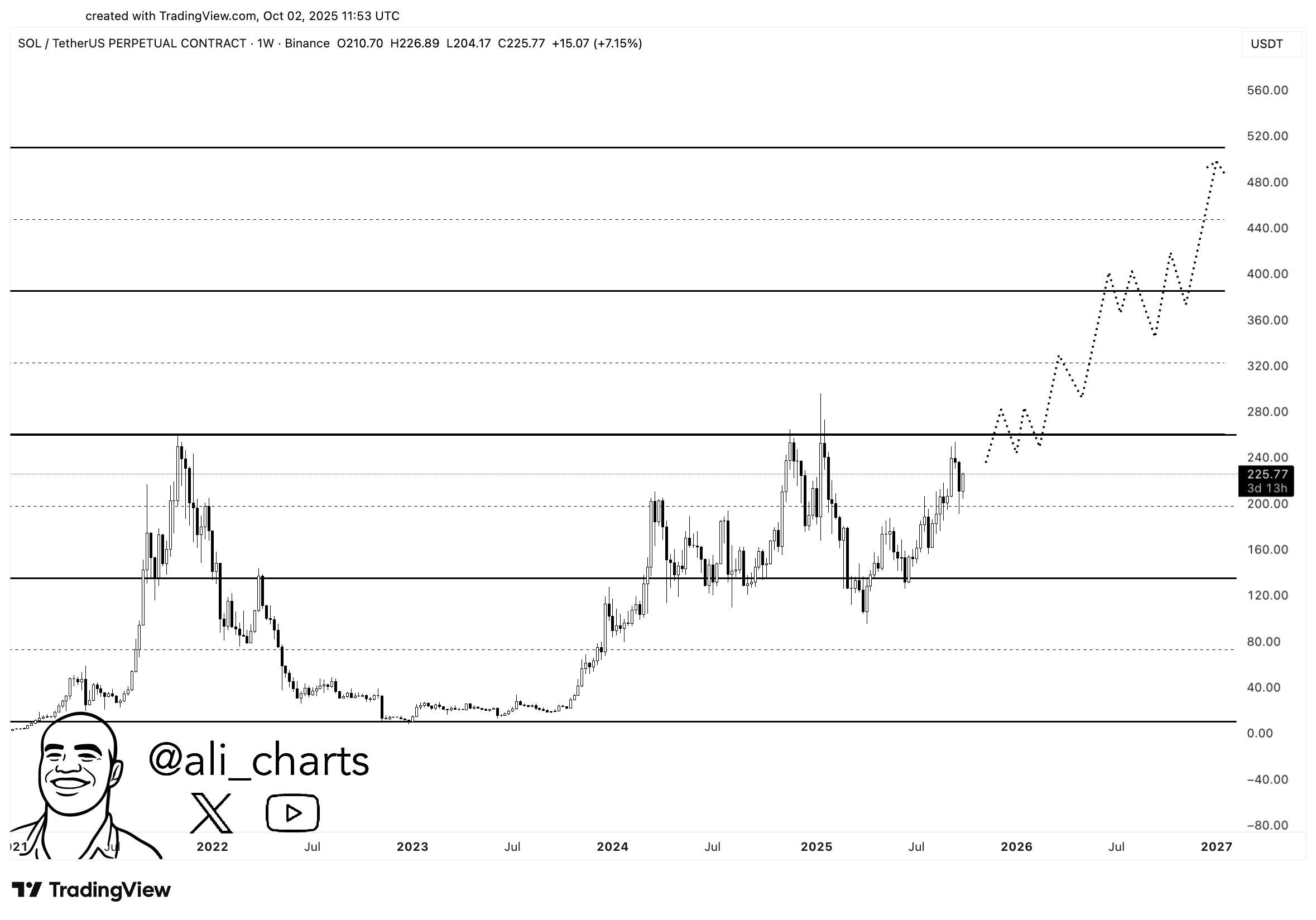

In a new thread, crypto trader Ali Martinez tells his 158,700 followers on X that the smart contract platform Solana ( SOL ) could explode all the way up to $520 if it has a weekly close over $260.

“A weekly close above $260 could ignite a Solana SOL bull rally to $520.”

Source: Ali Martinez/X

Source: Ali Martinez/X

However, according to the trader’s chart, an event like this wouldn’t happen until mid-2026 or 2027. Solana is trading for $230 at time of writing, a 1.9% rise during the last 24 hours.

Moving on to XRP , the digital asset associated with the payments platform Ripple, Martinez says the token appears as if it’s about to break out of a triangle, looking to hit a price tag of $3.60 sometime near the end of October.

“XRP looks set to break out of a triangle, with $3.60 as the target.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is valued at $3.05 at time of writing, a 3% rise on the day.

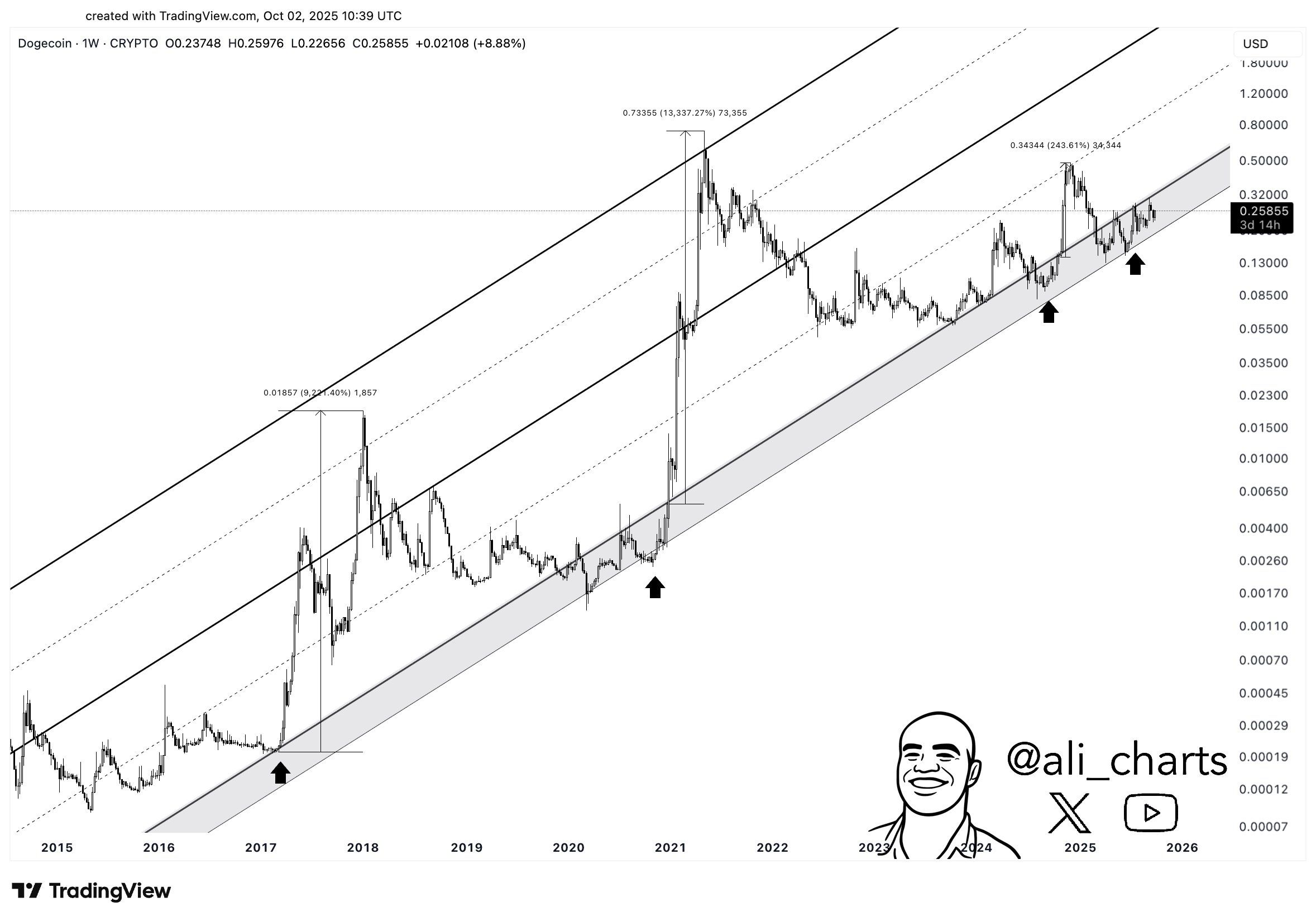

Next up, Martinez brings up the popular meme asset Dogecoin ( DOGE ), noting that it’s still in its accumulation phase and that a breakout is imminent.

Source: Ali Martinez/X

Source: Ali Martinez/X

DOGE is trading for $0.257 at time of writing, a 2.4% rise during the last 24 hours.

Concluding his analysis with the layer-1 blockchain Sui Network ( SUI ), Martinez says the asset appears to be in its prime “buy zone” before it works its way up to a price of $7 sometime before the end of the year.

Source: Ali Martinez/X

Source: Ali Martinez/X

SUI is valued at $3.61 at time of writing, a 2.8% gain on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fosun's Visionary Move: Digital Assets Propel Insurance Toward a Technology-Enabled Tomorrow

- Fosun Finance's Minsheng Life Insurance launched a virtual asset-linked insurance product, expanding into alternative assets via regulatory-approved "Finance + Technology" integration. - The product secures upfront regulatory approval to mitigate risks, contrasting with India's strict virtual compliance requirements and positioning Fosun to lead digital finance innovation. - Competitors like Hillhouse Capital and Axis Max Life Insurance pursue traditional equity strategies, while Fosun's blockchain-drive

Legal Team Portrays Pardon as Protective Measure Amid 'Crypto Crackdown'

- Binance founder CZ's legal team denied "pay-to-play" claims, asserting his 2025 pardon followed standard procedures and regulatory review. - Attorney Teresa Guillén rejected ties to Trump's crypto ventures, calling allegations "false" and emphasizing Zhao's case was regulatory, not criminal. - Critics like Sen. Warren accused Trump of corruption over World Liberty Financial ties, while the White House defended the pardon as routine presidential authority. - Legal scholars called the pardon "unprecedented

Cardano News Update: DeFi Faces $6M Setback as Low-Liquidity Pools Consume Major ADA Trade

- A dormant Cardano wallet lost $6M via extreme slippage in an illiquid USDA stablecoin pool, spiking its price to $1.26. - The trade exposed risks of large swaps in underfunded pools, flagged by on-chain investigator ZachXBT as a "textbook" liquidity trap. - USDA's $10.6M market cap couldn't absorb the 14.4M ADA swap, costing traders $8 per token and wiping $6.05M in value. - The incident highlights DeFi's slippage risks, with analysts urging better safeguards for high-risk trades on decentralized exchang

Bitcoin News Today: Bitcoin Faces Crucial $94K Threshold: Will It Hold Steady or Plunge Further?

- Bitcoin tests critical support near $94,000 as technical indicators signal bearish momentum amid Fed policy uncertainty and liquidity strains. - Record $463M BlackRock ETF outflows and $1.1B total redemptions highlight worsening market sentiment and institutional distress. - Analysts split between bear market forecasts through 2026 and potential stabilization near $94,000 tied to 6-12 month holder cost bases. - Key resistance at $103,000 remains pivotal - a sustained break could reignite bullish trends w