Ethereum is forming a weekly bull flag, trading near $4,463; a confirmed breakout above $4,505 could target $6,900, supported by spot ETH ETF inflows (~$80M) and steady on-chain activity that bolster bullish momentum.

-

ETH current price: $4,463 with $4,505 as immediate resistance.

-

Upside targets: $6,035 (1.618 Fibonacci) and $6,900 (measured move).

-

Market drivers: Spot ETH ETF buys (~$80M), whale accumulation, and steady weekly volumes.

Ethereum bull flag gains momentum; ETH price target $6,900 if $4,505 breaks — read analysis and trade implications from COINOTAG.

What is the Ethereum bull flag and why does it matter?

The Ethereum bull flag is a weekly continuation pattern formed after a strong rally, signaling consolidation before a potential breakout. It matters because a confirmed breakout above $4,505 could accelerate returns toward key targets like $6,035 and $6,900, particularly with ETF inflows and on-chain accumulation supporting demand.

How do spot ETH ETFs and $80M inflows affect the ETH price?

Spot ETH ETFs increase institutional demand and liquidity, which can tighten available supply and lift price action. Reported single-day ETF purchases of about $80 million coincide with whale accumulation and steady weekly trading volumes, reinforcing the bullish structure and improving probability of a breakout. Market-cap snapshot: ETH market capitalization near $538 billion with 24h volume around $47 billion (CoinMarketCap, plain text).

Bull Flag Structure Strengthens

The weekly chart shows a classic bull flag: a sharp prior rally followed by a tight, downward-sloping consolidation channel. Ethereum moved from under $2,500 in June to above $4,000 in August, then formed higher lows inside the flag. A breakout above the upper trendline and $4,505 resistance is the technical trigger for measured-move targets.

#Ethereum Bull Flag 🎯

Weekly bull flag pattern forming on $ETH.

A breakout could send price toward $6,900 🚀 pic.twitter.com/5DmGqrZifs

— Titan of Crypto (Washigorira) October 2, 2025

Analysis prepared by Titan of Crypto sets a measured-move breakout target near $6,900, calculated from the length of the earlier rally extended beyond the consolidation zone. The dotted projection on the chart indicates potential continuation once a confirmed weekly breakout occurs.

Market Data and Technical Signals

Key market data points front-loaded:

- Price range (24h): $4,396 – $4,550; closing near $4,463.

- Market capitalization: ~$538 billion (CoinMarketCap, plain text).

- 24h volume: ~$47 billion (CoinMarketCap, plain text).

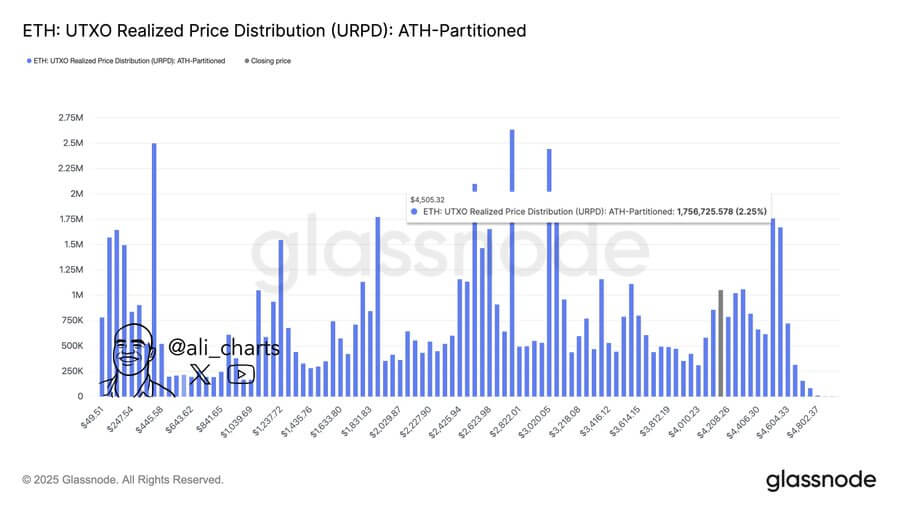

Analyst notes: Ali Martinez flags resistance at $4,505 as the immediate hurdle. Kamran Asghar notes a confirmed breakout above $4,282 with a 1.618 Fibonacci extension target at $6,035. Institutional flow data reported by SoSoValue shows spot ETF purchases around $80M in a single day, a notable demand signal when combined with on-chain whale accumulation.

Source: AliMartinez (X)

Source: AliMartinez (X)

How should traders interpret the technical setup?

Use clear triggers and risk management: a weekly close above $4,505 confirms continuation; a failure below the lower flag trendline invalidates the pattern. Volume confirmation—higher volumes on breakout—strengthens the signal. Apply stop-losses below recent swing lows and scale position sizes to volatility.

| Current price | $4,463 |

| Immediate resistance | $4,505 |

| Fibonacci target (1.618) | $6,035 |

| Measured move target | $6,900 |

| Reported ETF inflows (single day) | ~$80M |

Frequently Asked Questions

What price level confirms the bull flag breakout?

A weekly close above $4,505 that breaks the flag’s upper trendline with elevated volume generally confirms the breakout and opens targets like $6,035 and $6,900.

How much did spot ETH ETFs buy and why does it matter?

Spot ETH ETFs reportedly purchased around $80 million in one day. That volume matters because it signals institutional demand, which can support higher price targets if accumulation continues.

Key Takeaways

- Pattern: Weekly bull flag indicates consolidation with a bullish tilt.

- Trigger: Weekly close above $4,505 on strong volume confirms continuation.

- Drivers: Spot ETH ETF inflows (~$80M), whale accumulation, and steady on-chain metrics support upside.

Conclusion

Ethereum’s weekly bull flag and institutional flows create a high-probability bullish scenario if price clears $4,505. Traders should watch volume and on-chain metrics closely, use disciplined risk management, and monitor targets at $6,035 and $6,900. COINOTAG will continue tracking developments and updating levels as data evolves.