The XRP price is once again in the spotlight, with analysts eyeing a potential rally to $4 driven by a looming supply shock. While such a move would represent a substantial gain for holders, whispers across the market suggest Ripple’s next top pick may not even be XRP itself, but an emerging project with high growth potential.

The XRP Price $4 Rally Looms As Potential Ripple Top Pick Positions For Growth

The XRP price has once again become the focal point of Ripple’s ecosystem, with traders pointing to a potential pump and a programmed supply shock that could drive an XRP price rally to $4. Ripple’s cross-border partnerships, proven utility, and growing institutional demand all fuel this momentum, making XRP one of the most credible assets in the current market.

Yet, while the potential XRP price rally shows strength, its massive market cap places a ceiling on exponential growth. Significant rallies may no longer be the ticket to life-changing gains for XRP itself, meaning Ripple’s stability token may see more stable growth.

This is where Ripple’s emerging top pick enters the conversation. It combines early-stage positioning with real-world use cases, referral bonuses, community rewards, and yield mechanics that give its investors the potential to chase greater upside. Analysts suggest the same supply-and-demand dynamics that once fueled the XRP price early rallies could be replicated by other emerging projects.

XRP Price Rally To $4 Is The Signal, But There Are Other Breakouts

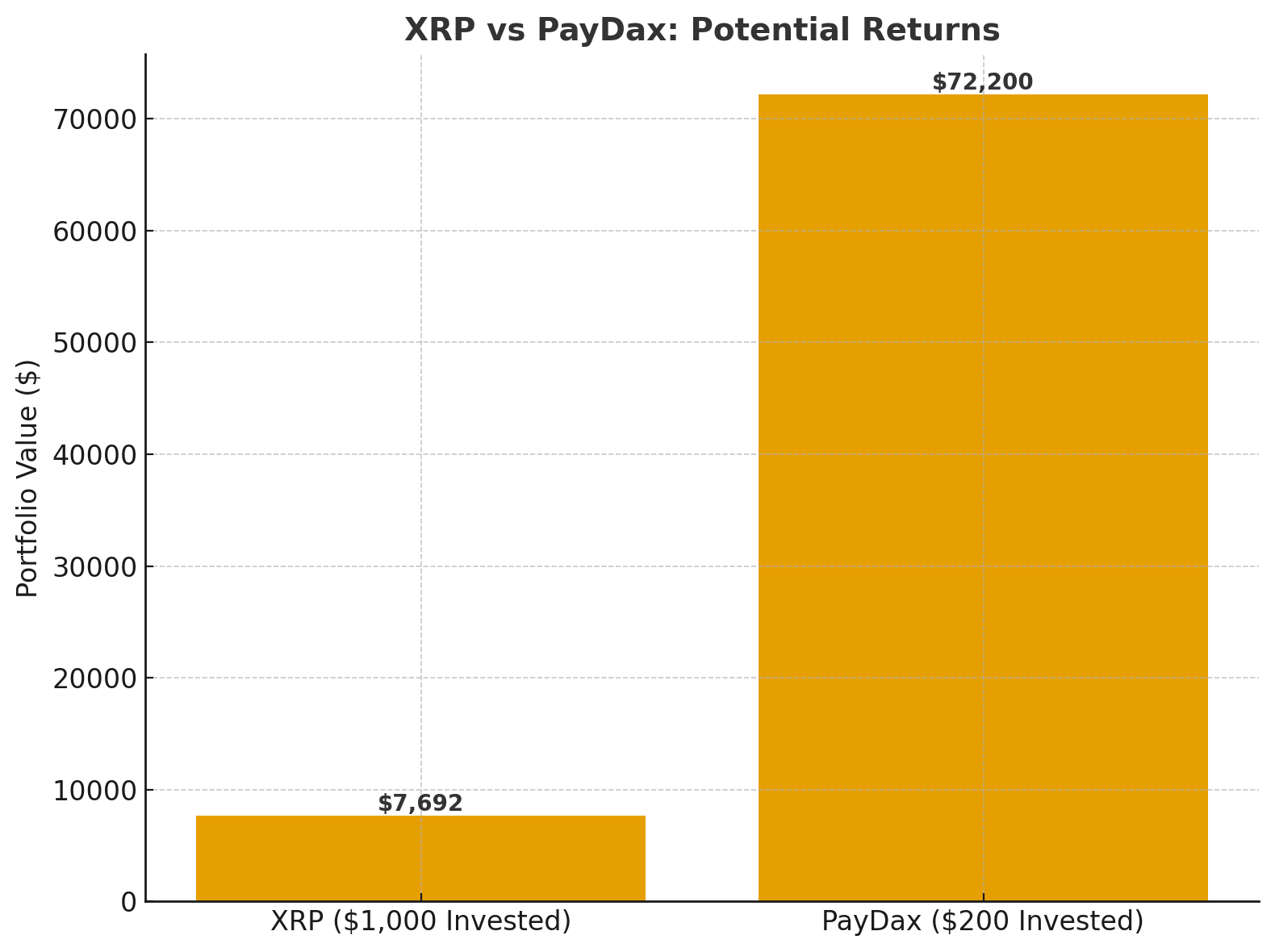

When Ripple programs a supply shock into XRP, the result is clear: an XRP price rally toward $4 becomes not just possible but almost inevitable. For long-time holders, that’s a welcome signal of strength. But here’s the reality: a $1,000 stake in XRP today would be worth under $8,000 at $4. Impressive, but not transformative.

Emerging projects are better positioned to absorb massive gains, thanks to their low market cap and early-stage advantage. Investors are interested in these opportunities for the compounding potential returns of early participation, as each project’s stage can accelerate upside.

The chart below shows how a modest investment in XRP compares to one in an early project stage:

The asymmetry is clear; while XRP offers solid gains, other emerging assets may carry further ignition potential.

Beyond High Gains: Unique Value of Emerging Projects

What truly sets these projects apart is not just the possibility of extraordinary rallies, but the real-world problem-solving utility that underpins their growth potential. Such projects may introduce frameworks designed to unlock liquidity from idle assets and reshape how capital moves in the crypto economy:

-

Asset-Backed Borrowing: Borrow against BTC, stablecoins, or even high-value real-world assets.

-

High-Yield Opportunities: Access lending rewards up to 15.2% APY and yield farming returns reaching 41.25% APY.

-

Institutional-Grade Infrastructure: Incoming partnerships for unmatched credibility.

-

Security & Transparency: Some have completed extensive audits, with leadership teams that are fully doxxed and accountable.