Blockchain network revenues declined 16% in September: Report

Network revenues across the blockchain ecosystem declined by 16% month-over-month in September, mainly due to reduced volatility in the crypto markets, according to asset manager VanEck.

Ethereum network revenue fell by 6%, Solana’s fell by 11%, and the Tron network recorded a 37% reduction in fees, due to a governance proposal that reduced gas fees by over 50% in August, according to VanEck’s report.

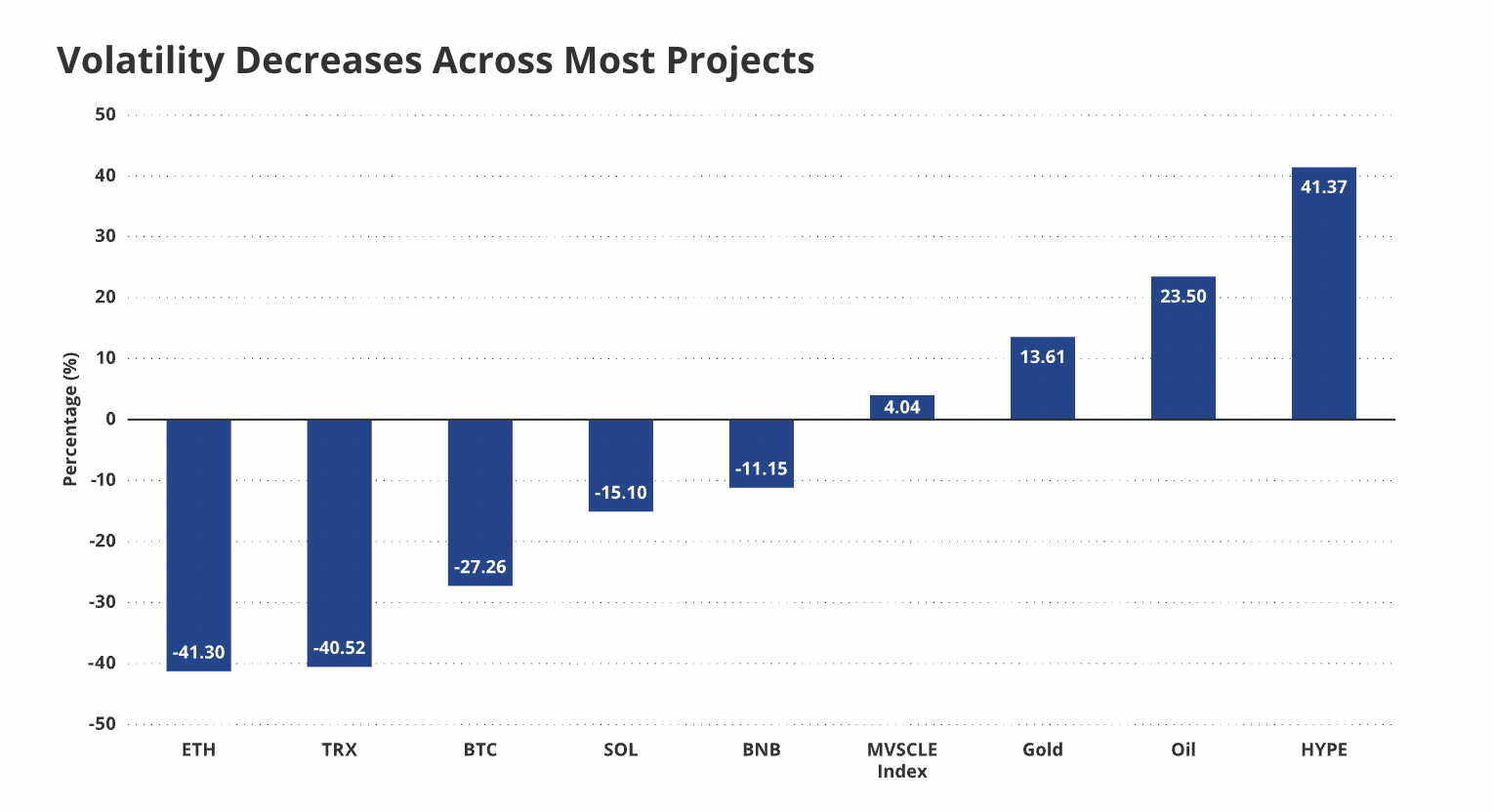

The revenue drop in the other networks was attributed to reduced volatility in the crypto markets and the underlying tokens powering those networks. Ether (ETH) volatility dropped by 40%, SOL (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26% in September.

“With reduced volatility for digital assets, there are fewer arbitrage opportunities to compel traders to pay high priority fees,” the writers of the report explained.

Network revenues and fees are a critical metric for economic activity in crypto ecosystems. Market analysts, traders, and investors monitor network fundamentals to gauge the overall health of a particular ecosystem, individual projects, and the broader crypto sector.

Related: Ethereum revenue dropped 44% in August amid ETH all-time high

Tron network continues to dominate revenue metrics

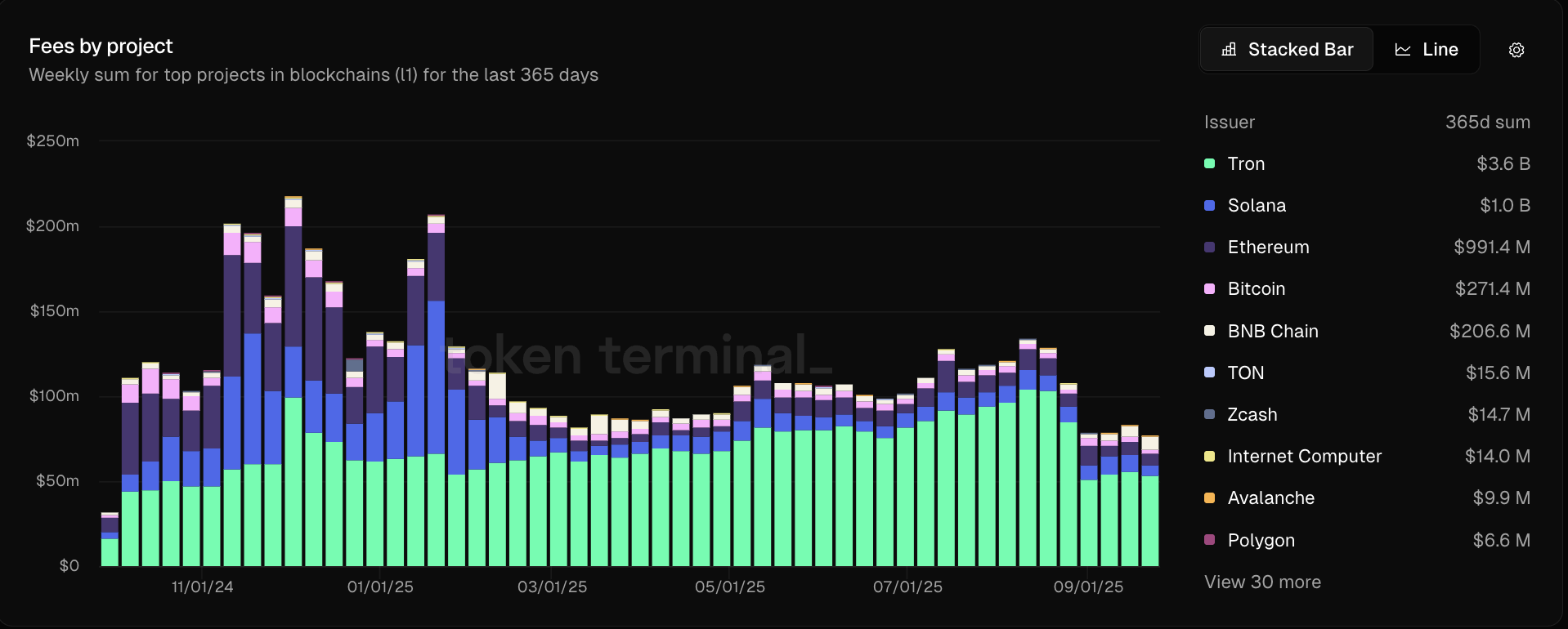

The Tron network is ranked as the number one crypto ecosystem for revenue, generating $3.6 billion in the last year, according to data from Token Terminal.

Ethereum, by comparison, only generated $1 billion in revenue over the last year, despite ETH hitting all-time highs in August, and a market capitalization of about $539 billion — over 16x the TRX (TRX) market capitalization, which is just north of $32 billion.

Tron’s revenue is attributed to its role in stablecoin settlements. 51% of all circulating Tether USDt (USDT) supply has been issued on the Tron network.

The stablecoin market cap crossed $292 billion in October 2025 and has been steadily growing since 2023, according to data from RWA.XYZ.

Stablecoins are a major use case for blockchain technology, as governments attempt to increase the salability of their fiat currencies by placing them on crypto rails.

Blockchain rails allow currencies to flow between borders, with near-instant settlement times, minimal fees, 24/7 trading, and do not require a bank account or traditional infrastructure to access.

Magazine: Ether could ‘rip like 2021’ as SOL traders brace for 10% drop: Trade Secrets

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Assessing How Federal Reserve Policies Influence Emerging Blockchain Assets Such as Solana

- Fed's 2025 rate cuts and liquidity injections initially boosted Solana prices by 3.01% but triggered 6.1% drops during October 2025 liquidations. - Regulatory frameworks like EU MiCA and U.S. GENIUS Act drove 8% institutional ownership of Solana, attracting $101.7M in November 2025 inflows. - 35% of crypto volatility stems from Fed policy shifts, with high-rate environments eroding Solana's appeal as investors favor cash equivalents. - Solana's SIMD-0411 proposal aims to reduce token issuance by $2.9B by

Sustainable Transportation in Cities and the Adoption of Renewable Energy in Developing Economies

- South Africa and India are leading solar-powered transit growth, driven by decarbonization goals and energy security needs in emerging markets. - Solar bus markets project $17.79B value by 2033 (21.6% CAGR), supported by falling solar costs, EV affordability, and policy frameworks in Africa/Asia. - Behavioral economics shapes e-mobility adoption, with South Africa targeting 18,000 tonnes CO₂ reduction via 120 electric buses and India using social nudges to boost EV uptake. - Cross-regional collaboration

A detailed overview of technology layoffs in 2025

PENGU Price Forecast for 2025: Steering Through Regulatory Challenges and Growing Institutional Confidence

- Pudgy Penguins (PENGU) faces regulatory uncertainty from SEC delays and EU MiCA, causing 30% price drops due to compliance risks. - Institutional interest grows with $273K whale accumulation and rising OBV, contrasting retail fear (Fear & Greed Index at 28). - Ecosystem expansion via Pudgy World and penguSOL, plus Bitso partnership, aims to boost utility but depends on user adoption and regulation. - Expert forecasts diverge: $0.02782 (CoinCodex) vs. $0.068 (CoinDCX), with technical analysis highlighting