Bitcoin’s surge to $125,000 triggered $397 million in total liquidations as extreme volatility forced leveraged positions to close; major whales locked in roughly $15 million in unrealized profits while DeFi perpetual DEXs captured a rising share of on-chain fees.

-

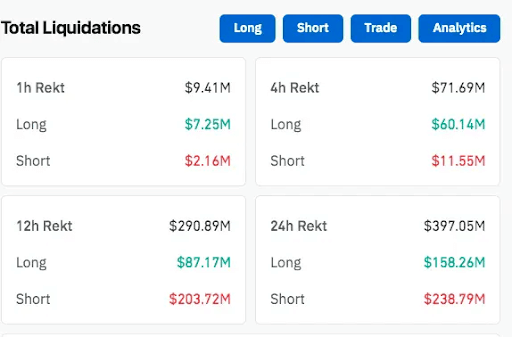

Liquidations totaled $397.05M across 24 hours, intensifying market volatility.

-

Whale trader 0x0a07 holds about $15M in unrealized gains, per Lookonchain (plain text).

-

DeFi perpetual DEX platforms accounted for roughly 32% of blockchain fees, signaling increased DeFi derivatives adoption.

Bitcoin $125K surge: $397M liquidations hit leveraged traders; read data-driven market analysis and next-step risk guidance.

What caused Bitcoin to surge to $125K and trigger $397M in liquidations?

Bitcoin’s move to $125,000 was driven by concentrated buying pressure and leverage unwinds that forced $397.05 million in liquidations over 24 hours. Short squeezes and concentrated whale activity accelerated volatility, producing outsized hourly and multi-hour liquidation spikes.

How did liquidations break down by timeframe and position?

Short-term data showed $9.41 million in liquidations in a single hour, highlighting immediate market shocks. Over four hours, total liquidations hit $71.69 million with longs bearing $60.14 million. In twelve hours, liquidations ballooned to $290.89 million, and 24-hour totals reached $397.05 million — shorts lost $238.79 million versus $158.26 million for longs.

Lookonchain (plain text) reported that whale 0x0a07 has roughly $15 million in unrealized profits across BTC and $PUMP positions. Historical on-chain trackers confirm this whale previously realized about $2.5 million from earlier BTC and ETH trades.

Why did DeFi perpetual DEXs capture more fees during the rally?

DeFi perpetual DEX platforms gained market share as traders sought non-custodial leverage and lower-latency execution. On-chain fee attribution showed perpetual DEX systems capturing near 32% of blockchain fees for derivatives activity, while perpetual futures volumes on decentralized venues rose about 30% compared with prior periods.

Source: Coinglass (plain text)

Source: Coinglass (plain text)

When did treasury and macro flows influence the broader market?

Crypto treasuries expanded through September 2025, reaching approximately $135 billion in reported holdings, according to VanEck (plain text). Despite treasury growth, the broader market saw selling pressure late in the month: 23 of 35 major tokens closed lower in the reported window, reflecting sector rotation and profit-taking after the BTC rally.

What does this mean for traders and risk management?

Short squeezes and whale-led rallies increase tail risk for leveraged participants. Traders should assess margin levels, reduce cross-margin exposure, and consider scaling position sizes. Use stop-loss discipline and avoid concentrated leverage during high-volatility breakouts.

Frequently Asked Questions

How large were hourly liquidation spikes during the breakout?

The breakout produced an hourly liquidation spike of $9.41 million, demonstrating sharp short-term volatility that forced rapid deleveraging among margin traders.

Can institutional treasuries stabilize prices after such rallies?

Institutional treasuries (reported at $135 billion) can provide liquidity buffers, but they do not eliminate volatility; treasury growth may support long-term price discovery while short-term trading remains dominated by leverage and sentiment.

Key Takeaways

- Surge Liquidations: Bitcoin reached $125K and prompted $397.05M in 24-hour liquidations, intensifying volatility.

- Whale Impact: Whale 0x0a07 holds approximately $15M in unrealized profits, underscoring large-player influence.

- DeFi Derivatives: Perpetual DEX platforms captured ~32% of blockchain fees, reflecting growing DeFi derivatives adoption.

Conclusion

This data-driven review shows Bitcoin’s breakout to $125,000 produced significant forced liquidations and reinforced DeFi derivatives’ rising role. Monitor leverage metrics and on-chain fee flows for signals of sustained momentum. For traders, prioritize risk controls and position sizing as volatility and whale activity continue to shape intraday moves.