Spot bitcoin ETFs saw a net inflow of $3.24 billion last week, marking the second highest weekly net inflow in history.

ChainCatcher news, according to SoSoValue data, last week the spot bitcoin ETF recorded a net weekly inflow of $3.24 billion during trading days.

The spot bitcoin ETF with the highest net weekly inflow last week was BlackRock Bitcoin ETF IBIT, with a weekly net inflow of $1.82 billion. Currently, IBIT's historical total net inflow has reached $62.63 billion. The next is Fidelity ETF FBTC, with a weekly net inflow of $692 million. Currently, FBTC's historical total net inflow has reached $12.62 billion. As of press time, the total net asset value of spot bitcoin ETFs is $164.5 billion, with the ETF net asset ratio (market value as a percentage of total bitcoin market value) reaching 6.74%. The historical cumulative net inflow has reached $60.05 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation sets strict 128-bit encryption rules for 2026

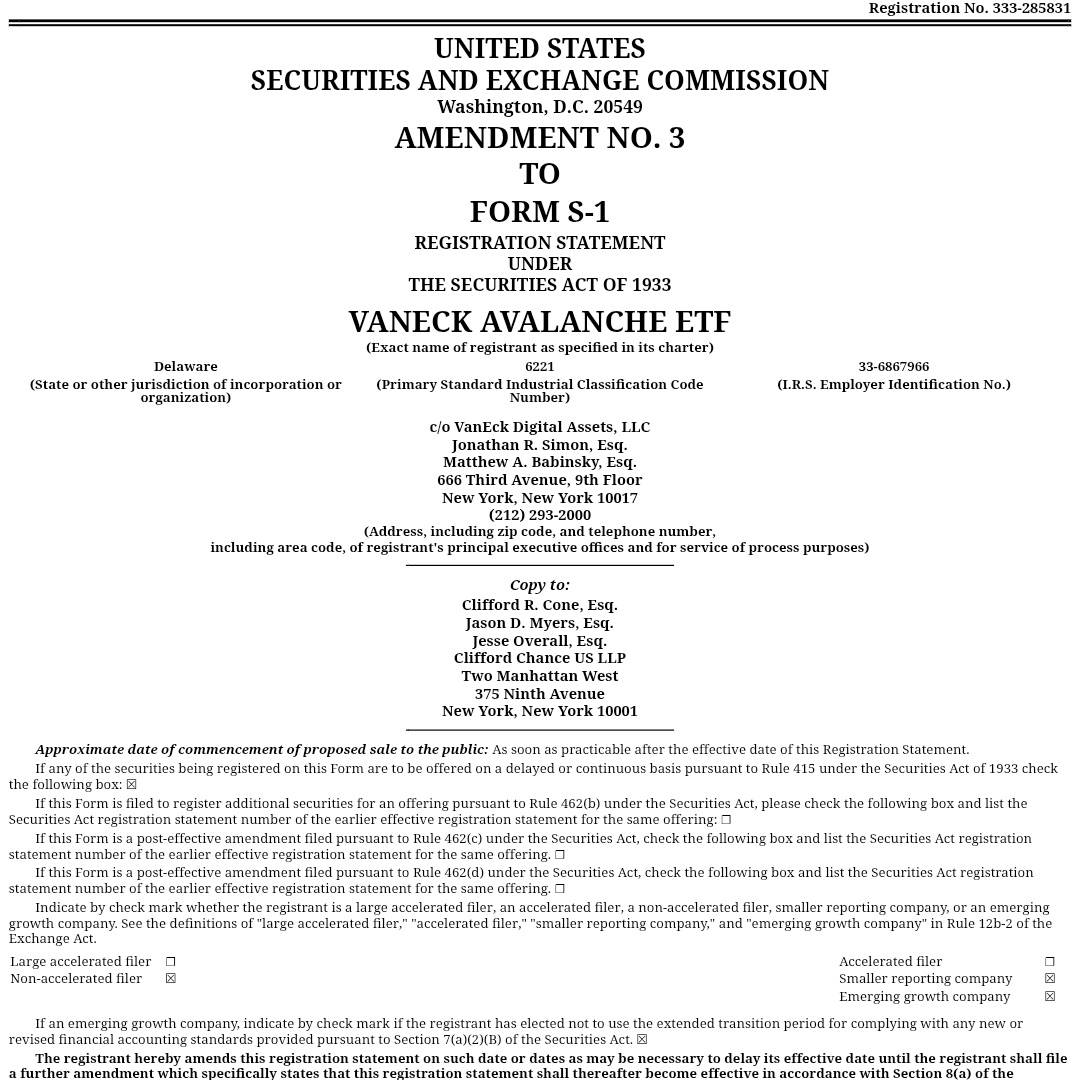

VanEck updates Avalanche ETF application to include staking rewards

VanEck submits spot AVAX ETF application to US SEC

Pi Network updates DEX and AMM features and launches holiday event