Will DOGE Survive the Shutdown?

Dogecoin price is entering a decisive phase at a time when global markets are dealing with unusual uncertainty. The U.S. government shutdown has left investors without key economic reports, forcing them to focus instead on Fed commentary, consumer sentiment, and corporate earnings. For risk assets like DOGE, this creates a fertile ground for volatility. The chart shows price coiling near support, hinting that the next macro trigger—whether dovish Fed signals or weak consumer spending—could set off a sharp move. The question is, will DOGE break toward 0.30 and beyond, or slip back into the 0.20 zone?

Dogecoin Price Prediction: How Does the Shutdown Affect Market Sentiment?

Census Bureau Economic Briefing Room Index of Economic Activity

Census Bureau Economic Briefing Room Index of Economic Activity

The U.S. government shutdown has left investors flying half-blind. With no official economic reports on jobs, trade deficit, or inventories, traders are relying on consumer sentiment data, corporate earnings, and Federal Reserve commentary. The Fed minutes from the recent rate cut meeting, alongside speeches from Powell and Miran, could heavily influence risk assets.

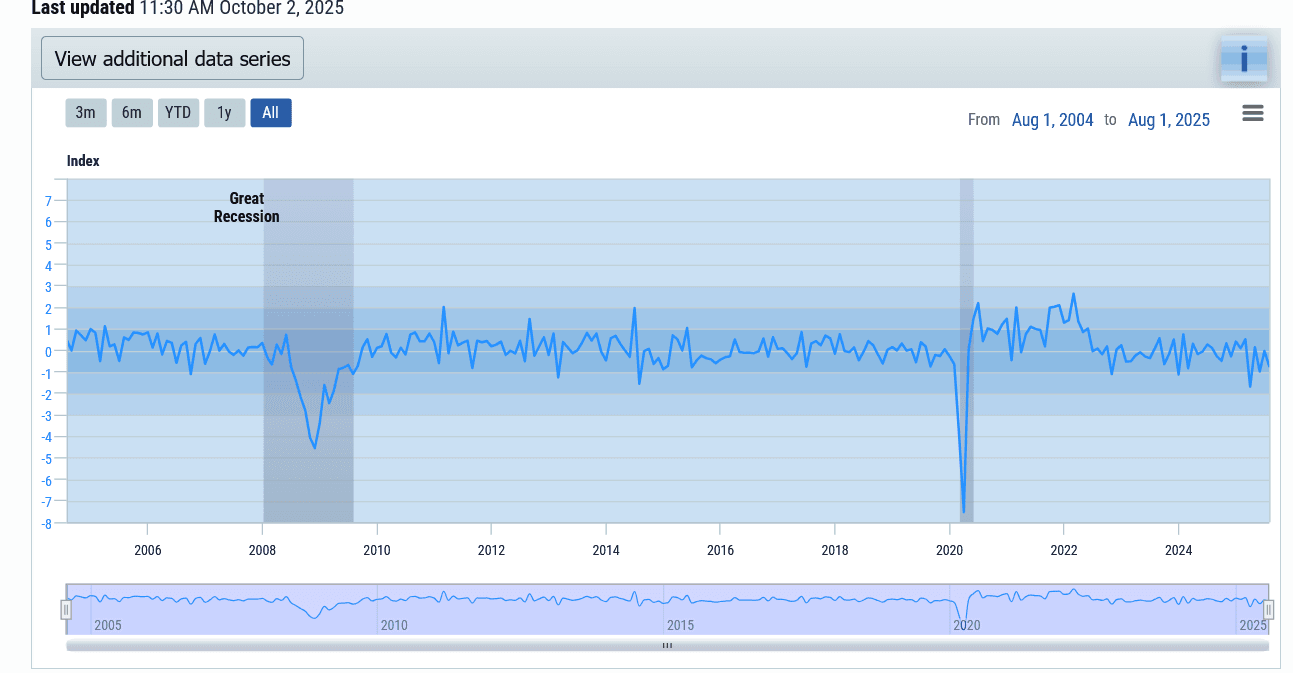

This chart shows the U.S. Census Bureau’s Index of Economic Activity (IDEA), which combines 15 of the agency’s main economic data series into one measure to capture overall economic momentum.

The timeline runs from 2004 through 2020, covering key downturns like the Great Recession in 2008–2009 and the sharp collapse during the 2020 COVID-19 crisis. The index dropped as low as -7 during the pandemic before quickly rebounding, reflecting both the severity of the shock and the speed of recovery. For most of the period, the index oscillates near zero, showing that the U.S. economy tends to move with modest expansions and contractions, with rare but deep downturns during major crises.

Historically, uncertainty over government data releases tends to push investors toward speculative assets like cryptocurrencies, especially if equities look overstretched. DOGE, as a high-beta altcoin, could benefit from this temporary data void.

What Does the Chart Reveal About Dogecoin’s Next Move?

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

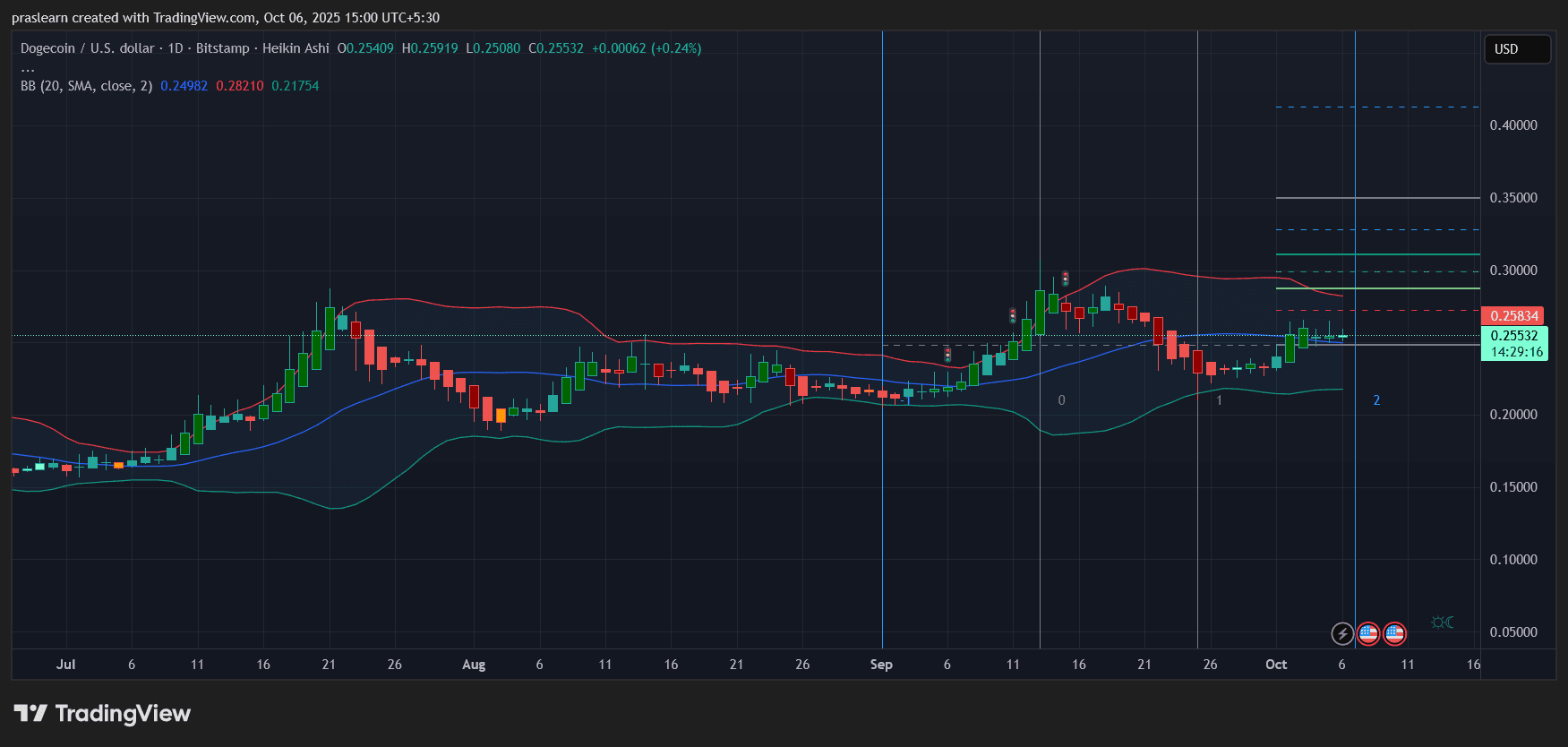

Looking at the daily chart, DOGE price is trading around 0.255 with Bollinger Bands starting to contract after a period of volatility. This signals that the coin is entering a consolidation phase. The mid-band (around 0.249) has been acting as a support, while resistance sits near 0.282. The recent bounce from the lower Bollinger Band at 0.217 shows that buyers are defending key zones.

More importantly, Dogecoin price is forming a base that could set up for a breakout. If the price closes above 0.26–0.27 with volume, the next target opens toward 0.30, followed by 0.35. Failure to hold above 0.245, however, risks a retest of the 0.22–0.20 zone.

Will Earnings and Fed Commentary Trigger Volatility in DOGE?

Corporate earnings this week from PepsiCo, Delta, Levi’s, and Amazon’s Prime event will shed light on consumer strength. Weak consumer spending signals could reinforce expectations for deeper Fed cuts, which often boosts risk appetite across crypto markets. In contrast, strong earnings could push capital back into equities, leaving Dogecoin price struggling to maintain momentum.

The wild card remains Fed commentary . If Powell and Miran hint at further aggressive cuts, DOGE price could mirror the broader crypto rally as traders hunt for yield and speculation.

Is DOGE Still Following Bitcoin’s Lead?

Despite its meme origins, Dogecoin price tends to follow Bitcoin’s macro cycles. Bitcoin’s recent resilience around support levels gives altcoins breathing room. If BTC breaks higher on the back of Fed optimism, DOGE price could ride the wave. The Fibonacci levels plotted suggest that DOGE’s medium-term upside extends toward 0.35–0.40 if momentum aligns with Bitcoin and macro catalysts.

Dogecoin Price Prediction: Where Could DOGE Price Be Headed Next?

In the near term, consolidation between 0.24 and 0.28 looks likely until a macro catalyst shakes markets. A confirmed close above 0.28 could set $DOGE on a path toward 0.30–0.35. On the downside, a breakdown below 0.24 risks dragging price back to 0.22 and possibly 0.20.

With Fed cuts on the table, consumer sentiment under watch, and earnings in play, $DOGE price has a window to surprise traders with a breakout rally—if momentum builds in its favor.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Witness the Dynamic Shifts in Bitcoin and Altcoin ETFs

In Brief Bitcoin and altcoin ETFs witness dynamic shifts in inflows and outflows. XRP and Solana ETFs attract notable investor attention and activity. Institutions explore diversified crypto ETFs for strategic risk management.

Peter Schiff Clashes With President Trump as Economic and Crypto Debates Intensify

Bitcoin Cash Jumps 40% and Establishes Itself as the Best-Performing L1 Blockchain of the Year

Bitcoin Price Plummets: Key Reasons Behind the Sudden Drop Below $88,000