GLDY is Streamex’s new gold-backed stablecoin offering up to 4.0% annualized yield paid in ounces of gold; a new $100M fund opens to qualified investors by Nov. 10, with minimums of $200,000 for individuals and $1M for institutions.

-

Gold-backed stablecoin with yield

-

Streamex committing at least $5 million.

-

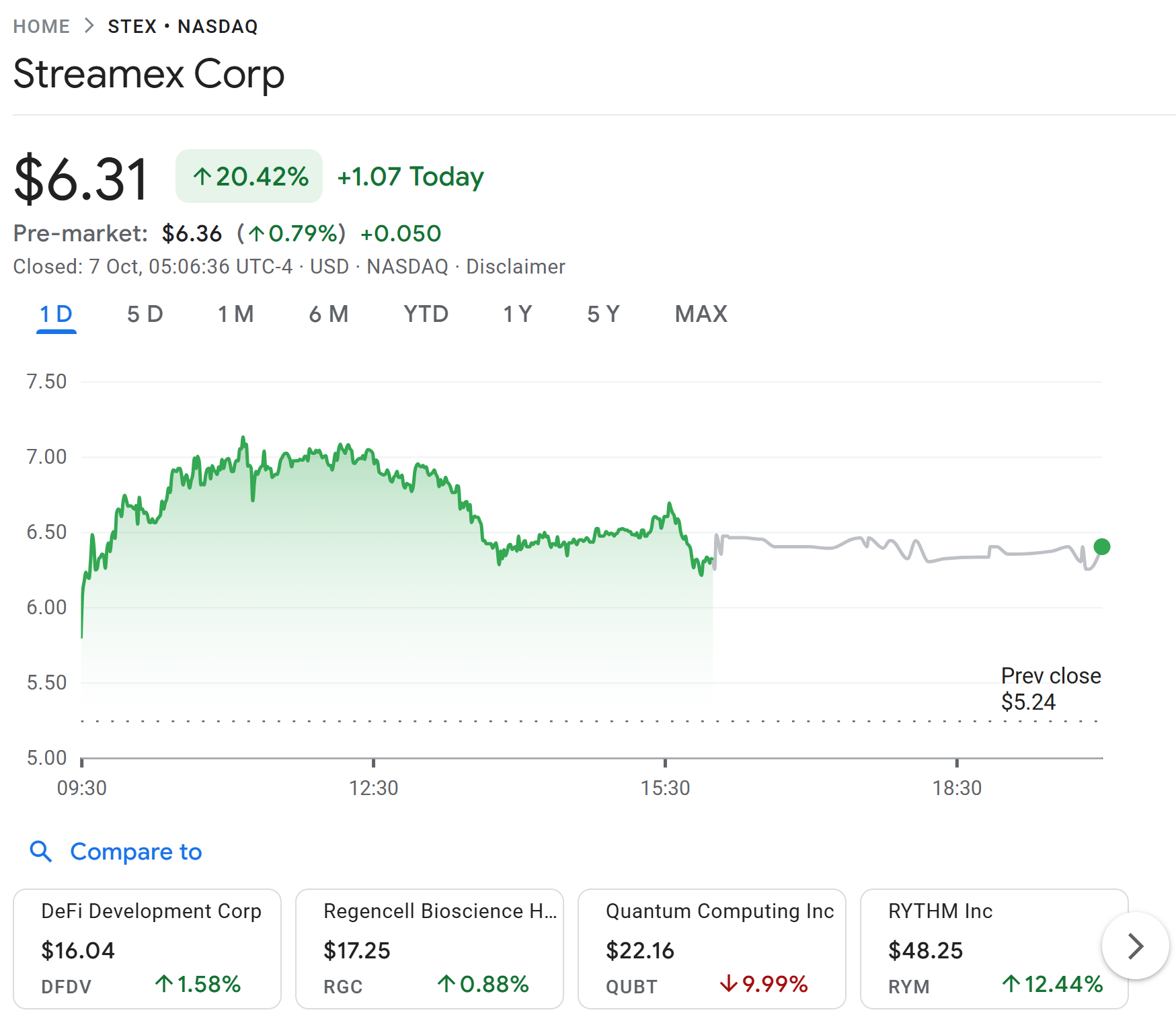

Market reaction: Streamex shares rose 20.42% on announcement; yield paid in ounces, backed by gold leasing via Monetary Metals.

What is the GLDY gold-backed stablecoin?

GLDY gold-backed stablecoin is a tokenized claim on physical gold bullion issued by Streamex that offers an annualized yield of up to 4.0%, paid in ounces of gold. It targets accredited individuals and institutions and is structured to provide liquidity, capital preservation, and commodity exposure for portfolios.

How does GLDY generate yield and who backs it?

Yield for GLDY is generated primarily through gold leasing arrangements secured via Streamex’s partnership with Monetary Metals. Streamex says yield payments will be denominated in ounces of gold, not fiat, enabling investors to earn a commodity-based return while retaining gold exposure.

The GLDY token offers exposure to physical gold bullion with yield paid in ounces of gold, targeting institutional investors, the firm announced on Monday. The stablecoin is part of Streamex’s broader mission to tokenize real-world commodities through digital instruments.

“The launch of GLDY represents a major evolution in how investors can access and benefit from physical gold,” said Henry McPhie, co-founder and CEO of Streamex. “Now, instead of paying to hold gold, investors can get paid to hold gold.”

Yield is generated through gold leasing deals backed by Streamex’s exclusive partnership with Monetary Metals.

Related (plain text): Standard Chartered analysis on stablecoins and Tether corporate activity are being cited across industry briefings. No external links provided.

Why are minimums and investor limits set for GLDY?

Participation in the GLDY token sale is limited to accredited individuals and institutions to align with regulatory frameworks and the institutional focus of the product. The minimum investment stands at $200,000 for individuals and $1 million for institutional entities, reflecting the targeted investor base and onboarding costs for custody and compliance.

How did markets respond to the GLDY announcement?

The market reacted quickly: Streamex shares jumped 20.42% on the day of the announcement and continued to trade slightly higher in pre-market sessions, according to data from Google Finance. The move indicates investor appetite for tokenized, yield-bearing commodity exposure.

Streamex shares jump 20% on the announcement. Source: Google Finance

The new initiative follows Streamex and BioSig securing $1.1 billion in growth funding to launch an on-chain, gold-backed treasury business in July, underscoring a firm capital base for issuance and liquidity planning.

How does GLDY compare to other gold exposure options?

Below is a compact comparison of typical characteristics across GLDY, fiat-pegged stablecoins, and physical gold ETFs or bullion holdings for quick scanning.

| Underlying | Physical gold bullion | Fiat reserves / short-term assets | Physical gold or derivatives |

| Yield | Up to 4.0% annualized, paid in ounces | Typically minimal or none | Depends on lending/leasing; varies |

| Investor focus | Institutions, accredited investors | Mass-market | Retail & institutional |

| Minimums | $200k individual / $1M institutional | Low | Varies |

Frequently Asked Questions

What are the investor minimums for GLDY?

Individual accredited investors must commit at least $200,000, while institutional participants face a $1 million minimum. These thresholds reflect the product’s institutional focus and custody costs.

Will GLDY issuance expand beyond the initial $100M?

Streamex states issuance could expand to $1 billion depending on demand; the company has committed at least $5 million to support initial liquidity and market confidence.

Key Takeaways

- GLDY offers commodity yield: Up to 4.0% annualized yield paid in ounces of gold, providing a novel income layer on gold exposure.

- Institutional focus: High minimums and institutional-only channels emphasize institutional adoption and compliance.

- Backed by partnerships: Yield mechanics rely on gold leasing arrangements via Monetary Metals and a substantial funding base.

Conclusion

Streamex’s GLDY gold-backed stablecoin introduces a new model for institutional gold exposure by combining tokenization, yield and custody safeguards. With clearly defined investor minimums and strong market reaction, GLDY aims to serve portfolio managers and balance sheets seeking liquid, yield-bearing commodity allocation.