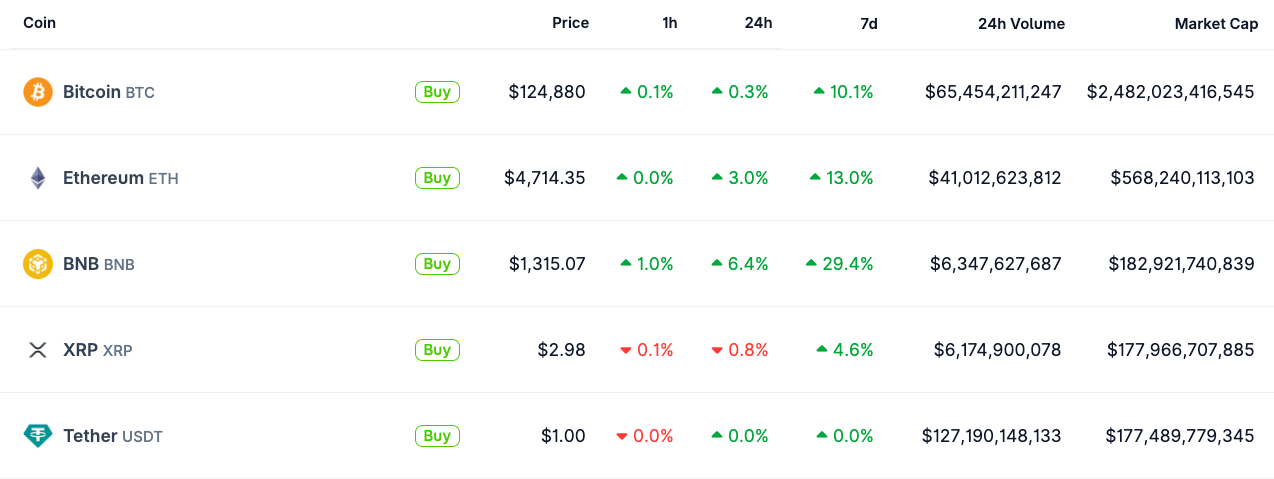

BNB’s market cap surge is a rapid price and capitalization rally: BNB climbed about 28% in seven days to trade near $1,326, pushing its market capitalization to roughly $182 billion and overtaking XRP to become the third-largest crypto asset, according to CoinGecko data.

-

BNB rose ~28% in seven days, adding roughly $40 billion to market cap

-

BNB overtook XRP to become the third-largest crypto by market capitalization.

-

Market observers cite on-chain adoption and regional fund launches; some social-media users allege possible price manipulation.

BNB market cap surge: BNB jumped 28% in seven days to $1,326, overtaking XRP to become the third-largest crypto asset—read analysis, data and concise takeaways.

Binance-backed BNB has outpaced the broader cryptocurrency rally, with a 28% increase in market capitalization over the past seven days, prompting fresh community scrutiny and debate.

What is driving BNB’s market cap surge?

BNB’s market cap surge is driven by a sharp price rally, increased chain activity and regional adoption initiatives. In seven days BNB rose roughly 28%, taking price to about $1,326 and lifting its market capitalization to near $182 billion, according to CoinGecko data.

How does BNB compare to Bitcoin and Ether during this rally?

BNB’s seven-day gain (~28%) far exceeded Bitcoin’s ~5% market-cap rise and Ether’s ~8.4% in the same window. The speed of BNB’s increase added roughly $40 billion in market value, while Bitcoin and Ether posted more modest, steady gains.

BNB ranked as the third-largest crypto asset after Bitcoin and Ether, with XRP and USDT following in fourth and fifth place, respectively, as of Oct. 7, 2025. Source: CoinGecko

When did BNB overtake XRP and what does that mean?

BNB surpassed XRP after breaking above $1,100 and continuing the rally into early October. Overtaking XRP signals a notable reordering of market capitalization rankings and highlights BNB Chain’s rising on-chain activity and adoption metrics.

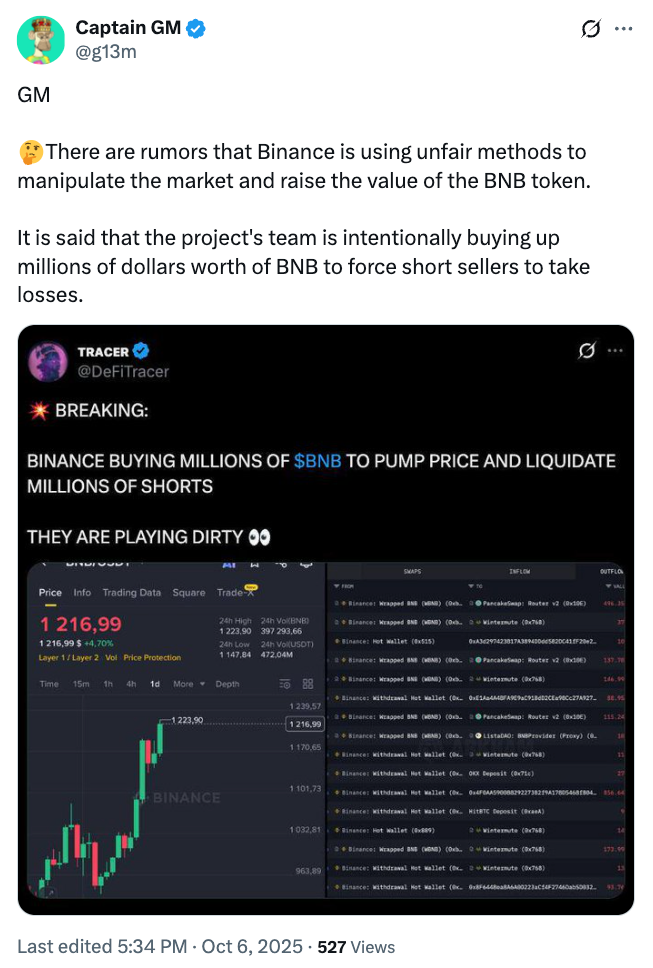

What community concerns have emerged about the rally?

Online discussions have raised concerns about concentrated holdings and unusual trading flows. Some social-media commentators referenced historic founder allocations and alleged exchange buying to pressure price. These claims remain at the level of community conjecture; no formal regulatory findings or exchange confirmations have been published.

BNB market capitalization since 2020. Source: CoinGecko

How concentrated are BNB holdings and could that influence price?

Past reporting has suggested a large portion of circulating BNB could be held by founders and associated entities. If an individual or small group controls a substantial share, that concentration can amplify price moves when large transactions occur. Transparency and on-chain analysis remain key to assessing this risk.

Source: Captain GM

Summary comparison table

| Bitcoin (BTC) | ~5% | — (largest) |

| Ether (ETH) | ~8.4% | ~$568B |

| BNB (BNB) | ~28% | ~$182B |

Frequently Asked Questions

Did any official statements explain the BNB rally?

As of Oct. 7, 2025, Binance and its executives had not issued formal statements acknowledging manipulation claims. Binance founder Changpeng Zhao posted “Keep building on BNB Chain” on social media, and the official BNB Chain account shared community analysis.

What on-chain metrics support BNB’s rally?

BNB Chain reported rising monthly active addresses—community sources cite roughly 60 million monthly active addresses—alongside renewed developer and dApp activity, which supports demand-based price interpretations.

Are manipulation allegations proven?

Allegations remain unproven. Community posts and social commentary have suggested suspicious flows, but independent regulatory findings or exchange confirmations were not available at the time of reporting.

Key Takeaways

- Rapid appreciation: BNB rose ~28% in seven days, adding roughly $40B to market cap.

- Rank shift: BNB overtook XRP to become the third-largest crypto by market cap.

- Mixed signals: Adoption metrics and regional initiatives support growth, while social-media allegations raise governance and concentration concerns.

Conclusion

BNB’s sharp seven-day rally pushed its market capitalization to about $182 billion and repositioned it as the third-largest crypto asset. The move reflects a mix of adoption-led demand and community scrutiny about concentration risk. Monitor on-chain metrics and official disclosures for clearer signals; COINOTAG will continue to track developments.