Mega Whales Keep ASTER’s All-Time High Hopes Alive — If It Clears $2.27

ASTER price action is flashing strength even as exchange flows rise. Mega whales are adding, indicators stay firm, and one key level could decide whether ASTER charts a new all-time high soon.

ASTER’s recent listing on Binance has pulled the token back into the spotlight. While the ASTER price briefly cooled to under $2 after strong gains, large-holder activity and strengthening indicators suggest the story is far from over.

The short-term data points to a tug-of-war between liquidity positioning and genuine selling, but if the bulls are right, leaving ASTER now might not be the best decision ever. More so as it’s mere 17% south of its recent all-time high.

Mega Whales Accumulate

On-chain data shows ASTER’s biggest holders are quietly strengthening their grip.

The top 100 addresses — or “mega whales” — now hold about 7.84 billion ASTER, up 1.76% in 24 hours. That’s roughly 134 million ASTER, worth around $264 million at current prices.

Meanwhile, public-figure wallets have also grown their holdings by 5.34%, adding about 236,000 ASTER (almost $465,000).

ASTER Holding Pattern:

ASTER Holding Pattern:

In contrast, smart-money wallets reduced exposure by nearly 70%, while whales trimmed holdings by 9.97%, selling about 7.5 million ASTER ( close to $15 million).

Exchange balances have surged 59.6% to 625 million ASTER, which could look like heavy selling — but that might be misleading. Given Binance’s new listing, part of this jump could be liquidity repositioning.

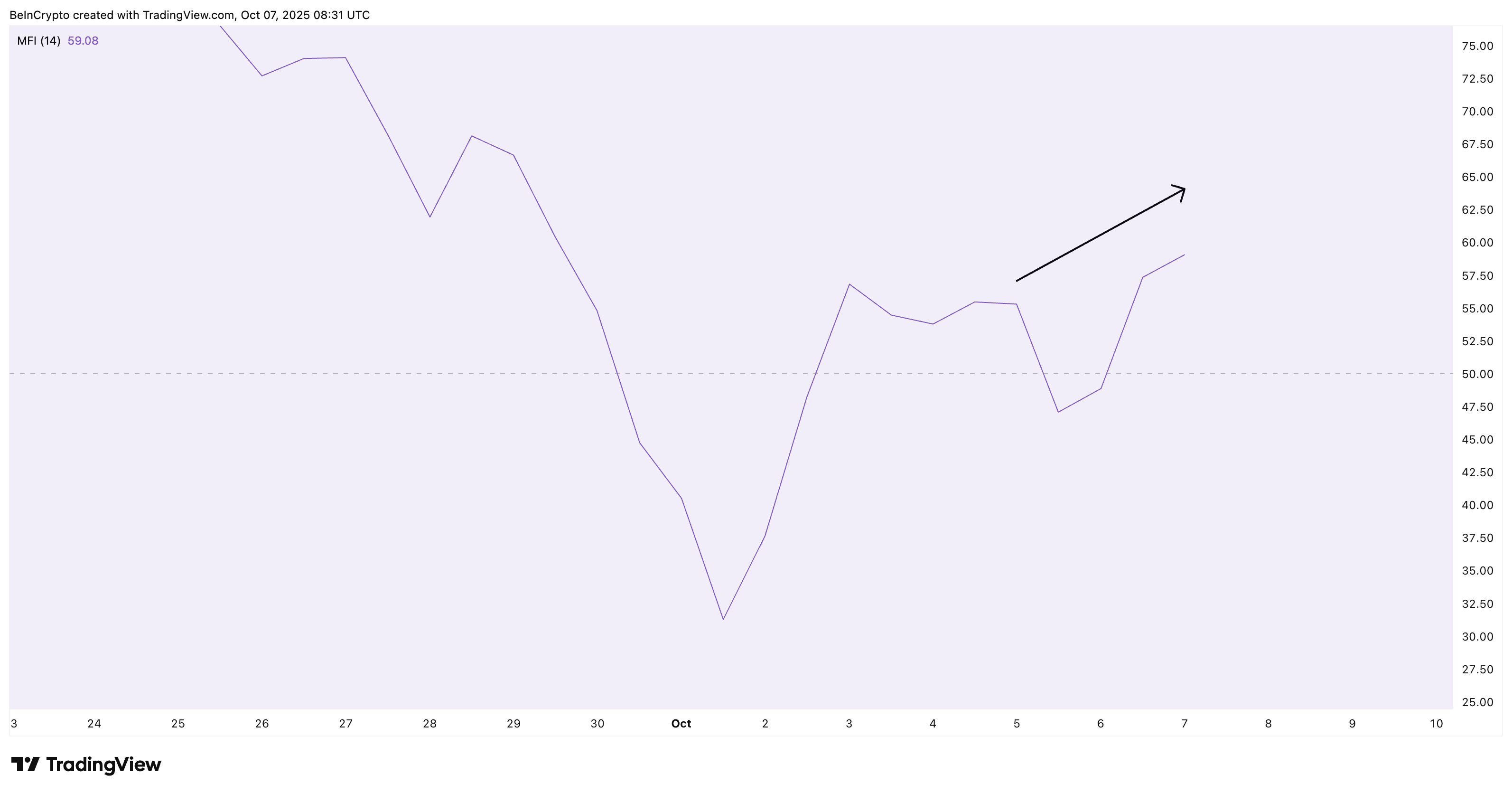

Supporting that, the Money Flow Index (MFI) — which measures buying and selling pressure based on price and volume — is trending upward.

ASTER MFI Still Trending Higher:

ASTER MFI Still Trending Higher:

If these inflows were truly sell-driven, MFI would have dropped. Instead, it’s rising toward 65, signaling that money is still flowing into ASTER.

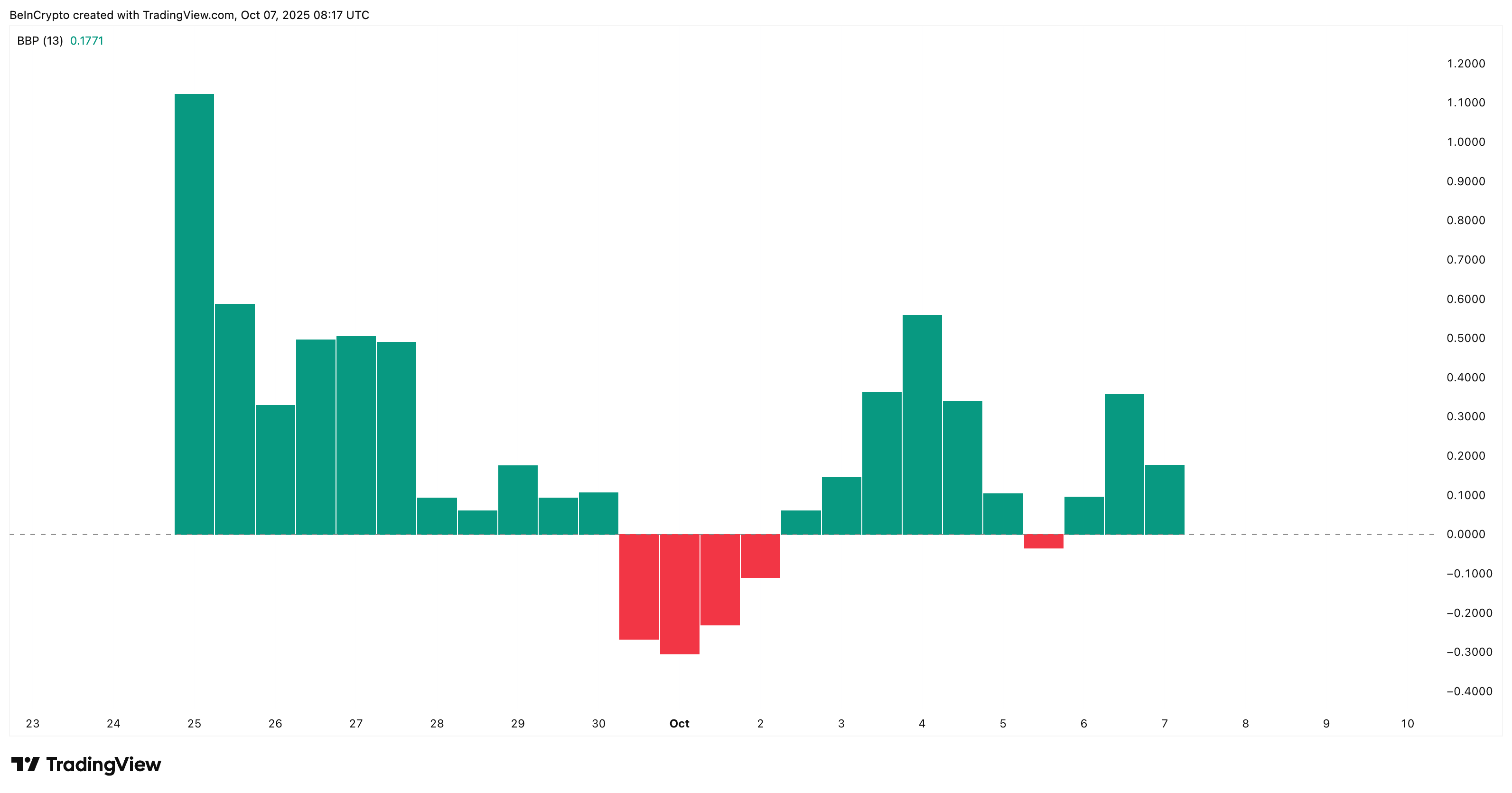

The Bull-Bear Power (BBP) indicator backs this up. BBP compares buying and selling momentum; when it’s green, bulls dominate. Since October 5, BBP bars have turned positive, showing renewed strength.

ASTER Bulls In Power:

ASTER Bulls In Power:

These two readings together suggest the so-called “selling pressure” might be a liquidity mirage, not a trend reversal.

Hidden Bullish Divergence Keeps ASTER Price Uptrend Intact

The 12-hour chart shows ASTER trading within an ascending triangle (with the ascending trendline acting as support), a structure that usually favors buyers.

Between September 30 and October 5, the Relative Strength Index (RSI) — which tracks market momentum — made a lower low, while prices made a higher low. This is called a hidden bullish divergence, a pattern that often confirms the continuation of an uptrend courtesy of fading selling pressure.

ASTER Price Analysis:

ASTER Price Analysis:

Key resistance sits at $2.04, $2.27, and $2.43 (ASTER’s all-time high). A 12-hour candle close above $2.27 would confirm breakout strength and could open the door to a new high above $2.43.

However, if the ASTER price dips under $1.77 and then under $1.66, thereby breaching the triangle on the downside, the bullish hypothesis would get invalidated.

As long as RSI stays above 50 and BBP remains positive, bulls hold the edge. For now, ASTER’s price action tells a simple story: the big holders haven’t left the table — and neither should the market’s attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Warren, Reed: Loopholes in Trump-Endorsed Crypto Pose Risks for Illegal Financial Activities

- U.S. Senators Warren and Reed demand federal investigation into Trump-linked crypto firm WLF over alleged ties to North Korean hackers and Russian sanctions evasion tools. - WLF's $WLFI token sales to entities like Lazarus Group and Tornado Cash raise risks of "supercharging illicit finance" and governance manipulation by foreign adversaries. - Trump family's 22.5B $WLFI token stake valued at $3B creates conflict of interest, with officials potentially prioritizing profit over compliance during Trump adm

Brazil Considers Stablecoins as Foreign Currency to Prevent Tax Evasion and Increase Revenue

- Brazil expands IOF tax to cross-border crypto payments, targeting stablecoins to close regulatory gaps and boost revenue. - Central Bank's 2026 framework classifies stablecoin transactions as forex, including international payments and wallet transfers. - USDT dominates 66% of Brazil's $42.8B crypto volume, surpassing Bitcoin's 11%, as authorities combat forex evasion and money laundering. - Global alignment emerges with U.S. planning 2026 crypto reporting rules, while Brazil tightens oversight of foreig

Cardano News Update: Limited Supply and Cutting-Edge Features Propel MUTM's DeFi Presale Growth

- Mutuum Finance (MUTM) raised $18.7M in its presale, with token price surging 250% to $0.035 as Phase 6 nears completion. - The project's structured phase-based pricing and scarcity model attracted 18,000+ holders, outpacing Cardano in community growth and funding speed. - MUTM's V1 protocol (Q4 2025) introduces mtTokens for real-time yield tracking, alongside CertiK audit and $50K bug bounty for security. - Gamified incentives and Ethereum whale accumulation position MUTM as a top 2025 DeFi contender, ch

Bitcoin Updates Today: Bitcoin Drops Sharply as ETF Outflows and Economic Uncertainty Challenge Market Stability

- Bitcoin plummeted to a seven-month low below $90,000 in late November as market fear intensified, with the CoinDesk Fear & Greed Index hitting 10. - The selloff was driven by large holder exits, $240M in derivatives liquidations, Fed rate-cut uncertainty, and $2.8B in ETF outflows eroding demand. - Institutional buying (8,178 BTC worth $835M) partially offset declines, while technical indicators like a "death cross" signaled prolonged bearish pressure. - Geopolitical tensions over alleged U.S. Bitcoin th