‘Hundreds of simulations’ pin Bitcoin at 50% odds of $140K this month

Bitcoin has a 50% probability of surpassing $140,000 this month, according to simulations using data from the past decade, says economist Timothy Peterson.

“There is a 50% chance Bitcoin finishes the month above $140k,” Peterson said in an X post on Wednesday. “But there is a 43% chance Bitcoin finishes below $136k,” he added.

Bitcoin (BTC) would need to gain about 14.7% to reach $140,000 at its current price of $122,032, which has cooled after setting a new all-time high of $126,200 on Monday, according to CoinMarketCap.

Peterson said the simulation shows “half of Bitcoin's October gains may have already happened. He told Cointelegraph that the simulation uses Bitcoin’s daily price data from 2015 to model how the market behaves over time.

Prediction “not human emotion or biased opinion”

Peterson said the prediction stemmed from “hundreds of simulations based purely on real data, not human emotion or biased opinion.”

“Every projection follows the same logic, price changes that match Bitcoin’s real historical, repetitive volatility and rhythm,” he added.

Bitcoin opened Oct. 1 at roughly $116,500, and a rise to $140,000 would represent a 20.17% gain for the month, closely matching Bitcoin’s historical October average.

October has been Bitcoin’s second-best-performing month on average since 2013, delivering typical gains of 20.75%, according to CoinGlass.

Peterson claimed that the forecast avoids the “bias and noise” that influences short-term sentiment.

“The result is a clear, probability-based picture of where Bitcoin’s value is most likely to go,” he said.

However, there have been many instances over the years where Bitcoin has diverged from broader market expectations and failed to follow past patterns, even when data suggested otherwise with high confidence.

Broader market remains confident in Bitcoin

Other crypto analysts anticipate a higher price for Bitcoin after it reached an all-time high on Monday before cooling.

Crypto analyst Jelle said in an X post on Tuesday that Bitcoin is retesting the previous all-time highs and may move higher. “It’s definitely over for bears. Send it higher,” Jelle said.

Echoing a similar sentiment, crypto analyst Matthew Hyland said in an X post on the same day that “the pressure is building.”

However, Peterson emphasized that “markets are not random in the short term.”

“They are cyclical in liquidity, sentiment, and positioning. October is historically significant because it marks the turn of institutional capital cycles: the end of Q3 portfolio rebalancing, the start of fiscal year planning for funds, and the approach of year-end reporting windows,” he explained.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

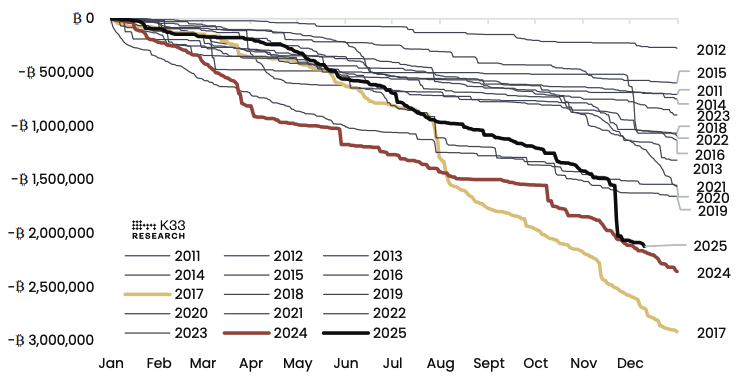

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off