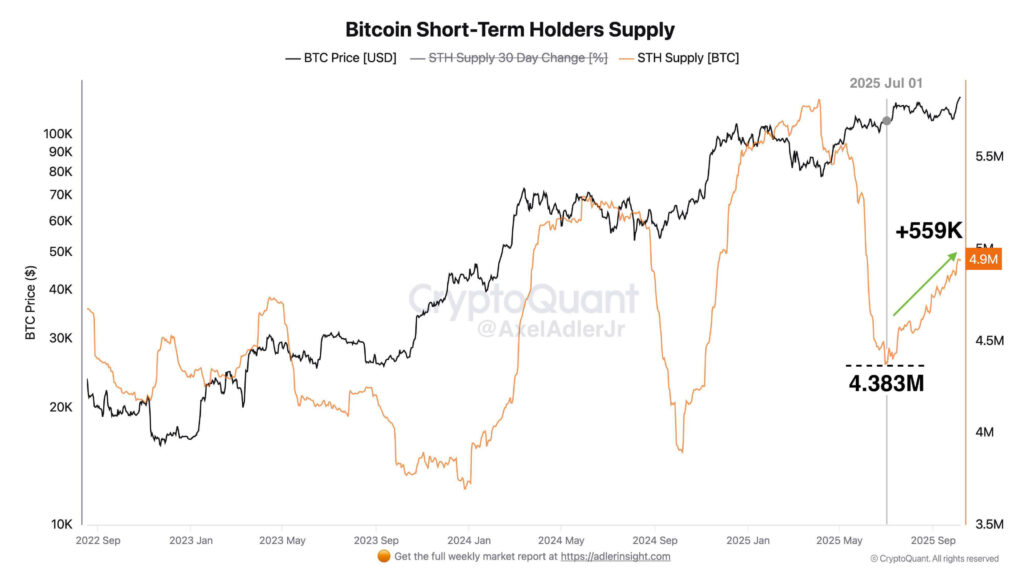

Bitcoin short term holder supply rose by ~559,000 BTC to roughly 4.94M BTC, signalling renewed accumulation and reduced derivatives selling pressure. With 99.4% of supply in profit and net taker volume neutral, on‑chain signals point to expanding speculative participation and improved market confidence.

-

Short term Bitcoin holdings surged to 4.94M BTC, up ~559K BTC since May 2025.

-

Profitability is near record levels: 99.4% of Bitcoin supply is in profit, reducing forced sell risk.

-

Net taker volume moved from -$400M to neutral, indicating balanced derivative flows and steadier sentiment.

Bitcoin short term holder supply jumps to 4.94M BTC with 99.4% profitability — read the full on‑chain analysis and key takeaways for traders and investors.

What is driving the recent rise in Bitcoin short term holder supply?

Bitcoin short term holder supply is rising because new and recently active investors are accumulating into steady price action. On‑chain metrics show STH supply increased by ~559,000 BTC since May 2025, reflecting renewed speculative interest and absorption of prior selling pressure.

How significant is the 559K BTC increase in short term holdings?

The jump from about 4.38M BTC to roughly 4.94M BTC is material: it indicates a notable inflow of recently acquired coins into active hands. Historically, STH supply expansions often coincide with heightened market activity and can precede local tops, but today the move is paired with broad profitability and neutral derivatives flow, which changes the typical risk profile.

Bitcoin short term holder supply rises by 559K BTC as profitability hits 99.4%, showing renewed market confidence.

- Short term Bitcoin holdings surged to 4.94M BTC, indicating growing activity from new investors.

- Analyst Axel notes 99.4% of Bitcoin supply is in profit as derivatives selling pressure eases.

- Net taker volume turned neutral from negative $400M, indicating balanced trading and steady market sentiment.

Short term Bitcoin investors are returning in large numbers, on‑chain data shows a sharp increase in holdings. According to analyst Axel, the total supply held by short term holders (STH) has grown by roughly 559,000 BTC since May 2025.

This rise took holdings from a low of 4.38 million BTC to nearly 4.94 million BTC by October. The surge comes as Bitcoin trades steadily at $122,000, indicating renewed speculative activity and accumulation from newer market participants.

Why does higher STH supply matter for market structure?

An expanding STH supply signals more coins are in addresses that moved recently, increasing short‑term liquidity and the pool of potential sellers. When STH supply rises alongside rising profitability, the market can absorb profit taking without abrupt price dislocations, reducing tail‑risk from forced deleveraging.

Surge in Short Term Holdings

The data shows a strong recovery in short term holder supply after last year’s sharp contraction. Notably, such increases often occur during phases of expanding market activity, when new investors buy into upward momentum. Historical trends show that STH supply tends to rise near local market highs, while steep declines have previously aligned with correction periods.

Source: Axel on X

However, Axel noted that the current increase appears different from earlier cycles, as Bitcoin’s price stability suggests that profit taking has been well absorbed by fresh demand. The steady growth of STH supply during this phase implies that speculative interest remains elevated, with investors positioning for potential upside continuation.

Profitability Near Record Levels

Almost the entire Bitcoin market is currently profitable. Axel reported that 99.4% of the total Bitcoin supply is in profit, indicating strong sentiment across the market. The analyst also noted a sharp change in derivatives market behavior. The net taker volume, which tracks the balance between buy and sell orders, has changed from deeply negative to neutral.

This transition is a clear reduction in selling pressure that dominated earlier in the year. During August, the monthly average net taker volume was near negative $400 million, indicating heavy sell side activity. It has now normalized, pointing to a healthier balance between buyers and sellers.

Neutral Derivative Flows

According to Axel, similar conditions appeared during Bitcoin’s April correction, preceding a period of solid price recovery. When derivatives selling pressure eases while spot demand rises, Bitcoin tends to find structural support at higher levels. Axel referenced the STH realized profit (RP) target at $133,000. This benchmark provides a potential medium term indicator of where the market could begin realizing gains if current accumulation continues.

The overall setup, with expanding STH holdings and balanced derivative activity, indicates a market regaining confidence amid steady institutional and retail participation.

Frequently Asked Questions

How does net taker volume influence Bitcoin price stability?

Net taker volume shows whether buyers or sellers dominate derivatives order flow. A move from -$400M to neutral reduces forced selling risk and allows spot demand to set prices, improving short‑term stability and lowering volatility spikes.

What does 99.4% profitability mean for investors?

When 99.4% of supply is in profit, most holders could sell at a gain. This can increase profit‑taking risk, but if demand absorbs supply, stability and continued accumulation are possible.

Key Takeaways

- STH surge: Short term holder supply rose ~559K BTC to ~4.94M BTC, signalling renewed short‑term accumulation.

- High profitability: 99.4% of Bitcoin supply in profit reduces immediate downside from forced losses.

- Balanced derivatives: Net taker volume normalizing from -$400M indicates easing selling pressure and steadier market structure.

Conclusion

The recent rise in short term Bitcoin holdings and near‑record profitability point to a market where fresh demand is absorbing previous selling pressure. Combined on‑chain and derivatives metrics suggest growing market confidence; traders should monitor STH realized profit targets and net taker volume for next directional clues. COINOTAG will continue to track these signals and publish updates as conditions evolve.