Ethereum Traders Hit Pause as $5,000 Dream Fades for Now

Ethereum’s $5,000 push has stalled as volatility fades and traders turn cautious. With ETH trading sideways, a breakout could hinge on whether volatility or demand returns to the market.

In the last few sessions, leading altcoin Ethereum has traded flat around the $4,700 mark. This signals waning market momentum as both buyers and sellers ease off activity.

As technical indicators begin to signal a dip in market volatility, ETH could stay locked in a narrow range for now.

Ethereum Price Stuck in a Tight Range as Traders Wait for Volatility to Return

Readings from the ETH/USD one-day chart show that the altcoin has trended within a narrow range over the past three trading sessions. Since Monday, ETH has faced resistance at $4,742 and found support near $4,426.

This sideways trend occurs when market volatility dips, highlighting a relative balance in buying and selling pressure.

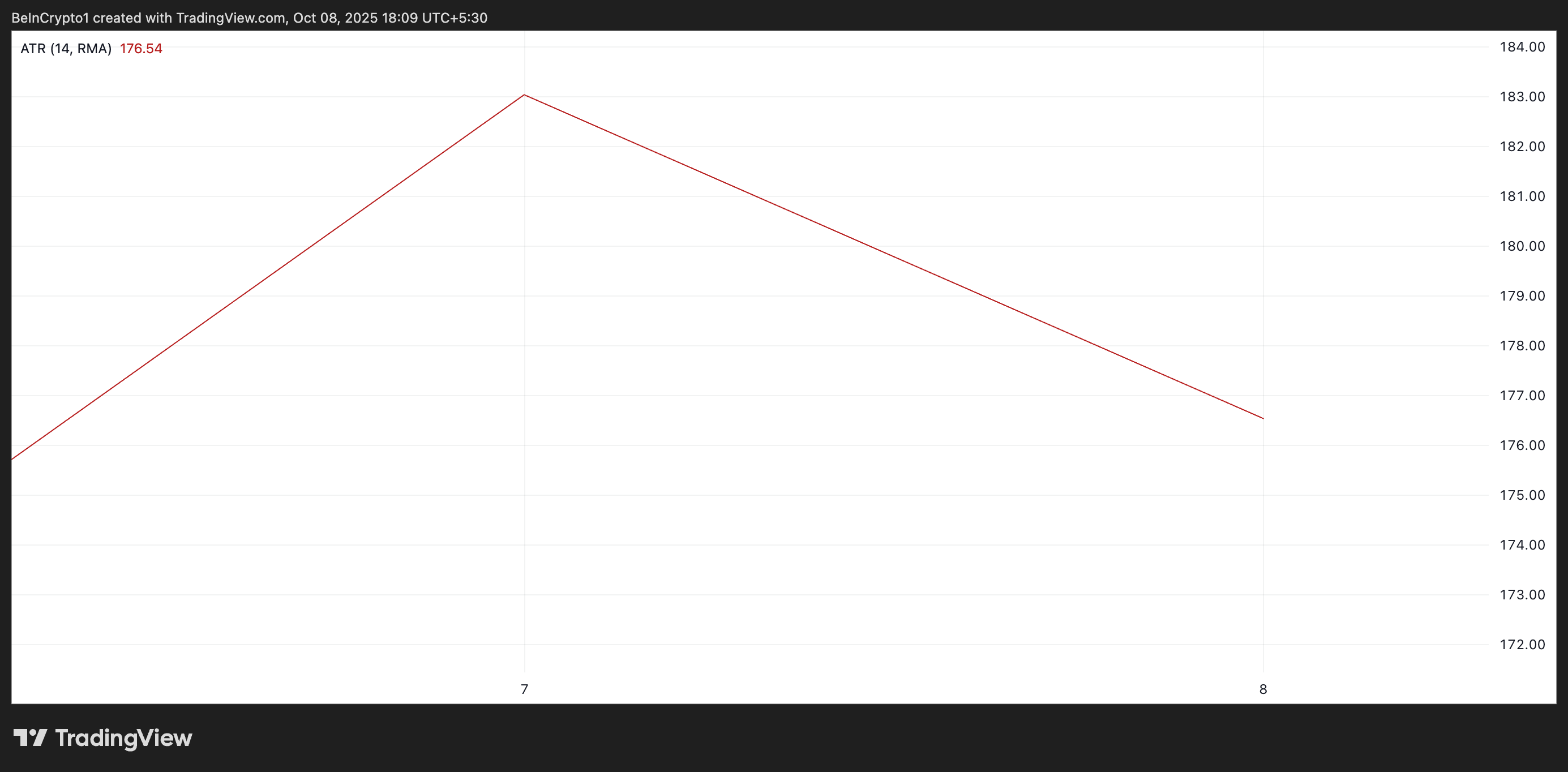

The decline in volatility is evident in ETH’s Average True Range (ATR), which has started to fall. At press time, this indicator, which measures the degree of price fluctuation over a set period, is at 176.54.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

ETH Average True Range. Source:

TradingView

ETH Average True Range. Source:

TradingView

When the ATR falls, it suggests that market participants are becoming more cautious and less willing to take on risk. This results in smaller price swings and lower trading volumes, keeping the asset within a range.

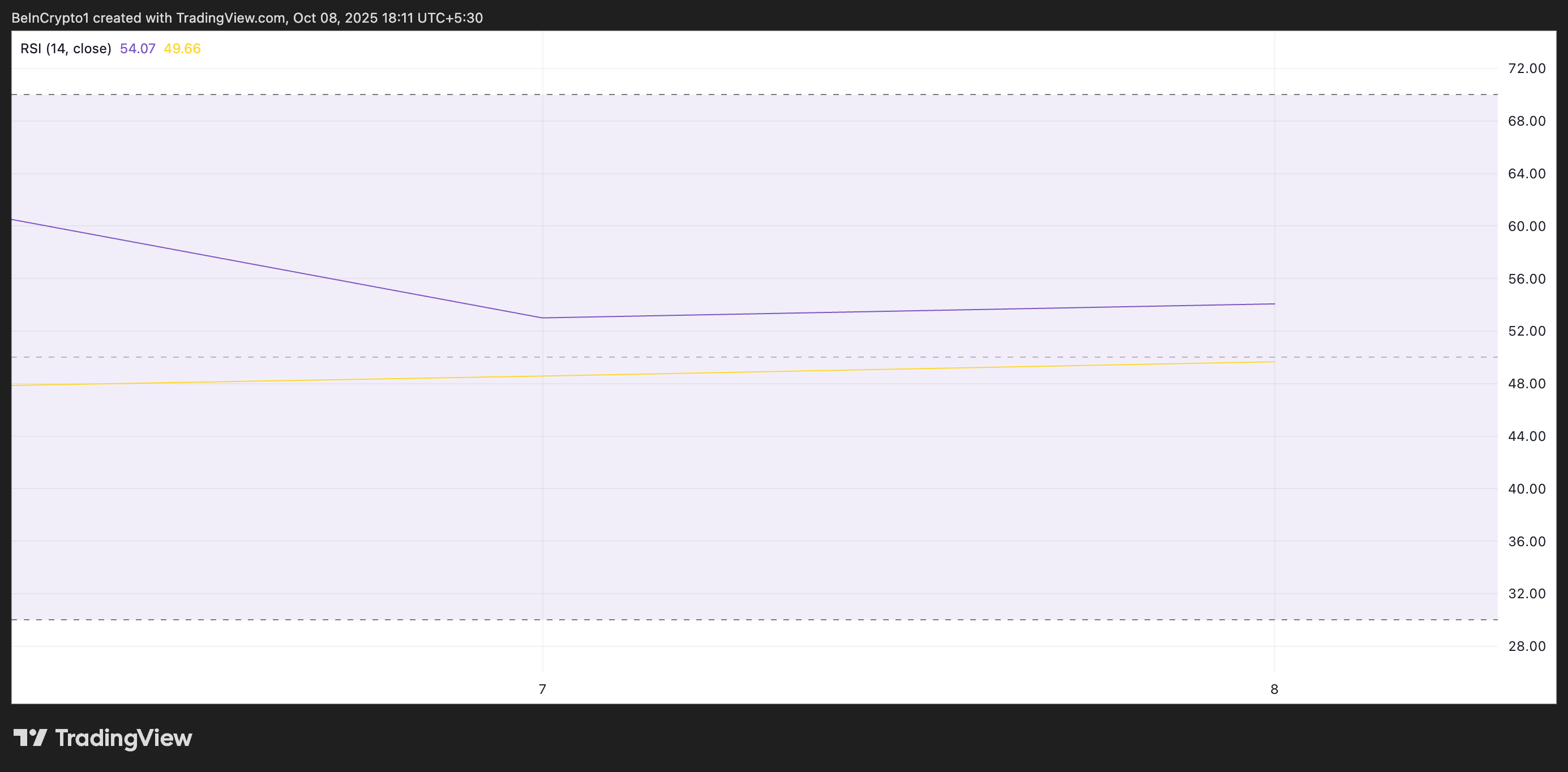

Moreover, ETH’s flattening Relative Strength Index (RSI) confirms this trend. At press time, it stands at 54.07.

ETH Relative Strength Index. Source:

TradingView

ETH Relative Strength Index. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

A flat RSI signals a relative balance between buying and selling pressures, highlighting that neither side currently has the upper hand. This balance confirms the low market volatility; if it persists, ETH’s price could remain subdued within its narrow range.

Ethereum Traders on Edge

While periods of low volatility suggest market stability, they signal that traders are less active, which is often a precursor to a sharp breakout in either direction.

Unless volatility regains momentum, ETH could remain range-bound between its current support and resistance zones. If sell-side pressure strengthens, they could trigger a breach of this support floor and a price decline toward $4,211.

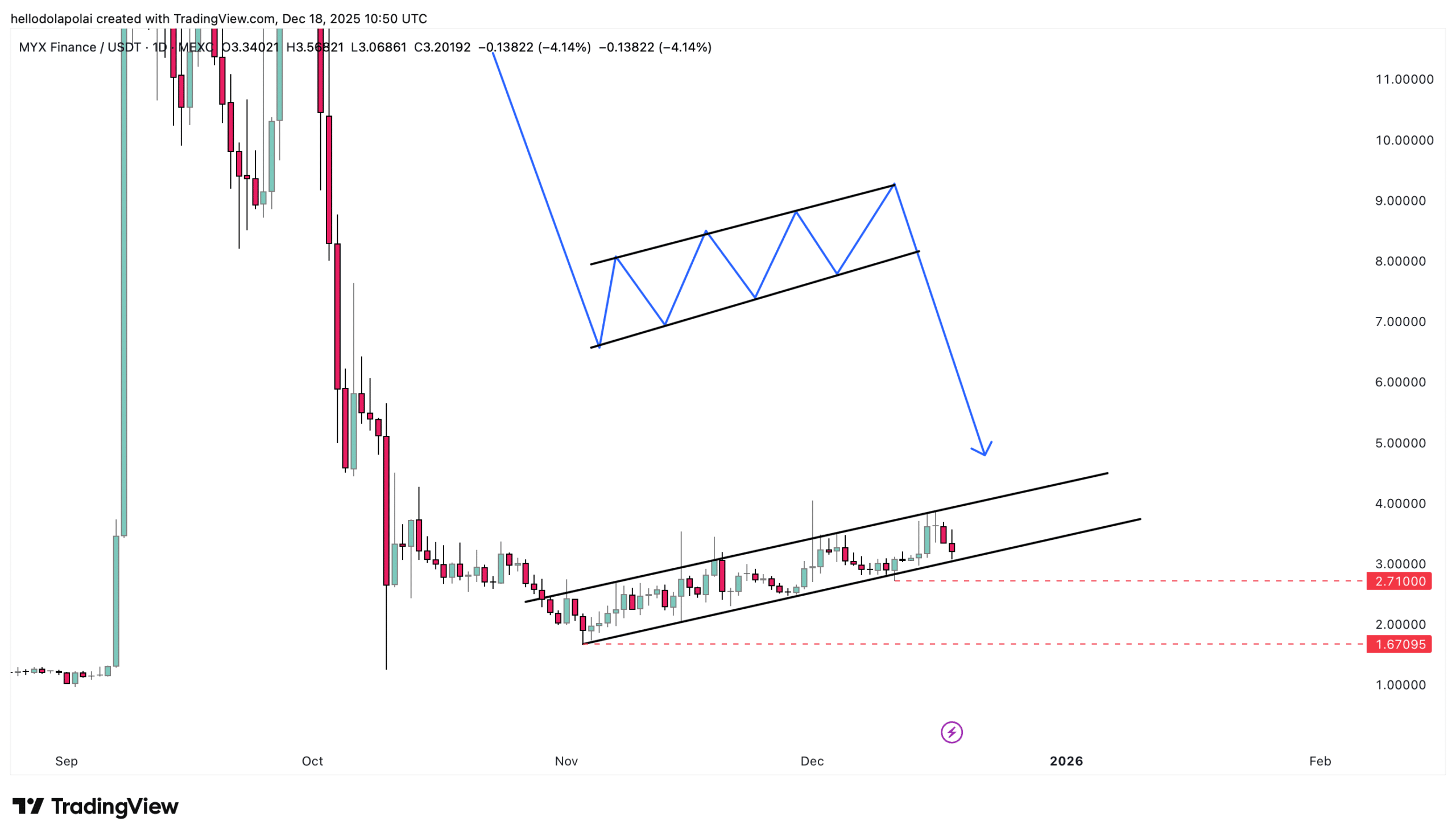

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

On the other hand, if new demand enters the market, this bearish outlook will be invalidated. In that scenario, ETH’s price could break above the resistance at $4,742 and attempt to reclaim its all-time high of $4,957.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That