Panic Grips ASTER After DeFiLlama Delisting: Whales and Smart Money Exit Fast

Aster’s delisting from DeFiLlama has shaken market confidence, with whales and smart money exiting positions. The altcoin now hovers near critical support, facing mounting bearish pressure unless trust and demand return.

Aster’s recent delisting from DeFiLlama has triggered a pullback in demand for its native token, ASTER.

Following the DEX’s removal and mounting doubts over its data accuracy, ASTER’s price performance has flattened, reflecting uncertainty in the market. With key investors reducing their holdings, the altcoin might soon witness a move to the downside as sentiment weakens.

ASTER Faces Confidence Crisis After DeFiLlama Delisting

On October 5, the founder of leading decentralized finance (DeFi) analytics platform DeFiLlama0xngmi announced on X that Aster’s reported volumes appeared to mirror those of Binance’s perpetuals market, raising red flags about the accuracy of its data.

This revelation has prompted DeFiLlama to remove Aster from its listings, triggering debate over whether Aster’s meteoric rise in trading volume was organic or artificially inflated.

Since the DEX delisting, its native token, ASTER, has suffered. The altcoin has traded sideways, showing a relative balance between buying and selling pressures as the controversy continues.

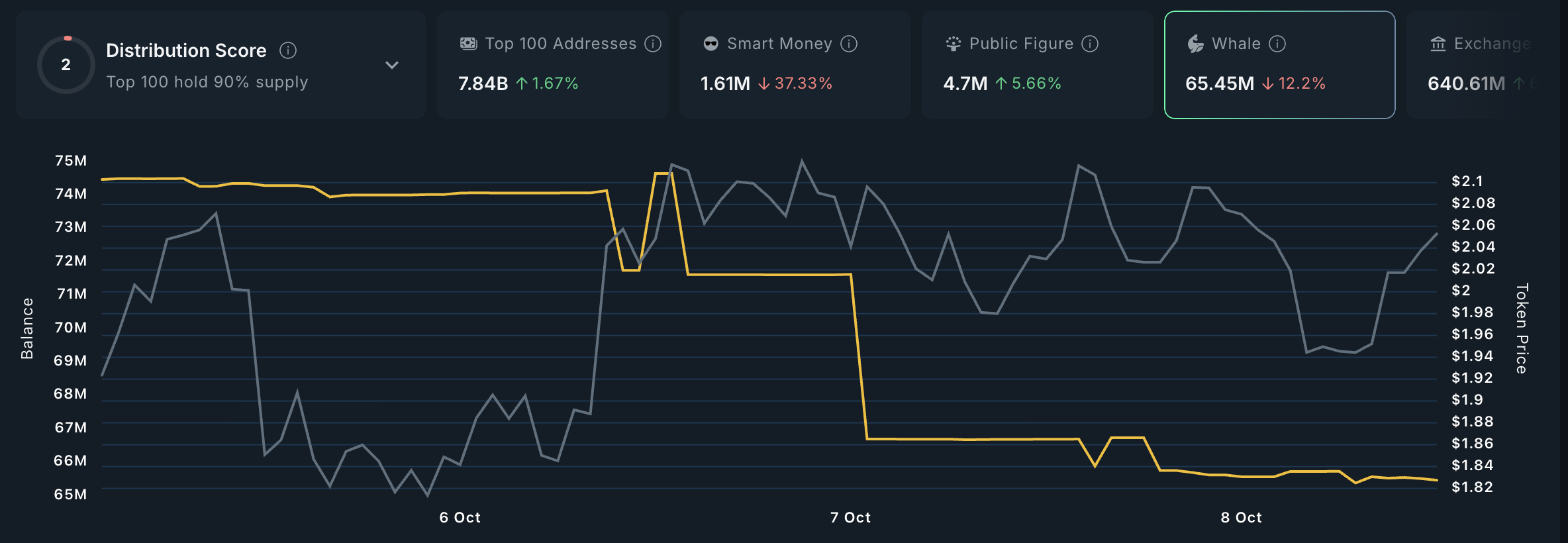

However, on-chain data reveals that whales have been distributing their holdings significantly, a clear sign that large investors are turning bearish. According to Nansen, whale wallets with ASTER holdings valued above $1 million have decreased their token supply by 12% since Sunday.

ASTER Whale Holding. Source:

Nansen

ASTER Whale Holding. Source:

Nansen

This dip in whale accumulation strengthens the bearish sentiment against ASTER and could drive a dip below its narrow range in the near term.

Further, smart money investors have also begun scaling back exposure. This signals that major holders are focused on preventing further losses rather than accumulating. Per Nansen, this cohort of ASTER holders has reduced their supply by 37% since the DEX’s delisting.

The data provider defines “smart money” as experienced investors, institutions, and high-performing traders whose on-chain activity often signals early market trends and high-conviction opportunities.

Therefore, this reduction in their ASTER holdings could further erode trader confidence, setting the stage for a potential price dip.

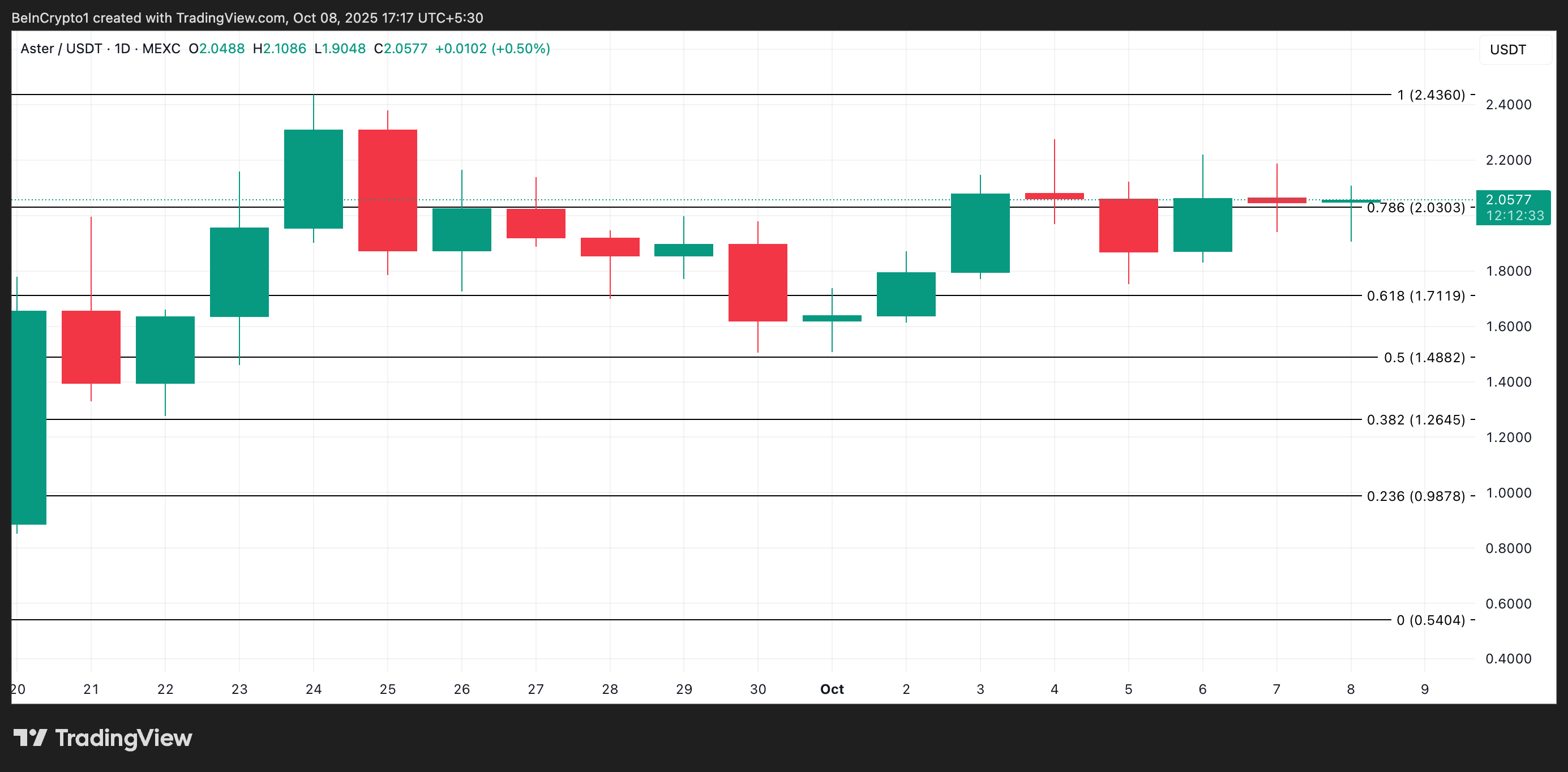

ASTER Price on the Brink — Can Bulls Defend $2.03

Restoring trust in its data may prove critical to stabilizing ASTER’s price and preventing a deeper market slide. The altcoin trades near the support floor at press time at $2.0303.

If the bearish pressure gains momentum, ASTER could slide downward, break this support level, and fall toward $1.7119.

ASTER Price Analysis. Source:

TradingView

ASTER Price Analysis. Source:

TradingView

However, if demand returns to the market, ASTER could attempt to revisit its all-time high of $2.4360.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

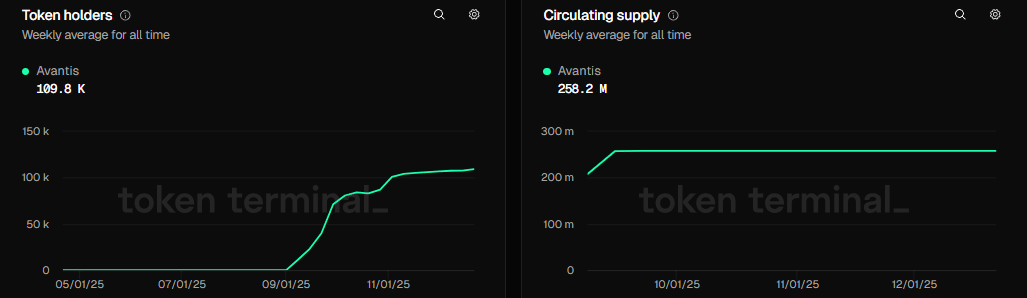

Avantis – Assessing key drivers of AVNT’s 62% weekly rally

Bitcoin – Is it a case of ‘pain today, gains tomorrow’ for BTC’s price?

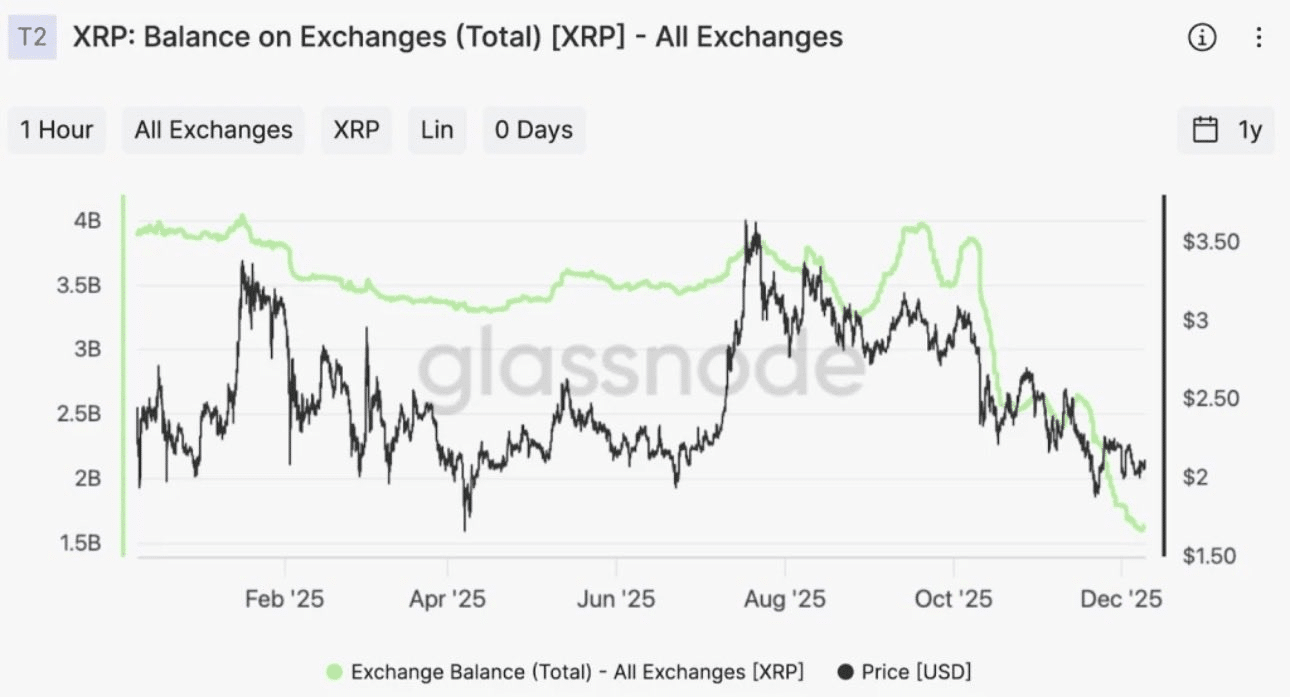

Are XRP and Cardano Losing Relevance? Mike Novogratz Explains Key Indicators as Crypto Investors Move Beyond Hype, Seek Real Utility

Reasons why XRP is poised to lead 2026 DESPITE drop below $2