Lista DAO Jumps 20% Despite Brief Outage as BNB Ecosystem Rallies

Lista DAO saw its token jump in volume by 20%, retaining these gains despite a technical setback. The firm’s diligence and responsiveness to this issue yielded a positive response from the community.

Moreover, this BNB-based project is benefiting from the bullish momentum in that ecosystem. YZi Labs apparently made a brief comment in favor of the protocol, encouraging waves of new investors.

Lista DAO’s Chaotic Day

Lista DAO, a DeFi protocol with lending and staking abilities, is a moderate success with its $130 million market cap. However, a few recent events have shown a remarkable level of confidence from retail investors, which may suggest that there’s more to this project than meets the eye.

A few hours ago, Lista DAO reported an abnormality on its platform. There were strange price fluctuations with the YUSD stablecoin, which caused the security team to preemptively shut down all activity.

Our security team has detected abnormal price movement in one of the collaterals on Lista Lending ($YUSD).

— Lista DAO (@lista_dao) October 8, 2025

As a precaution, the Lista platform has been temporarily paused to ensure that all users’ funds remain fully protected.

We are conducting a detailed investigation and will… pic.twitter.com/XCDYpkgAmu

This outage lasted less than an hour before the firm resumed operations, prompting celebrations from the community. Considering that some crypto platforms are slow or actively hostile to performing basic due diligence during possible scams, Lista DAO’s energetic responses have earned a lot of trust.

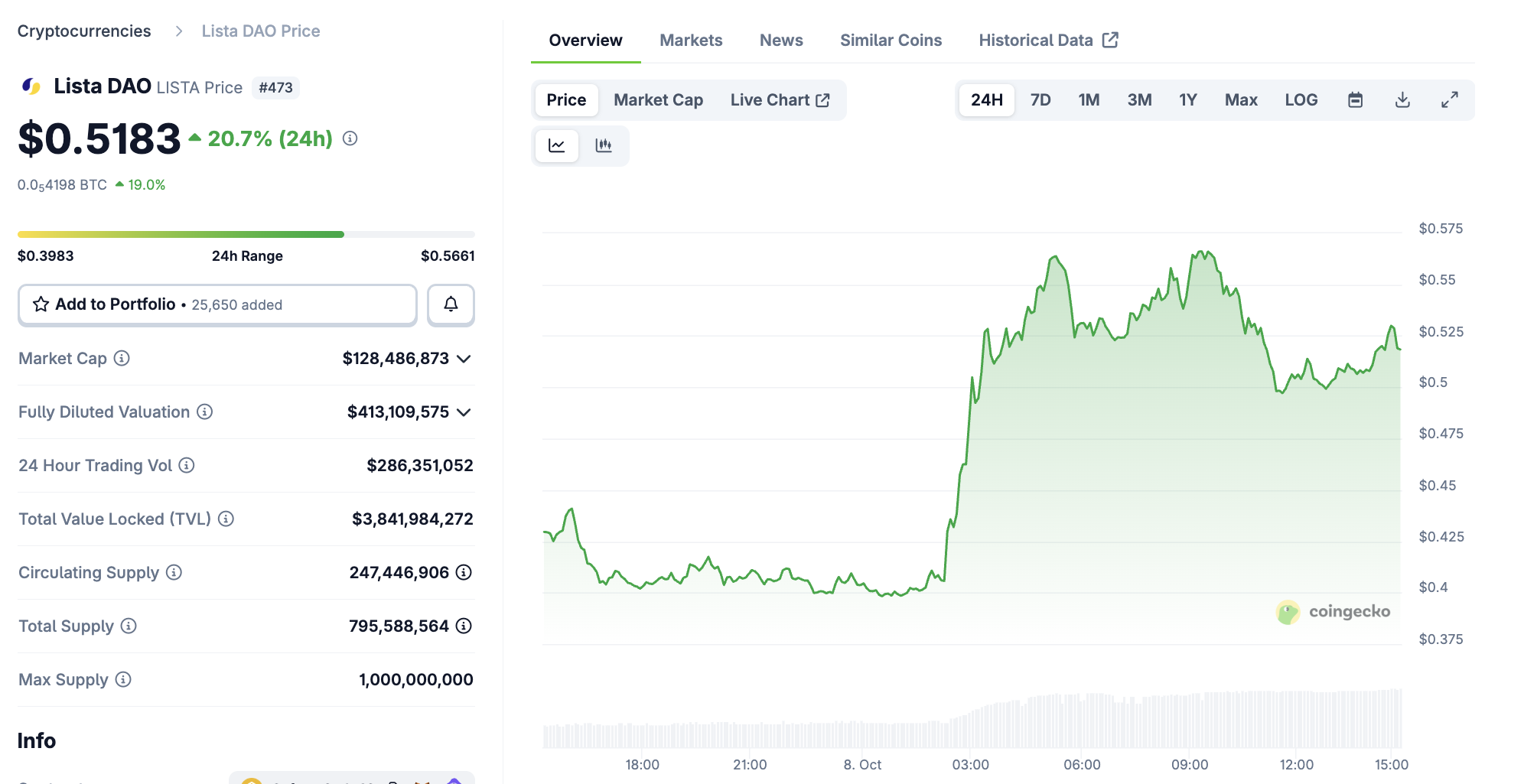

Still, it’s hard to quite quantify this sentiment with social media posts alone. Instead, a price graph might be more useful; Lista DAO underwent its largest price spike in 2025 a few hours before this outage, and the LISTA token maintained most of these huge gains anyway.

The BNB Ecosystem Keeps Rising

So, the firm’s ability to hold onto these gains despite the incident is pretty remarkable. What caused it, though? YZi Labs, a major player in the skyrocketing BSC token ecosystem, recently announced a $1 billion investment into promising projects.

Analysts noticed that this report put Lista DAO in the second spot in its list of Most Valuable Builders (MVBs), which suggests a firm level of confidence.

For the record, at the time of this writing, YZi Labs has evidently edited this announcement, removing all references to specific firms in its MVB program. Apparently, favoritism wasn’t part of its agenda.

Still, this brief mention has attracted a lot of attention. Lista DAO has a healthy market cap and $2.5 billion in TVL, and it’s based on the BNB Smart Chain. This entire ecosystem is rallying, and YZi Labs’ offhand or accidental endorsement has evidently boosted LISTA even more so.

It’ll be interesting to see how much longevity this rally has. Still, Lista DAO made a good showing of itself today, building community trust and quickly responding to problems. Hopefully, it’ll be able to turn this fortune into durable momentum.

The post Lista DAO Jumps 20% Despite Brief Outage as BNB Ecosystem Rallies appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.

Revealing the Value of Green Gold: The Transformative Impact of Institutional-Grade Platforms on Clean Energy Markets

- Clean energy markets hit $35.42B in 2025 but face VPPA/PPA liquidity gaps as U.S. policy rollbacks raise costs by 11.8% YoY. - REsurety's CleanTrade platform digitizes PPA trading, unlocking $16B in liquidity via CFTC-approved SEF infrastructure within two months. - Strategic S&P Global partnership standardizes PPA/REC valuations, addressing institutional investors' risk management gaps in green energy markets. - While global PPA markets grow at 14.6% CAGR to $9.5B by 2035, U.S. policy uncertainty remain

Paradex rolls out Privacy Perps with enhanced end-to-end data privacy