TRUMP Coin ETF appears on DTCC list but token remains 90% below all-time highTRUMP price fails to pick up pace

Canary Capital’s spot Trump Coin ETF is the latest to be added to the Depository Trust & Clearing Corporation’s National Securities Clearing Corporation list ahead of a potential approval.

- Canary Capital’s Trump Coin ETF has been added to the DTCC clearing list.

- TRUMP price briefly rallied earlier in the day but failed to regain momentum.

DTCC updated its clearing list on Oct. 9 to add the Trump Coin ETF under the ticker TRPC, completing a key operational step in the ETF launch process. With this in place, the only regulatory hurdle remaining is approval from the U.S. Securities and Exchange Commission, which would officially clear the product for trading in U.S. markets.

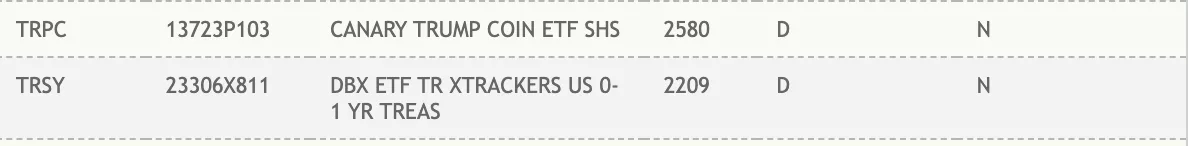

DTCC’s National Securities Clearing Corporation list | Source: DTCC

DTCC’s National Securities Clearing Corporation list | Source: DTCC

For those unaware, the DTCC is a major clearing and settlement provider for U.S. securities that handles the post-trade processes for exchange-traded funds, including clearing, settlement, and custody.

Over the past months, a number of altcoin-linked ETFs from issuers such as Fidelity Investments and Canary Capital have been added to the DTCC’s eligible securities list, including proposed products tied to Solana, XRP, Polkadot, Hedera, and Sui.

However, even as the industry remains optimistic that most of these altcoin ETFs will eventually receive the green light, progress has stalled due to the ongoing U.S. government shutdown.

TRUMP price fails to pick up pace

Canary Capital filed its S-1 registration for a spot ETF tracking the Official Trump meme coin in late August, aiming to offer institutional investors exposure to the politically themed meme coin that has been publicly endorsed by the Trump family and promoted by President Donald Trump himself.

More recently, unnamed sources have reported that Fight Fight Fight LLC, the issuer of the TRUMP meme coin, is looking to raise funds to establish a digital asset treasury company that would focus on accumulating Trump-linked tokens, including the Official Trump token.

However, such developments, although generally bullish for an asset, have done little to revive investor interest around the Trump meme coin, which remains roughly 90% below its all-time price of $73.43, which was hit right after the token launched in January.

Today, the token briefly rallied to an intraday high of $7.85 before cooling off to settle around $7.80 at press time, with gains of 3% recorded in the past 24 hours. But it still lacked the momentum to reclaim previous levels, as trading volume dropped over 22% during the same period.

TRUMP token has remained under pressure mainly due to market uncertainty around the project and an influx of new meme tokens competing for attention.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin