$100 Million Lost in One Hour: Bitcoin Drops Spark Rampaging Liquidations

Bitcoin’s $4,000 drop sparked $700 million in liquidations, proving retail traders still wield power despite institutional dominance. Analysts now eye how these dual forces will shape BTC’s next move.

Retail Bitcoin traders made themselves heard today, causing $700 million in crypto liquidations. The price of BTC fell by around $4,000 as on-chain activity spiked, even though institutions kept buying.

Whether or not BTC keeps dropping or recovers soon, we need to pay attention to these dynamics. Corporate liquidity is very influential in the market, but it’s not the final arbiter of price.

Bitcoin Causes Surprise Liquidations

When Bitcoin hit two successive all-time highs earlier this week, it caused a little consternation in the community. This took place despite a lack of retail activity, with institutional investors powering the growth.

Crucially, these corporations continued making huge purchases while BTC’s value was inflated.

In other words, there have been fears that these inflows could profoundly alter market cycles. Arthur Hayes even proclaimed that the four-year cycle was dead and that global institutional liquidity would determine token prices now.

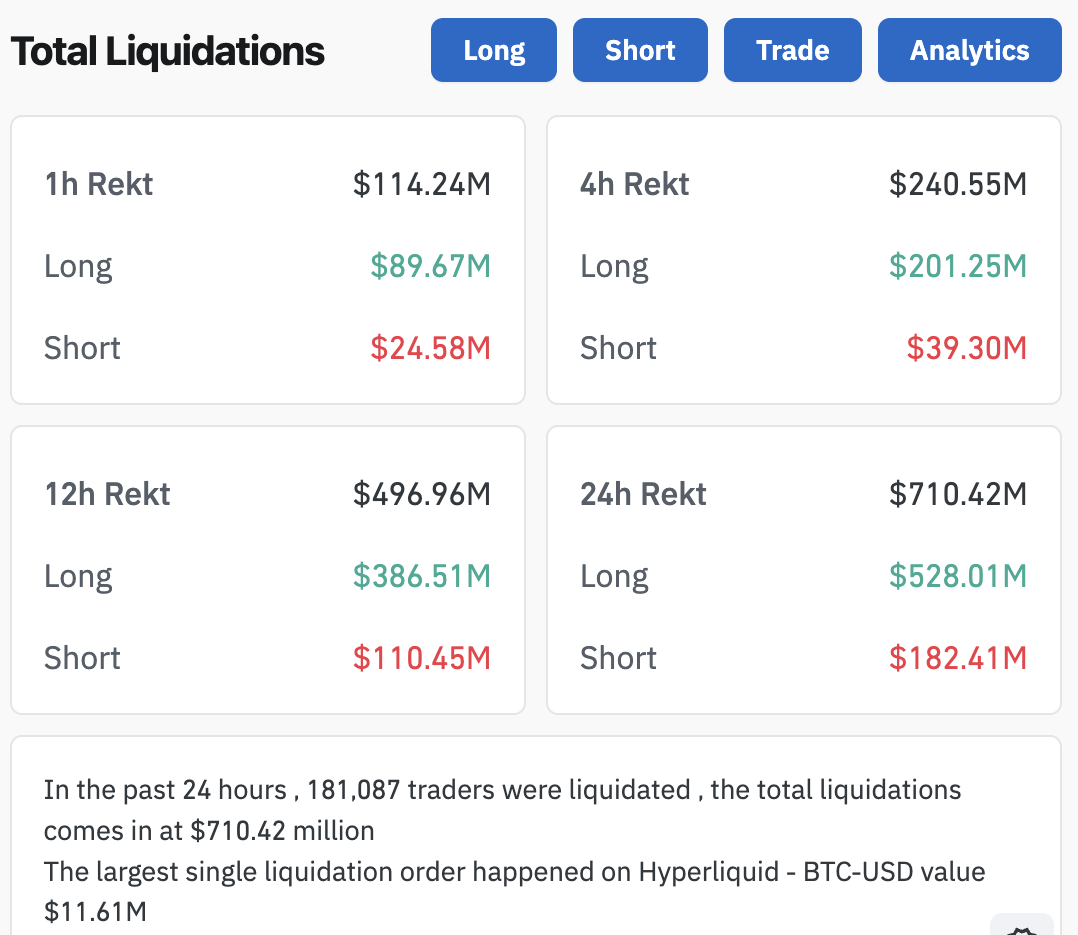

Today, however, these concerns seem less serious. Bitcoin fell around $4,000 in the last 24 hours, spawning a frenzy of crypto liquidations. Over $114 million in total short positions were eradicated in one hour:

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Bitcoin Drops Cause Liquidations. Source:

CoinGlass

Retail Traders’ Impact

A few key factors suggest that retail Bitcoin traders caused all these liquidations. For one thing, ETF issuers continued buying BTC at elevated rates, and the products are seeing huge inflows. Meanwhile, BTC’s on-chain trading activity has spiked between 4% and 5%, showing that activity is stirring awake.

Analysts have already identified some of the most likely causes for Bitcoin’s retreat to $120,000, which triggered these liquidations. They seem like pretty standard price actions; long-term traders are taking profits, holder accumulation rates sparked low confidence, etc.

Furthermore, there are even signs that BTC could rebound in the near future.

This, too, presents a useful opportunity to gather valuable market data. These new structural forces are very powerful, but they aren’t all-powerful.

Retail activity still spurred a major Bitcoin price dump, causing a cascade of liquidations. What new narratives can help explain this behavior and enable accurate predictions?

Whether Bitcoin keeps going up or down, these questions should be at the forefront of traders’ minds. These institutions are apparently going to keep stockpiling Bitcoin either way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.

Algo Falls by 0.69% as Market Fluctuations and Ongoing Downtrend Persist

- Algo (ALGO) fell 0.69% in 24 hours to $0.1434, contrasting with 5.52% weekly gains but a 57.16% annual decline amid crypto market uncertainty. - Switzerland delayed CARF crypto reporting rules until 2027, citing stalled international data-sharing talks, hindering global regulatory alignment. - Bonk (BONK) launched Europe's first ETP on SIX Swiss Exchange, enabling traditional investors to access memecoins without digital wallets. - Ethereum prepares December 3 gas limit upgrade to 60M, enhancing layer-2