ECB: Digital euro could lead to up to €700 billion in deposit losses in case of bank runs

a simulation by the European Central Bank (ECB) on Friday showed that in the event of a run on commercial banks, digital euros could lead to as much as 700 billion euros (approximately 810.88 billion US dollars) in deposits being transferred, causing liquidity constraints for around a dozen banks in the eurozone.

The study, mandated by European lawmakers, aims to assess the risks posed to the banking sector by digital currency (essentially an electronic wallet guaranteed by the ECB) in different scenarios, including the hypothetical "flight to safety" scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korean Police Probe Counterfeit Cash Ring That Targeted Crypto Traders

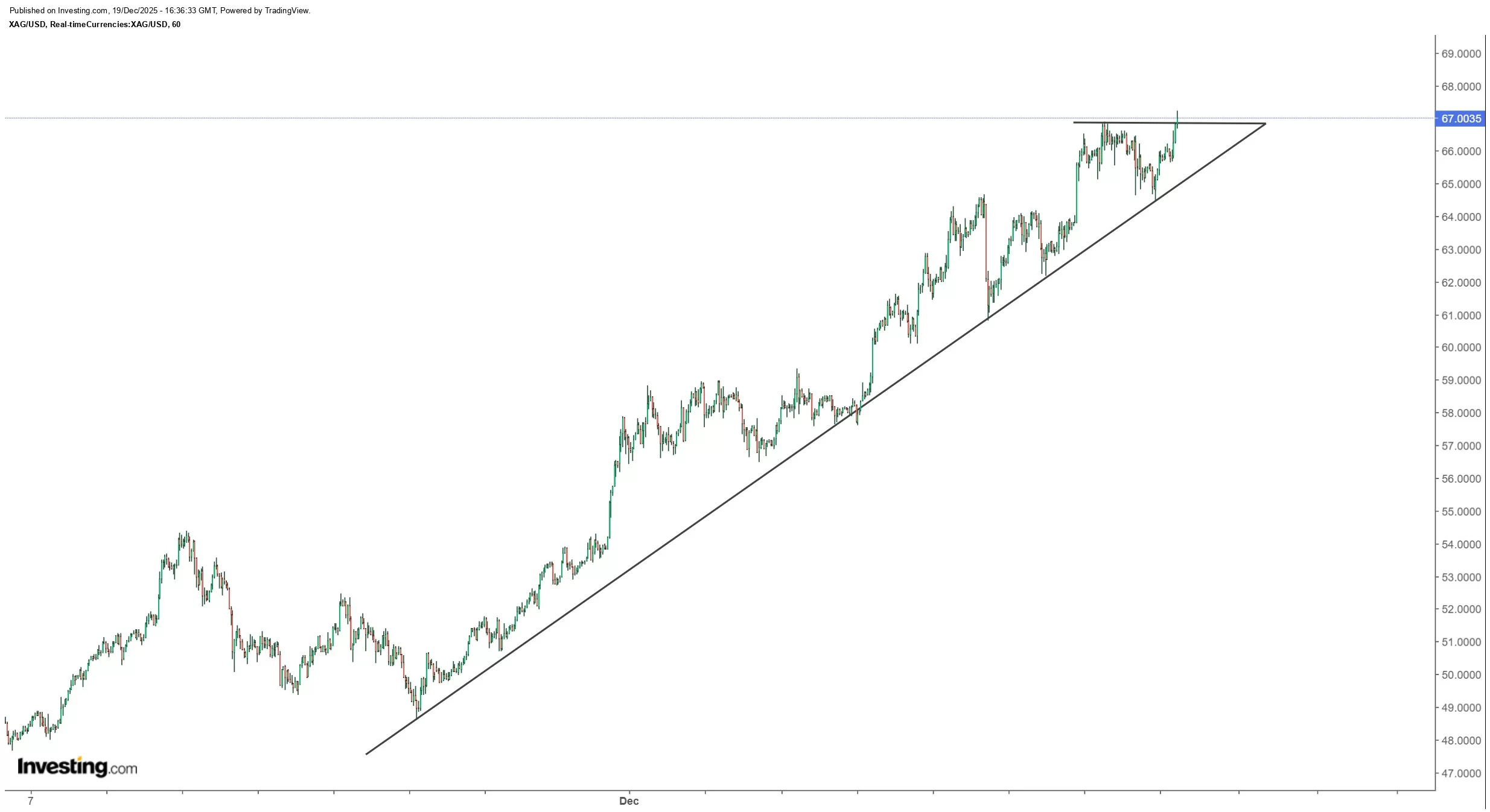

Silver Shatters Records with Unprecedented Performance This Year

How to Buy DeepSnitch AI at Discount Prices: Senate Confirms Selig and Hill, Traders Pile In For Moonshots

Ethereum Traders Chase Upside With Historic Leverage – Breakout Fuel Or Fragile Setup?