Trader Talk | Why Did This Market Experience an Epic Crash and When Is the Right Time to Buy the Dip?

Some stayed up all night, some saw their portfolio go to zero overnight; once again, the crypto world staged a "doomsday reboot" amidst the storm.

On October 11, 2025, this day will be engraved in crypto history. In response to the announcement of restarting the trade war by U.S. President Trump, the global market instantly entered panic mode. Starting at 5 a.m., Bitcoin began a nearly unsupported freefall, triggering a rapid chain reaction that spread throughout the entire crypto market.

According to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached as high as $19.1 billion, with over 1.6 million individuals being liquidated—both in terms of amount and number of individuals, this set a new record in the ten-year history of cryptocurrency contract trading. Some stayed up all night, some lost everything in a single night, and once again, the crypto world staged a "doomsday reset" amidst the stormy waves.

However, why was this liquidation so intense? Has the market bottom been reached? BlockBeats has compiled the insights of multiple market traders and renowned KOLs, analyzing this epic liquidation event from the perspectives of the macro environment, liquidity, market sentiment, and more, for reference only.

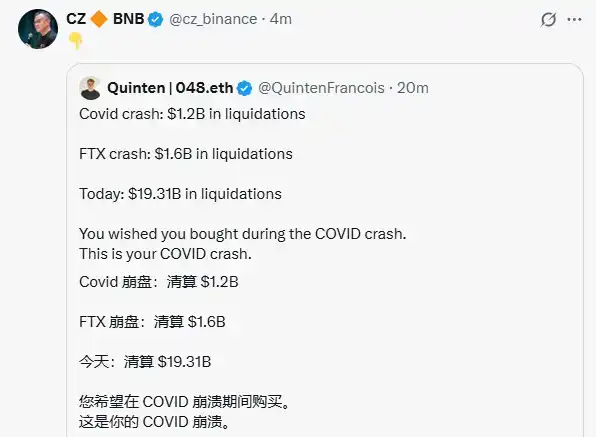

CZ: Buy the Dip

On October 11, CZ reshared views from Quinten, co-founder of weRate, on social media:

"Collapsed during COVID for $1.2 billion, collapsed on FTX for $1.6 billion, liquidated $19.31 billion today, people want to have bought the dip during COVID crash, but this is the COVID crash level dip right now."

Jack Yi-Hua (Liquid Capital Founder)

On October 11, Jack Yi-Hua, founder of Liquid Capital (formerly LD Capital), stated in a post that the institution had not yet bought the dip and needed to patiently wait for the situation to clarify. The scale of this event's decline far exceeded previous expectations. This is the first time since shouting singles on ETH that a full clear has been made (on-chain public plate). Previously, it was only leveraging through borrowing. There are a few reasons to mention:

· First, Bitcoin rose to a new high-pressure level, and without a major positive breakthrough, a pullback was inevitable

· Second, U.S. stocks hit new highs, with AI and semiconductor companies engaging in capital pool games that are unsustainable

· Third, with Japan about to have a new Prime Minister, the risk of rate hikes and continuously rising rates is increasing

· Fourth, altcoins in the crypto space have been consistently declining, and MEME fever has drained liquidity

Vida (Founder of Formula News)

On October 11, the founder of Formula News, Vida, posted on social media, saying: "Recently, a friend told me about a risk-free arbitrage opportunity where you can engage in USDE circular lending on Binance, achieving an annualized interest rate of around 26%. An institutional friend he knows used a $100 million USDT principal to circulate to $500 million USDE on the Binance trading platform for arbitrage."

Vida explained that this massive-scale liquidation was speculated to have occurred in a scenario of a significant market drop with low liquidity:

· The USDE arbitrageur's circular lending position was liquidated

· Resulting in a low USDE price

· Leading to a decrease in the collateral capacity of USDE as the unified account collateral

· Triggering more liquidation of market makers' positions using USDE as collateral

· Triggering assets such as BNSOL, WBETH, which, even though high in collateralization, had their value entirely determined by the order book and, under the prevailing conditions, no one came in to support to maintain the peg, resulting in a price collapse and further liquidation. It can be guessed that with a high probability some market makers using the unified account also got liquidated, hence the extremely extreme prices of many small coins.

Haotian (Crypto Researcher)

To be frank, the Black Swan event on 10/11 has made me, originally an optimistic industry observer, feel a hint of despair.

Initially, I thought I understood the current "Three Kingdoms" situation in the crypto industry, thinking it was a scenario where giants fought, and retail investors could benefit a bit. However, after experiencing this bloodbath, digging into its underlying logic, I realized it's not what I thought.

In essence, I thought the techies were innovating, exchanges were driving traffic, Wall Street was deploying funds, each party doing their own thing, and as retail investors, we just needed to seize the opportunity, follow the trend during tech innovations, ride the hype waves, and enter when funds flowed in, always being able to get a piece of the action.

But after going through the bloodbath of 10/11, I suddenly realized that perhaps these three parties aren't engaging in orderly competition but are actually harvesting all liquidity within the final battleground?

First Force: Exchange Monopoly, Vampires Holding Traffic and Liquidity Pools.

To be honest, I used to think that exchanges just wanted to build a large platform, capture a lot of traffic, grow the ecosystem, and make money off trading fees. However, the USDe cross-margin incident exposed the powerlessness of retail investors under the rules defined by the exchange platform. The leverage levels to improve product service experience and the unclear risk control capabilities in the dark corners that exchanges have implemented are actually traps for retail investors.

All sorts of rebate activities, Alpha launches, MEME launchpads, various yield farming and liquidity mining schemes, and high leverage contract trading strategies have emerged. It seems to provide retail investors with many money-making opportunities, but once the exchange cannot handle the on-chain DeFi cascade liquidation risk, retail investors will also suffer. Such is life.

What's even more terrifying is that the top 10 exchanges had a Q2 trading volume of $21.6 trillion, yet overall market liquidity is still decreasing. Where did the money go? Apart from trading fees, a significant portion goes to various liquidations. Who has siphoned off the liquidity?

Second Force: Wall Street Capital, Entering the Arena with a Compliance Coat.

I was actually looking forward to Wall Street entering the scene, thinking that institutional funds could bring greater market stability, as institutions are long-term players that can inject incremental liquidity into the market, allowing us to enjoy the industry dividend of Crypto merging with TradFi.

However, before this recent crash, we saw news of whales accurately shorting the market for profit. Prior to the crash, there were multiple instances where wallets, suspected to be structured by Wall Street, initiated massive airdrop positions, reaping billions in profits. There are many similar incidents, reading like insider trading, but occurring at such panic-inducing moments, one can't help but question why institutions always seem to have the advantage of "front-running" before a Black Swan event.

These TradFi institutions, under the guise of compliance and bringing funds, what are they really up to? Tethering the DeFi ecosystem to stablecoin public chains, channeling fund flows through ETFs, gradually eroding the market's discourse power with various financial instruments? On the surface, they claim to be advancing the industry, but in reality? Let's not delve into the numerous conspiracy theories about the Trump family enriching themselves.

Third Force: Tech-Native Faction + Retail Developer, Cannon Fodder Caught in the Crossfire.

I believe this is where the majority of retail participants and developers in the industry, the so-called builders, truly find themselves in despair. Since last year, many meme coins have been knocked down, but this time, they were obliterated directly to zero, forcing us to face the harsh reality that the liquidity of many meme coins has nearly dried up.

The key issue is that there is a mountain of infrastructural technical debt, applications are not meeting expectations, developers are painstakingly building, but what's the result? The market simply doesn't buy it.

So, I can't see clearly how the next wave of the copycat market will rise again, I don't understand how these copycat project teams will snatch liquidity from exchanges, how they will compete with Wall Street institutions in price manipulation. If the market no longer buys into the narrative of storytelling, if the market is only left with the so-called MEME gambling, then for the altcoin market, it is a decisive clearance and reshuffle, developers flee, and insiders undergo structural reshuffling. Is the market really heading towards nothingness? Sigh, it's too difficult!

So.....

Talking too much, it's all tears. If the current situation of the crypto industry continues the Three Kingdoms-style gameplay, where exchanges monopolize by skimming, Wall Street precisely harvests, and retail technical players are double-killed, this is definitely a disaster for the periodic play of the past Crypto cycles.

Over time, the market will only leave a few short-term winners and long-term losers.

Mindao (Founder of DeFi Protocol dForce)

On October 11th, Mindao, the founder of the DeFi protocol dForce, posted on social media, stating that the similarity between this crash and the Luna incident is that they both occurred when major trading platforms started accepting unregulated stablecoins as high LTV collateral, causing risks to permeate between trading platforms. At that time, it was UST, today it is USDe, where "stability" + high collateralization ratio has confused most people.

When introducing unregulated stable assets as collateral, the worst combination is to use market price as the oracle, while allowing a high collateralization ratio; coupled with the fact that CEXs do not have fully open arbitrage opportunities, low arbitrage efficiency further amplifies the risk. LSD-type assets face the same problem. In fact, these assets are all volatile assets disguised under the cloak of "stability."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K

Bitcoin's dormant capital has finally awakened

In recent years, a completely new ecosystem has been forming around bitcoin.

Privacy concerns have become the biggest obstacle for enterprises using blockchain for commercial payments.

What is preventing enterprises from applying blockchain technology to business scenarios?