US–China Tariff War: Can Crypto Market Survive the New Trade War?

The global markets were shaken after President Donald Trump announced a 100% tariff on Chinese goods starting November 1, reigniting a full-scale trade war between the two largest economies. With $1.6 trillion already wiped from the US stock market in a single day, the question on every investor’s mind is simple: what happens next for crypto?

Why US–China Tariff Matter for Crypto Market?

Unlike traditional equities, cryptocurrencies are not tied to a single economy, but they react sharply to macroeconomic shocks. Tariffs between the US and China hit two pressure points: inflation and liquidity. Higher import costs push inflation up, and central banks may respond with tighter monetary policy, reducing liquidity. For risk assets like Bitcoin and altcoins, reduced liquidity often translates into selling pressure.

At the same time, crypto is increasingly viewed as a hedge against geopolitical risk. If trade tensions escalate into broader financial instability, investors may turn to Bitcoin as a digital safe haven, mirroring how gold reacts to crises. This dual role creates volatility: panic selling first, then speculative inflows if confidence in fiat weakens.

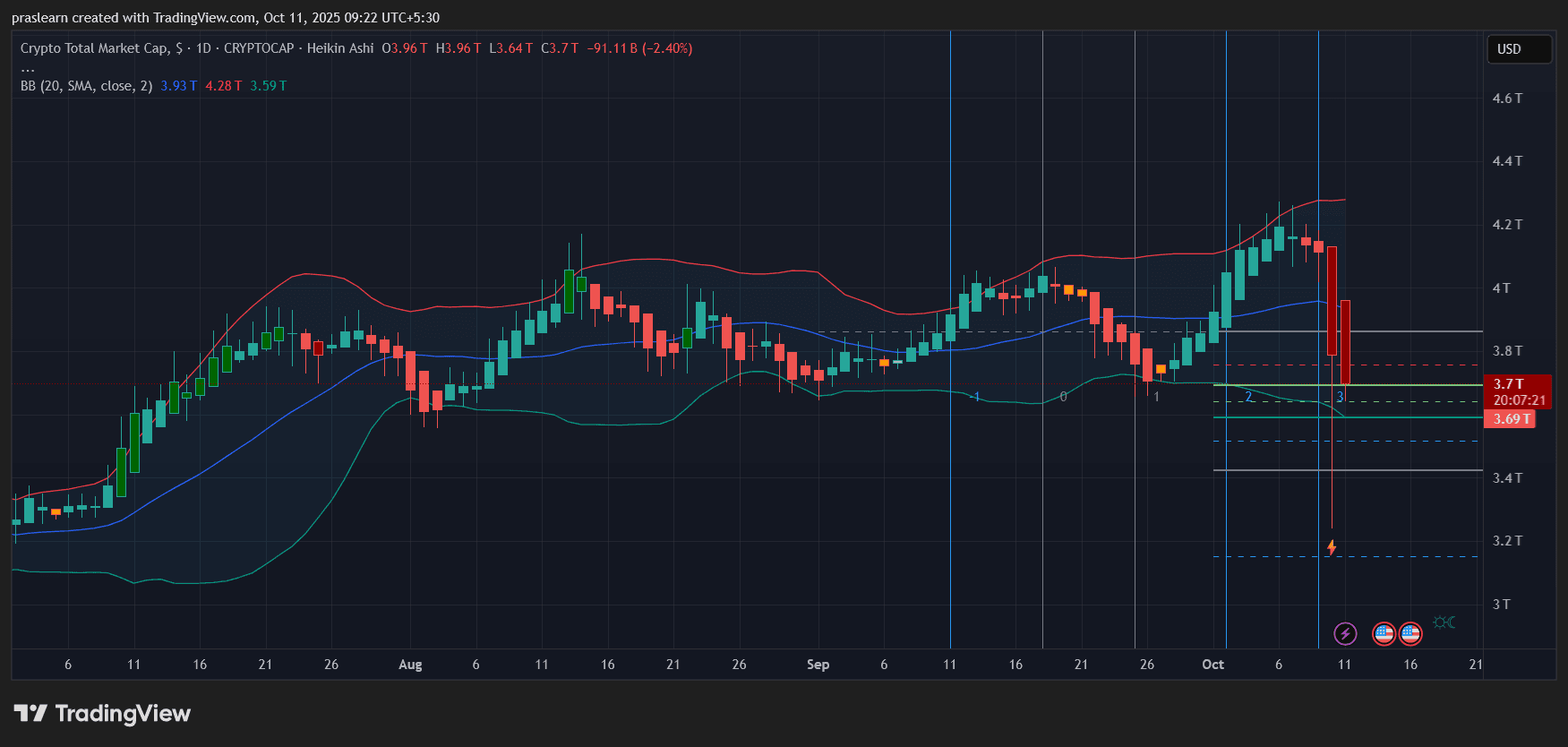

Chart Analysis: Where Is the Crypto Market Headed?

Total Market Cap: TradingView

Total Market Cap: TradingView

Looking at the Total Crypto Market Cap chart, the recent candles tell a story of sharp reversal. After testing the upper Bollinger Band near $4.2 trillion, the market plunged below $3.7 trillion, with a massive wick extending towards $3.2 trillion. That wick signals extreme panic liquidation, followed by partial recovery.

The Bollinger Bands are widening, which usually signals higher volatility ahead. The mid-band around $3.93 trillion is acting as resistance, while immediate support sits near $3.59 trillion. If this level breaks decisively, the next stop could be $3.2 trillion. On the upside, reclaiming $3.9–4 trillion could set the stage for a rebound rally.

Could Rare Earth Politics Spill Into Crypto Market?

Image Source: Truthsocial

Image Source: Truthsocial

China’s restrictions on rare earth exports aren’t just about minerals; they’re a geopolitical weapon. Rare earths are essential for high-tech industries, including chips, batteries, and EVs. Any disruption in this supply chain threatens US tech stocks, which are already reeling. When equities are unstable, crypto often becomes collateral damage as institutions de-risk across all volatile asset classes.

But here’s the twist: if US–China relations worsen further and global trust in traditional financial systems declines, crypto could see inflows as an alternative store of value. In essence, rare earth disputes may indirectly fuel Bitcoin’s “digital gold” narrative.

Short-Term Outlook: More Crypto Market Crash Before Relief?

Given the November 1 deadline for tariffs by Donald Trump, markets are bracing for weeks of uncertainty. Expect sharp swings as traders position for worst-case outcomes. The chart suggests crypto market cap could retest $3.5 trillion, with a possible extension to $3.2 trillion if panic deepens.

However, if inflation fears push more investors to seek decentralized assets, Bitcoin and Ethereum may lead a relief rally. Historically, crypto thrives when traditional markets lose investor trust.

Long-Term View: A Turning Point for Adoption?

If the trade war escalates, crypto adoption could accelerate. Both the US and China are heavily invested in blockchain technologies. For China, pushing digital yuan adoption could reduce reliance on dollar-settled trade. For the US, crypto may gain traction as retail and institutional investors seek alternatives to inflation-weakened fiat.

The rare earth standoff might also highlight blockchain’s role in securing supply chains, further intertwining crypto with geopolitics.

Final Take

The US–China tariff battle has thrown crypto into a storm of uncertainty. Short-term, volatility and downside risk dominate the charts. But long-term, these geopolitical tensions may be the very fuel that strengthens crypto’s case as a hedge against inflation, trade wars, and broken global trust.

The question isn’t just whether crypto will fall or rise in the next few weeks. The deeper question is whether this trade war marks the beginning of crypto’s evolution from speculative asset to essential financial refuge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."