AI predicts XRP price for end of 2025

XRP is currently experiencing a significant capital outflow in line with the broader market, but an artificial intelligence (AI) tool estimates the asset could potentially end 2025 valued above $3.

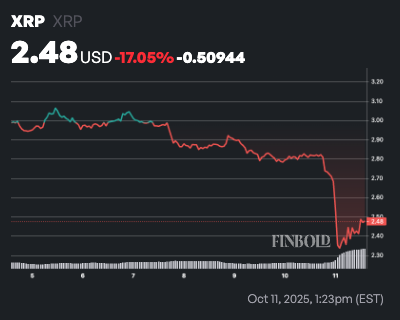

As of press time, XRP was trading at $2.48, having dropped nearly 12% in the past 24 hours. On the weekly timeframe, the token is down over 17%.

AI predicts XRP price

Regarding the asset’s outlook for the end of 2025, Finbold consulted OpenAI’s ChatGPT, which highlighted several factors likely to shape XRP’s trajectory.

The model noted that approval of an XRP-focused exchange-traded fund (ETF) could inject $3 to $10 billion in institutional capital, potentially driving the price higher. Conversely, a delay or denial of the ETF could stall growth or lead to a decline.

However, despite the approval being delayed due to the ongoing government shutdown, expectations remain high that regulators will grant the nod in 2025.

At the same time, ChatGPT noted that global macroeconomic conditions, geopolitical tensions, and Bitcoin’s performance are key influences. A positive end-of-year crypto rally could lift XRP alongside broader market momentum, while continued uncertainty could weigh on prices.

Additionally, Ripple’s adoption in cross-border payments and expanding partnerships in Europe and Asia provide further support for the asset, strengthening its fundamental demand.

XRP price key levels to watch

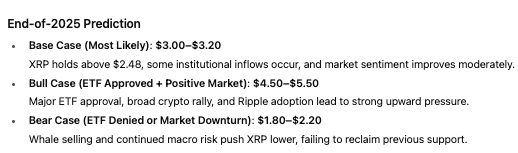

Considering current trends, support levels, and the potential impact of ETF approval, the AI analysis projects XRP could realistically end 2025 around $3.10 and $3.20 under a moderate scenario.

In a bullish outcome with ETF approval and a strong crypto market, XRP could reach $4.50 or higher. However, risks from whale selling and macroeconomic pressures could see the price fall to the $1.80 and $2.20 range.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes