Since late last night, the cryptocurrency market ‘s primary focus has been the statements made by Donald Trump. Not only does this make headlines in the crypto realm, but it also takes center stage globally due to Trump’s remarks concerning China.

Market Volatility on the Rise

With U.S. President Donald Trump’s announcement of imposing a 100% tariff on China, fear surged through the crypto markets. The Crypto Fear & Greed Index plummeted dramatically from a “greed” level of 64 on Friday to a “fear” level of 27 on Saturday, reflecting a notable 37-point decline. Bitcoin’s price also fell to $102,000 in Binance futures following Trump’s declarations.

In the past 24 hours alone, according to CoinGlass data, approximately $19.27 billion worth of long and short positions were liquidated. This incident starkly highlighted the rapid decline in investor confidence.

Analyzing Market Sentiment

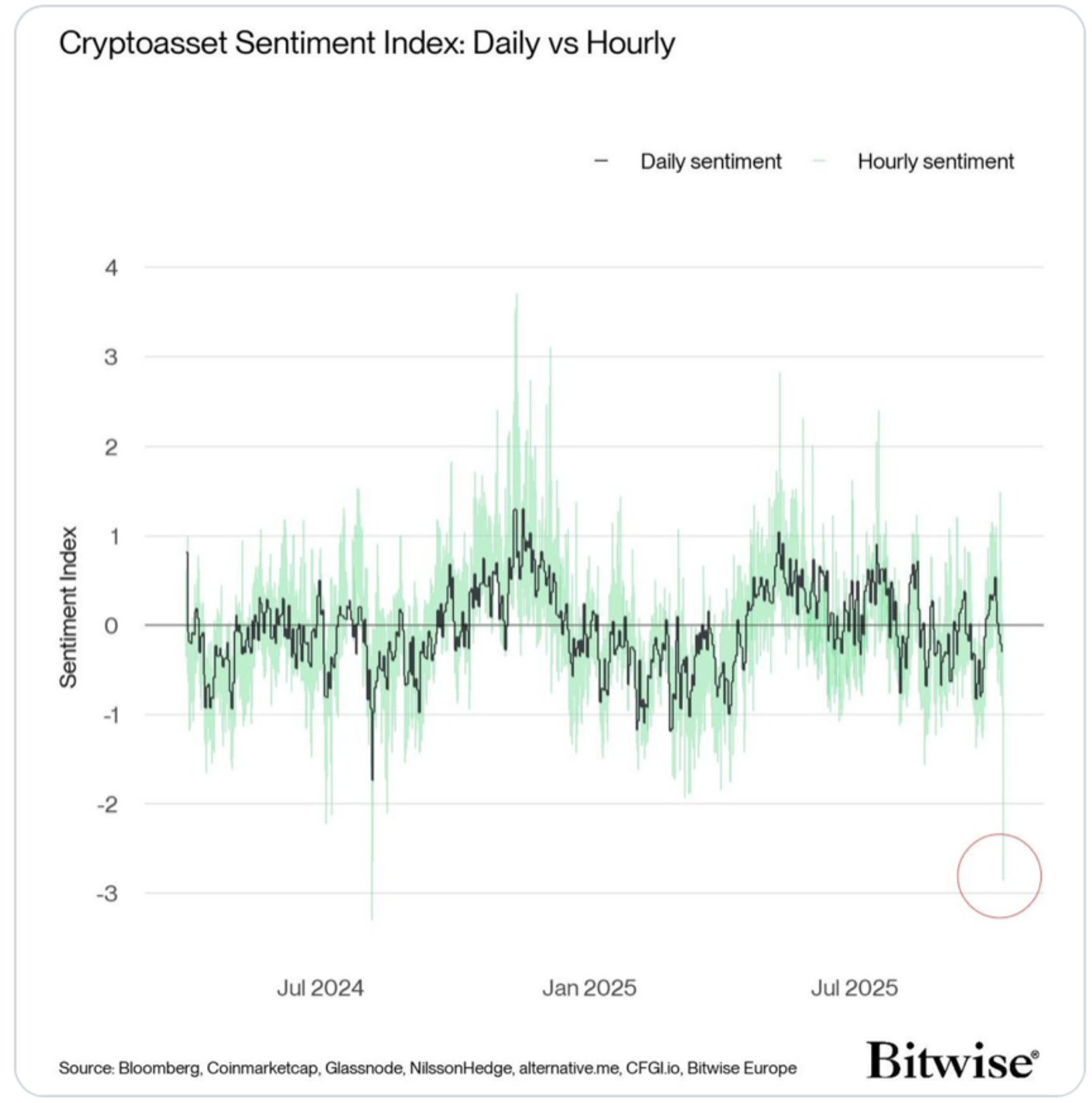

Despite the turmoil, Andre Dragosch, the Director of Research for Bitwise Europe, revealed on X that the firm’s intraday sentiment index has emitted a strong counter-buy signal. He noted that the index fell to its lowest point since the 2024 summer “Yen Carry Trade Unwind” period with a -2.8 standard deviation.

A similar level of low sentiment was last observed on April 16, 2024. At that time, Bitcoin $112,269 dropped to $77,000 amid escalating trade tensions. Trump’s announcement of a 90-day pause on tariffs, with rates reduced to 10% for most countries, echoed through the market.

Bitcoin’s new high of $125,100 at the start of the week surprisingly garnered limited excitement on social media, according to Santiment analyst Brian Quinlivan. During an interview on the Thinking Crypto podcast, Quinlivan stated, “Unlike previous records, the response this time was remarkably constrained.” He emphasized that investors seem to view such surges as normal, suggesting a “saturation phase” in market psychology.

Similarly, a Glassnode analysis last week pointed out that Bitcoin’s new peaks were not supported by increased trading volumes, indicating a tendency among investors to capitalize on their gains.

In conclusion, Trump’s tariff announcement creates a sense of uncertainty in the crypto market , unseen for a while. Nevertheless, some analysts perceive this downturn as a “buying opportunity” because of the market’s entry into an extreme fear zone. While short-term volatility might increase, history shows that such panic periods often precede recoveries.