DeFi Passes Real-World Stress Test As Major Exchanges Buckle Under Trump’s Tariff Shock

Centralized platforms like Binance and Coinbase suffered glitches as trading volumes surged, while decentralized finance protocols such as Aave and Uniswap processed billions without interruption.

A wave of heavy market activity on October 10 sent shockwaves through both traditional and digital markets, exposing the limits of major centralized crypto exchanges.

The turbulence began moments after US President Donald Trump announced a 100% tariff on Chinese imports. The policy surprise spooked global investors, triggering a sell-off that spread from equities to digital assets within minutes.

Trump’s Tariff Shock Exposes Cracks in Major Crypto Exchanges

Following the announcement, crypto traders responded in two distinct ways. Some rushed to cut their losses, while others scrambled to “buy the dip.”

The simultaneous surge in orders overloaded several exchanges, including Binance, Coinbase, Gemini, Kraken, and Robinhood.

As a result, several social-media users reported frozen dashboards, mismatched prices, and failed trades as trading engines struggled to keep up with demand.

However, Binance and Coinbase later said the disruptions were caused by extreme user activity rather than security breaches.

We are happy to report that all services have been restored and are progressively returning to normal. We are continuing to monitor the situation to ensure all operations continue running smoothly. We appreciate everyone’s understanding.

— Binance (@binance) October 11, 2025

Although most platforms restored normal service within hours, the episode raised debate over whether centralized exchanges could scale fast enough during major volatility events.

While centralized platforms struggled to stay online, decentralized finance (DeFi) protocols largely operated without interruption.

Aave founder Stani Kulechov described the market crash as “the largest stress test in DeFi history.” During the period, the lending platform liquidated roughly $180 million in collateral within an hour without downtime or transaction errors.

Chainlink’s community liaison, Zach Rynes, attributed that performance to reliable on-chain price feeds that allowed automated liquidations to execute in real time.

Similarly, Hyperliquid, a top decentralized derivatives exchange, reported zero latency despite record traffic volumes. It credited its HyperBFT consensus system for maintaining throughput and solvency.

During the recent market volatility, the Hyperliquid blockchain had zero downtime or latency issues despite record traffic and volumes. HyperBFT consensus and execution handled the spike in throughput gracefully. This was an important stress test proving that Hyperliquid's…

— Hyperliquid (@HyperliquidX) October 11, 2025

On Ethereum, Uniswap processed an estimated $9 billion in daily trading volume—significantly above its norm—without notable slowdowns.

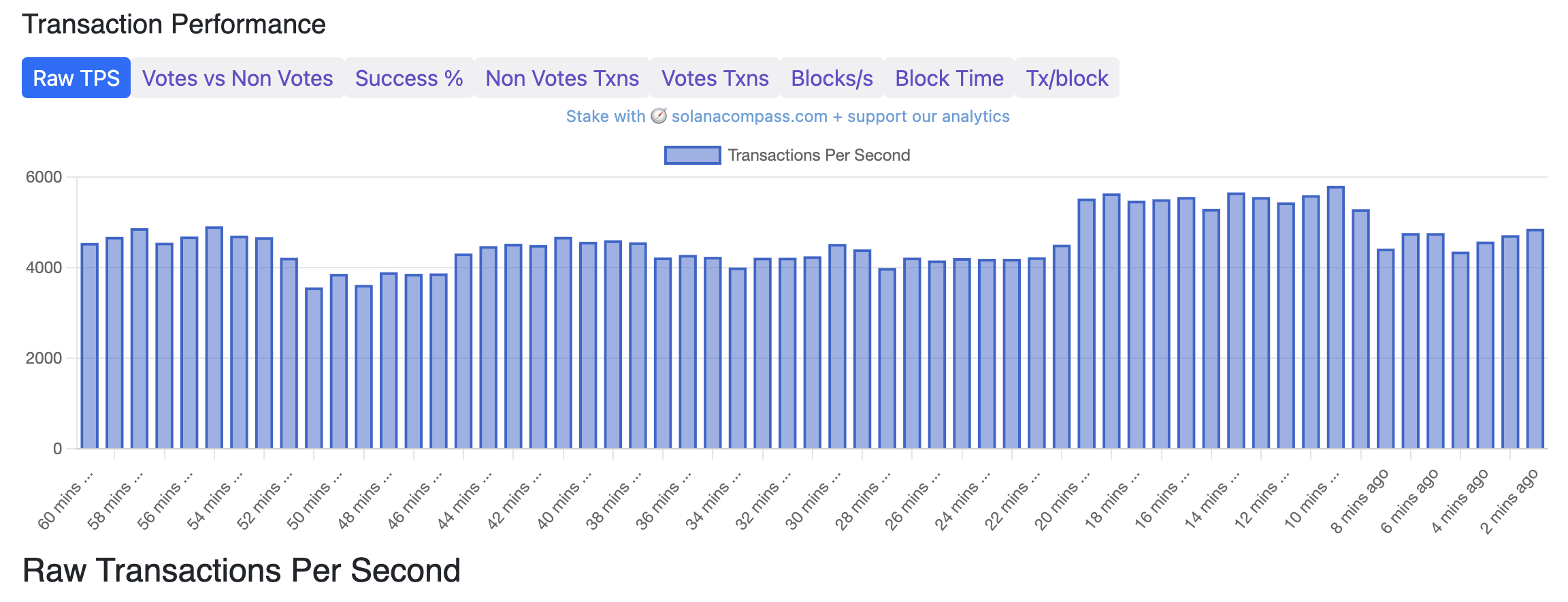

Meanwhile, the resilience extended to Solana’s ecosystem, where Kamino Finance confirmed zero bad debt while the network itself handled up to 10,000 transactions per second.

Solana’s Raw Transaction Per Second. Source:

Solana

Solana’s Raw Transaction Per Second. Source:

Solana

Speaking about these DeFi protocols’ strong performance, Paul Frambot, CEO of Morpho Labs, said DeFi’s resilience highlights why open, programmable financial infrastructure may eventually outlast traditional intermediaries.

Antonio Garcia Martinez, an executive at Coinbase’s Base network, echoed similar views, while adding that:

“The fact you have financial infrastructure managing billions that runs as literal code in a decentralized way across machines owned by strangers who don’t trust each other is one of the great tech miracles of our time. There are cathedrals everywhere for those with eyes to see.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K

Trending news

MoreBitget Daily Digest (Dec. 9)|Michael Saylor is promoting a Bitcoin-backed banking system to governments; the CFTC has launched a digital asset pilot program allowing BTC, ETH, and USDC to be used as collateral

[English Thread] Wake-up Call and Review for the Crypto Industry in 2025: Where Is the Direction of the Next Cycle?