- Cardano: Upcoming upgrades and stable technical structure position ADA for a potential Q4 breakout.

- Chainlink: Institutional partnerships and integrations strengthen LINK’s outlook for renewed market momentum.

- Avalanche: Treasury accumulation and ecosystem growth signal strong potential for continued upside this quarter.

As the last quarter is running, crypto traders are reassessing their strategies for any potential outperformers. Analysts have identified a few leading crypto projects that are showing off sound fundamentals and technical strength going into the year-end. The most promising are Cardano, Chainlink and Avalanche, all of which are advancing through real development and not hype. With new developments, partnerships, and institutional interest growing, these three altcoins appear ready to define Q4’s major crypto plays.

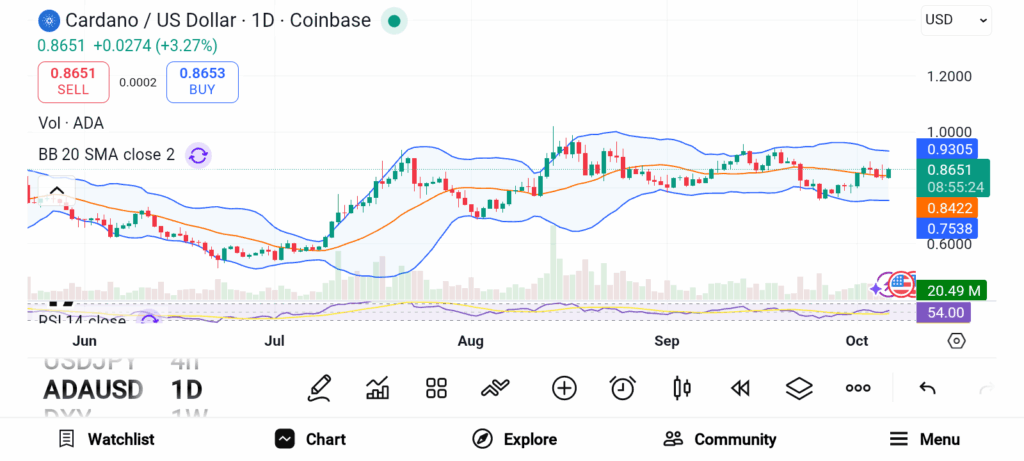

Cardano (ADA)

Source: Trading View

Source: Trading View

Cardano’s ongoing roadmap has gained momentum as the network transitions further into the Basho and Voltaire phases, which focus on scaling and on-chain governance—two important features that could play a role in the potential long-term growth of Cardano. The upcoming Ouroboros Leios update is being tested which may increase efficiency by as much as fifty times. Technically, ADA is holding firm even as the broader markets move sideways. The token has settled within the $0.79 to $0.82 range. Should the buyers defend $0.90, analysts see a potential push to the $1.02 range and possibly $1.20 resistance from there.

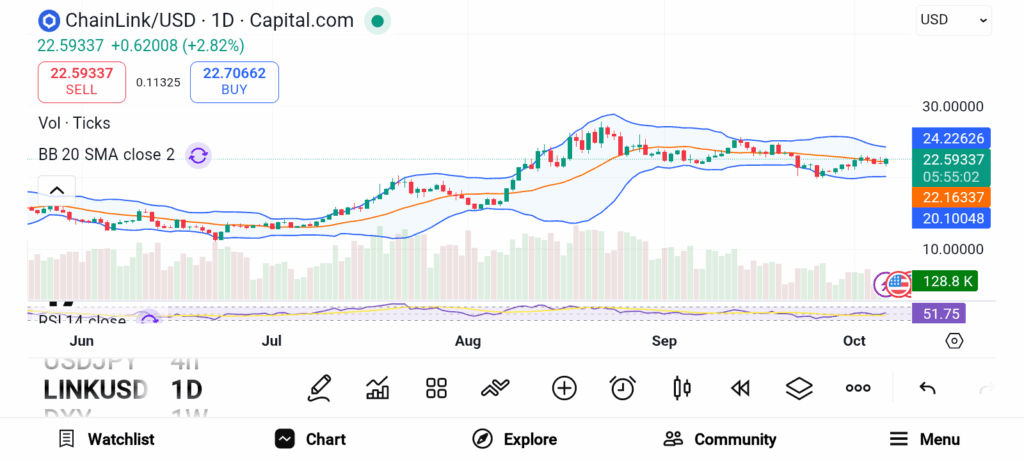

Chainlink (LINK)

Source: Trading View

Source: Trading View

Chainlink continues to strengthen its role as a bridge between traditional finance and blockchain infrastructure. Recent developments support that outlook. Stablecoin project Plasma has integrated Chainlink’s services, expanding the network’s real-world use cases. Meanwhile, UBS partnered with SWIFT in a pilot using Chainlink’s CCIP protocol to test tokenized asset transfers.

Such partnerships show how Chainlink continues to secure relevance in institutional-grade adoption. Institutional confidence in Chainlink is also rising. Asset manager Caliber recently disclosed a $6.5 million LINK purchase, while ongoing treasury buybacks have provided steady market support. After a brief correction to six-week lows, analysts view the token as gearing up for another advance.

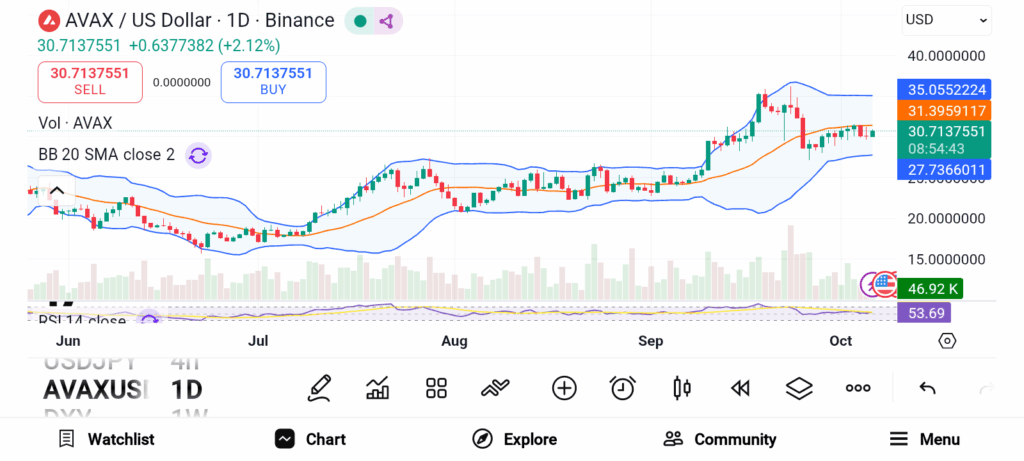

Avalanche (AVAX)

Source: Trading View

Source: Trading View

Avalanche also stands out among analysts’ top picks for this quarter. Reports highlight a treasury initiative tied to the network that targets up to $1 billion in AVAX accumulation. This move aligns with broader institutional strategies supporting long-term ecosystem growth. Analysts believe such capital formation signals confidence in Avalanche’s expanding infrastructure.

Beyond treasury accumulation, Avalanche continues to grow through Subnet expansion and ecosystem development. New projects and partnerships are emerging, driving both user activity and investor interest. There is also rising discussion around a possible Avalanche-based ETF, which could further attract institutional money.

Cardano prepares for major upgrades that may lift scalability and adoption. Chainlink continues to link blockchain with global finance through strong institutional partnerships. Avalanche gains momentum through treasury expansion and ecosystem growth. Together, these altcoins represent analyst-backed picks poised for strength through the fourth quarter.