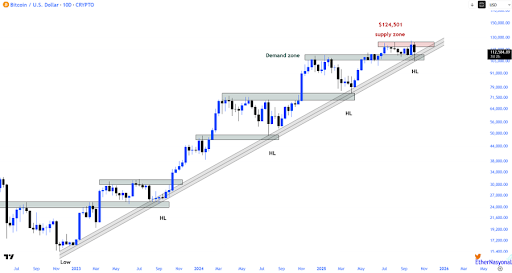

Bitcoin’s Pullback A Healthy One? Chart Signals Move To New All-Time High

Bitcoin appears to be quietly gathering strength beneath the surface. After a healthy pullback that shook out weak hands, the market is showing signs of renewed momentum. Key technical signals suggest this correction may have been a setup for the next major rally, potentially paving the way for a new all-time high.

Healthy Correction Within A Dominant Uptrend

EtherNasyonaL, in a recent post, highlighted that Bitcoin continues to maintain its upward trajectory despite recent market fluctuations. The analyst described the latest movement as a healthy correction within the broader bullish trend, emphasizing that such retracements are natural in a sustained rally.

Following a rejection from the supply zone, Bitcoin found strong support at a key demand area, where buyers quickly stepped in to defend the price. This rebound underscores the underlying strength of market participants and reaffirms that bullish sentiment remains dominant.

EtherNasyonaL noted that short-term volatility, for traders not involved in leveraged positions, often appears as noise in the bigger picture. BTC’s macro trend is still positive, and the ongoing correction may simply serve as fuel for the next leg higher. Overall, Bitcoin’s structure remains solid, with its trend intact and momentum still alive.

Bullish Spring Formation Points To Possible Breakout Setup

Crypto analyst Christopher Inks, in an X post, noted that Bitcoin’s latest price action has refined its trading range, offering a clearer market structure. He suggested that the asset may have just formed a heavy spring or bullish Swing Failure Pattern (SFP), a setup that often precedes strong upward movement.

If this bullish setup holds, the analyst expects a validation phase, where Bitcoin could form a higher low on lower volume, a classic sign of successful testing. Such a move would confirm the spring’s strength and potentially trigger momentum toward a new all-time high (ATH). This phase is critical in determining whether the next major rally is about to begin.

Inks also pointed to Open Interest (OI) as a key confirmation tool. A decline in open interest as price consolidates would suggest short covering and validate the bullish test. On the other hand, rising OI on lower closes would imply continued distribution, signaling that the market may need more time before reversing decisively.

From an Elliott Wave Theory (EWT) perspective, Inks identified a three-wave structure from the swing low while printing a new swing high that fits a flat correction pattern. Since flat corrections often occur before the continuation of a larger uptrend, this analysis aligns with the Wyckoff interpretation, suggesting Bitcoin’s structure remains strong and poised for another upward leg.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.