- UNI A high FDV-to-market-cap gap and rising turnover point to range trading unless volume cools and cap flattens.

- With most supply circulating and FDV near spot, price should track demand, not issuance shocks.

- An 82% vol/mkt-cap ratio fueled the jump, but stabilization needs sustained cap gains with normalized volume.

DeFi markets split directions as leading tokens printed distinct intraday structures. Uniswap fell hard, Tezos stayed balanced, and Curve advanced on strong flow. These moves frame near-term paths shaped by supply design, liquidity, and participation.

Uniswap (UNI): High-FDV Pressure After Shock-and-Drift

UNI traded near $5.69 after dropping about eighteen percent during the session. Market cap hovered around $3.58 billion as the curve trended lower. Meanwhile, volume jumped roughly ninety-three percent to about $1.12 billion, signaling heavy participation.

Source: CoinMarketCap

The volume-to-market-cap ratio printed near thirty-two percent and signaled active two-sided trade. Circulating supply stood near 630 million out of one billion total, leaving room for further issuance. FDV around $5.68 billion created a notable premium over spot capitalization.

Price behavior fit a shock-and-drift pattern that often precedes range trading. A durable base would show a flattening cap line and easing turnover. Otherwise, continued heavy volume with a downward lean can extend the drift.

Tezos (XTZ): Steady Float, Demand-Driven Moves

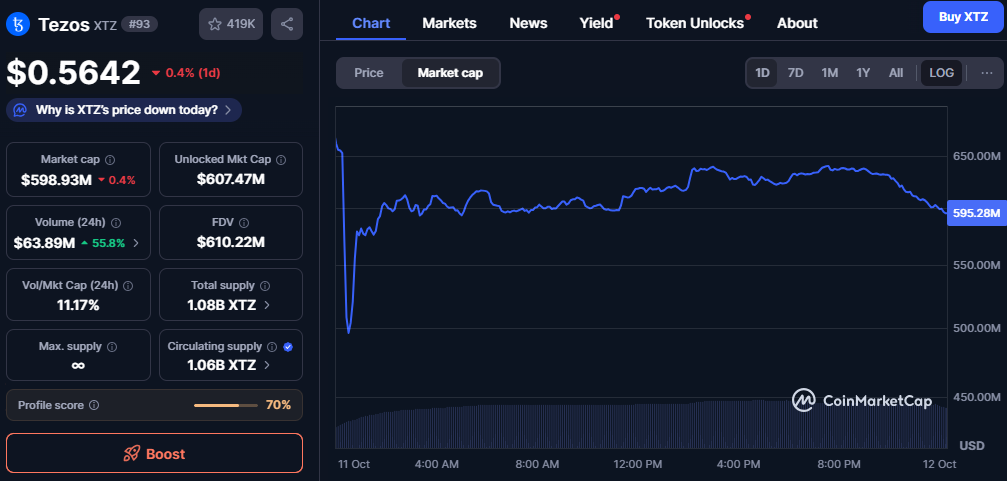

XTZ traded near $0.564 with a nearly flat daily change and a ~$599 million market cap. The cap curve dipped early, climbed gradually, and faded late into the finish. Participation improved as volume rose about fifty-six percent to ~$63.9 million.

Source: CoinMarketCap

The volume-to-market-cap ratio near eleven percent implied moderate liquidity compared with peers. Circulating supply reached about 1.06 billion from 1.08 billion total, so most float already trades. Unlocked market cap and FDV sat close together, reflecting limited dilution risk.

With supply largely live, price tends to mirror demand rather than issuance cycles. Confirmation of strength would feature a steady cap uptrend with consistent volume. Conversely, fading activity with a flat curve would keep XTZ in a tight range.

Curve DAO (CRV): Rebound Backed by Strong Volume

CRV printed about $0.467 after gaining roughly fifteen percent on the day. Market cap stood near $654 million while the curve cooled after an early spike. Turnover surged about seventy-five percent to roughly $514 million, producing the strongest participation of the group.

Source: CoinMarketcap

The volume-to-market-cap ratio reached roughly eighty-two percent, underscoring intense intraday engagement. Circulating supply measured around 1.39 billion against 2.31 billion total and 3.03 billion maximum. FDV near $1.41 billion still exceeded spot capitalization by a wide margin.

Follow-through now matters more than the first burst higher. A sustained cap climb with normalized yet healthy volume would support stabilization. If turnover collapses while the curve stalls, the rally could retrace quickly.

Outlook: Signals to Confirm or Fade

Across these names, structure and supply framed outcomes more than headlines. UNI faced a premium FDV and heavy turnover, while XTZ tracked demand with a mature float. CRV advanced on outsized activity but still carried a sizable FDV gap.

The next cue is simple and testable across charts. Market-cap lines should flatten and then rise as volume normalizes. If that sequence appears, bases can form; otherwise, expect range trading and mean reversion.