[Bitpush Weekend Key News Review] Strategy's portfolio value evaporated by over 8 billion USD this week, Michael Saylor says BTC will not be subject to tariffs; ARK launches AI-driven DAO governance framework, leading a new paradigm in DeFi governance; Crypto.com CEO calls on regulators to investigate exchanges involved in large-scale liquidations over the past 24 hours.

Bitpush Weekend Key News Review:

[Crypto.com CEO and Wintermute Team Members Respond to Market FUD: Institutions Operating Normally, Bankruptcy Rumors Are False]

Bitpush News, in response to market rumors of "Crypto.com and Wintermute suspected of bankruptcy," Crypto.com CEO Kris Marzsalek commented that "the system is running perfectly, this is baseless FUD"; Wintermute team BD and partner cooperation member Arnaud stated that the rumor is false.

[Insider: Polymarket Token Launch Imminent, But Not Expected This Year]

Bitpush News, according to Decrypt, insiders revealed that Polymarket plans to launch its native crypto token, but it is not expected to be released in the coming months. Sources said Polymarket does not intend to launch its token before regaining a foothold in the US market, which is currently dominated by competitor Kalshi.

[Aethir Launches $45 Million DAT Buyback Program]

Bitpush News, Aethir's Digital Asset Treasury (DAT), which is listed on Nasdaq as $POAI, has officially launched a 45-day, $45 million $ATH open market buyback program.

[Strategy's Portfolio Value Evaporated by Over $8 Billion This Week, Michael Saylor Says BTC Will Not Be Taxed]

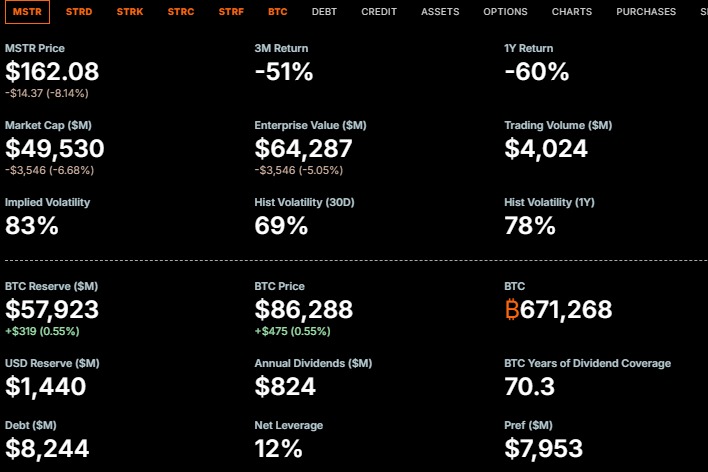

Bitpush News, despite the crypto market turmoil causing Strategy's (MicroStrategy) bitcoin holdings to lose over $8 billion in value this week (dropping from over $80 billion on Tuesday to about $71.93 billion), the company still has unrealized gains of over $24.5 billion, with a current return of 51.91%.

Currently, Strategy holds 640,031 bitcoins, with a total investment of about $4.735 billion and an average price of approximately $73,983. Its founder and executive chairman Michael Saylor posted on X that bitcoin will not be subject to tariffs.

[Securitize Plans to Go Public via Merger with Cantor's SPAC, Valuation to Exceed $1 Billion]

Bitpush News, according to Bloomberg, insiders revealed that tokenization company Securitize is in talks to go public through a merger with a special purpose acquisition company (SPAC) founded by Cantor Fitzgerald LP.

After merging with Cantor Equity Partners II Inc., Securitize's valuation will exceed $1 billion. Discussions are still ongoing, and Securitize may still decide to remain private. Previously, Cantor Equity II raised $240 million through an IPO in May.

[ARK Launches AI-Driven DAO Governance Architecture, Leading a New Paradigm in DeFi Governance]

Bitpush News, decentralized finance and artificial intelligence integration protocol ARK (Ark DeFAI) announced that its DAO governance system (Decentralized Autonomous Organization) will officially go live at 07:00 UTC on October 12.

This upgrade combines the AI Consensus Layer and the Community Governance System, allowing AI models to simulate policies, provide decision-making suggestions, and issue risk warnings, while opening up proposal and voting participation to global token holders.

ARK DAO Governance Committee Chairman Carmelo Ippolito stated: "Decentralization is not the disappearance of power, but the popularization of participation."

The launch of this governance system will build a three-layer architecture of "AI Advice × Citizen Voting × Community Consensus," achieving Human–AI Co-Governance and ushering in a new era for DeFi governance.

[Ethena: Multiple Independent Third Parties Confirm USDe Still Has About $66 Million in Excess Collateral]

Bitpush News, Ethena Labs posted on social media that "USDe proof of reserves is usually provided weekly by third-party independent verification agencies, including Chaos Labs, Chainlink, Llama Risk, and Harris & Trotter."

At the community's request, we have provided an off-cycle proof of reserves based on market events in the past 24 hours, which is linked below this message.

These independent third parties have all confirmed that USDe still has about $66 million in excess collateral.

[Crypto.com CEO Calls on Regulators to Investigate Exchanges with Large-Scale Liquidations in the Past 24 Hours]

Bitpush News, Crypto.com CEO Kris posted on X that regulators should investigate exchanges that experienced large-scale liquidations in the past 24 hours and thoroughly review the fairness of their actions.

The review should include: whether trading systems experienced outages or delays that prevented users from trading, whether all trade pricing was consistent with the index, the setup of trading monitoring and anti-money laundering (AML) mechanisms, and whether internal trading teams were effectively isolated.

He pointed out that $2 billion in liquidations harmed a large number of users, and it is the regulators' duty to protect consumers and ensure market integrity.

[CZ: BNB Has No Market Makers]

Bitpush News, CZ posted on X that many projects have market makers, but BNB does not. He is not aware of any of his affiliated entities buying or selling BNB in the past few days/weeks. BNB has builders and a community, and BNB is "deflationary."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plummeted below $85,000 today, but $600M in liquidations hides a much scarier macro catalyst

MetaMask Brings Bitcoin On-Chain as Wallet Go Multichain