- Jeff from Hyperliquid accuses CEXs of hiding real liquidation data

- Claims thousands of liquidations occur per second, but only a few are shown

- Raises concerns about transparency and trust in centralized platforms

Are Centralized Exchanges Hiding Liquidation Chaos?

Jeff, the founder of Hyperliquid ($HYPE), has leveled serious allegations against major centralized exchanges (CEXs), claiming they drastically underreport liquidation events. According to Jeff, “thousands” of liquidations can occur within a single second—yet only one might be publicly visible.

This revelation adds fuel to the growing fire of distrust surrounding centralized platforms in the crypto space. With billions of dollars at stake in leveraged trading, transparent reporting is essential. If Jeff’s claims hold weight, it could mean the crypto community has been misled about the true scale of volatility during major market moves.

Glassnode and other analytics platforms often report liquidation data based on exchange disclosures. If those disclosures are incomplete or manipulated, it calls into question the reliability of widely used market metrics.

Transparency Gap Sparks Industry Concerns

Jeff’s statement suggests a deliberate strategy by CEXs to conceal the extent of forced liquidations, possibly to downplay market risk or maintain user confidence. He argues that this lack of transparency makes it difficult for traders to assess real-time market conditions and risks, especially during periods of high volatility.

This is especially relevant given recent leverage wipeouts and funding rate collapses. If liquidation events are vastly underreported, traders may be operating under a false sense of market stability.

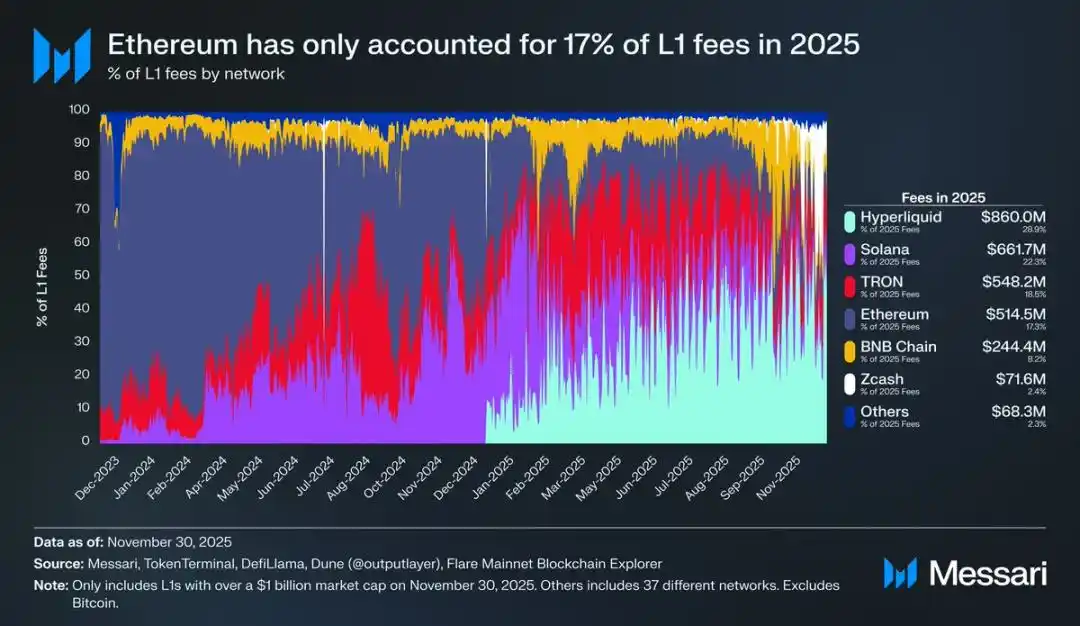

Hyperliquid, a decentralized perpetual exchange, has built its reputation on transparency and real-time on-chain data. Jeff’s criticism of CEXs may also reflect a broader push by decentralized platforms to highlight the weaknesses of their centralized counterparts.

What This Means for Crypto Traders

For everyday traders, Jeff’s accusations serve as a wake-up call: centralized platforms might not be telling the full story. This underlines the importance of cross-referencing on-chain data, using decentralized alternatives, and staying alert during extreme market movements.

If CEXs are indeed suppressing liquidation data, regulatory attention could follow. Trust, transparency, and verifiable data may soon become defining factors for exchanges competing for long-term user loyalty.

Read Also:

- Hyperliquid Founder: CEXs Hide True Liquidation Numbers

- Larry Fink: Crypto Is an Alternative Like Gold

- Crypto Funding Rates Hit Lowest Since 2022 Crash

- Tapbit Delivers a Strong Presence at TOKEN2049 Singapore

- Whale’s $27M BTC Short Breaks Even—Then Dives Again