In the past few days, the crypto market has experienced what can be described as a "textbook-level" crash and rebound.

On the evening of October 10, Trump's tariff policy triggered panic, causing BTC to plummet from $122,550 to $102,000. ETH, BNB, and SOL all dropped by more than 12%, with total liquidations across the network reaching $19.1 billions.

But within three days, the market rebounded sharply: BTC returned to $115,000, ETH climbed above $4,100, and SOL once again approached $200. When the market went through a crash and rebound, what were you doing?

Did you panic sell at the bottom, only to miss out on the rebound?

Did you go all-in at the bottom, only to find the market continued to fall?

Or did you get liquidated due to leverage and leave the market in tears?

If you are experiencing these pains, then the spot DCA (Dollar Cost Averaging) strategy introduced today may be the perfect way for you to turn losses into gains.

I. Why Now Is the "Golden Window" for Spot DCA

1️⃣ After the Crash, DCA Enters the "Value Accumulation Zone"

The market has just undergone a deep correction. No matter how fierce the short-term rebound, the overall trend is still in the bottoming phase.

For the DCA strategy, this kind of "panic sell-off + rapid rebound" structure is the ideal environment for building positions.

When BTC drops from 122k to 102k, short-term players may have already sold at a loss and exited, while your DCA strategy steadily executes low buys at the bottom, automatically performing the action of "being greedy when others are fearful." It does not try to time the bottom or top; it simply accumulates steadily when others are afraid.

2️⃣ In a Highly Volatile Market, DCA Is the Most Effective "Explosion Shield"

The current market can only be described with one word: extreme volatility. Any news, data, or tweet can instantly reverse the trend.

In such an environment:

Leverage trading? Even the most accurate direction can be liquidated.

Short-term trading? Chasing highs and selling lows, losing more than you gain.

Going all-in at the bottom? Often ends up buying halfway down.

DCA allows you to completely get rid of "timing anxiety." It replaces prediction with discipline: every price dip is an opportunity for it to automatically buy low; every rebound is a process of gradually locking in profits.

This is an automated, patient strategy that relies not on skill, but on execution.

3️⃣ Market Structure Is Shifting, DCA Helps You Capture the New Main Uptrend

The recent rebound structure has already made things clear: ETH's rebound strength has surpassed BTC, SOL rose over 10% in a single day, and BNB remains stable above $1,200. This shows that the market's leading logic is shifting from BTC dominance to "multiple main lines resonating."

In the current setup, if you only focus on one coin, you may miss out on the rotation opportunities across the entire sector.

With the DCA strategy, you can simultaneously deploy multiple potential coins and automatically capture whichever one takes off first.

II. Seize Opportunities in Four Core Coins: Run a "Four-Coin Spot DCA Portfolio" with One Click

BTC is stable, ETH is strong, SOL is highly elastic, and BNB is a stable hedge—these four coins almost cover all the main market narratives. You can fully deploy them within a single DCA strategy.

💡 Practical method (for reference only):

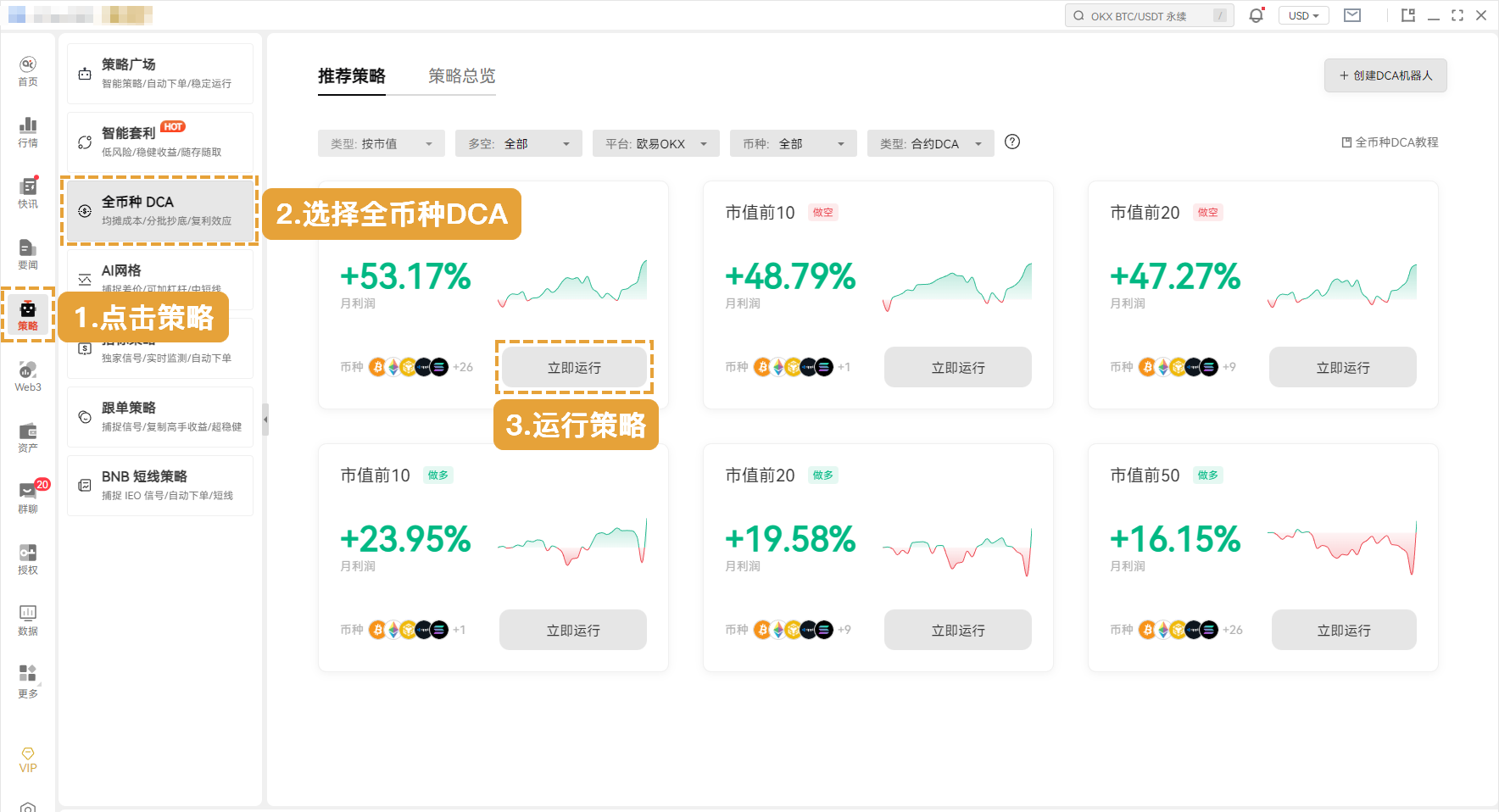

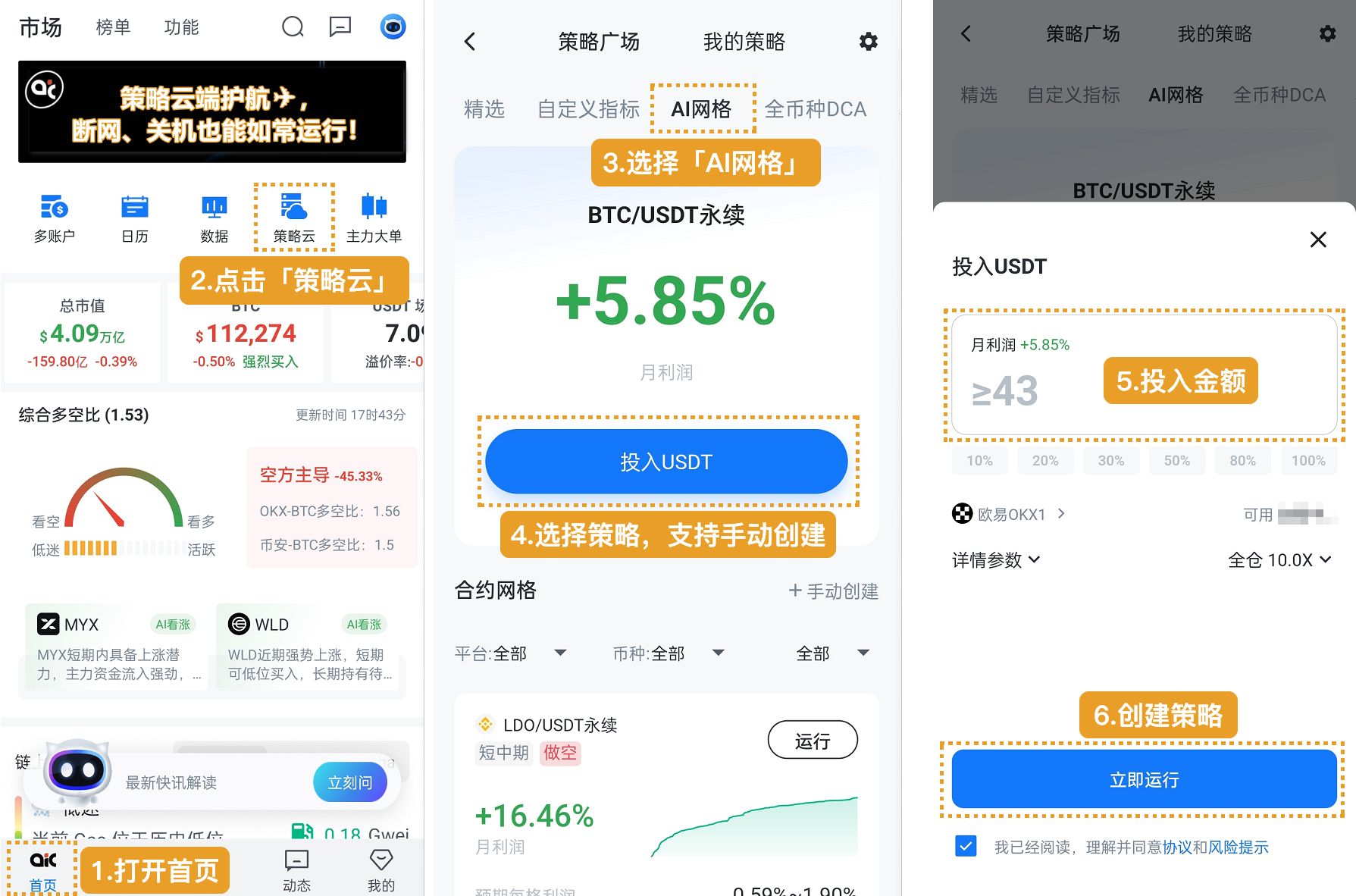

1️⃣ Create a Watchlist

In AiCoin, add the spot trading pairs of BTC, ETH, BNB, and SOL to your watchlist (such as Binance BTC/USDT, etc.).

2️⃣ Create a Strategy Based on Your Watchlist

Go to the AiCoin DCA strategy interface → Create a DCA bot → Choose "By Watchlist" → Load these four coins.

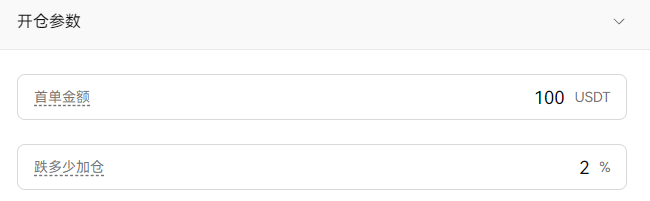

3️⃣ Set Unified Rules:

Replenishment Logic: Automatically buy more every time the price drops by 2%;

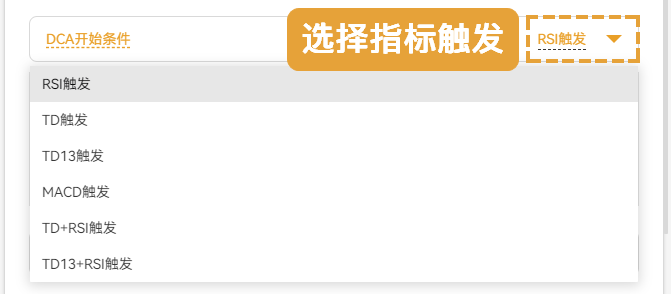

Trigger Conditions: Choose indicator triggers (TD/RSI/MACD), avoid blind bottom fishing

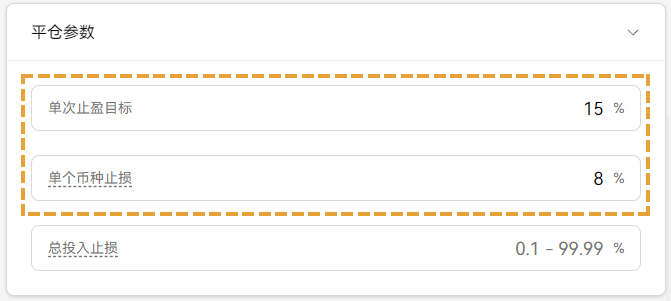

Take Profit/Stop Loss: Take profit at 15%, stop loss at 8%;

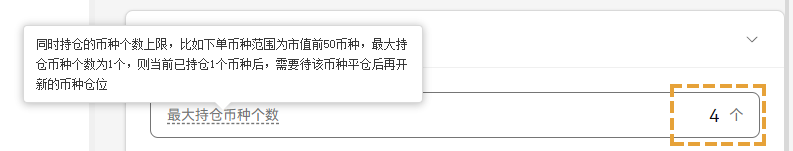

Advanced Settings: Set "Maximum Number of Positions" to 4 (lock in BTC, ETH, SOL, BNB);

Maximum Holding Period: 30 days;

Enable Profit Reinvestment: 50% of profits are automatically rolled into the next round.

Once the strategy is running, the system will automatically monitor these four coins in your watchlist.

As soon as any of them meets the trigger condition, the first order will be executed automatically, followed by the replenishment and take profit plan.

This means you don't need to stare at the screen, nor worry about missing the breakout signal of any coin.

Funds are diversified, risks are hedged, and efficiency is multiplied—three benefits in one.

III. Why Can AiCoin's DCA Strategy Outperform?

✅ 1. Full Coin Support, Spot + Futures All Covered

Supports all mainstream and emerging coins. Both spot DCA and futures DCA (long/short) can be configured with one click.

✅ 2. Smart Triggers, Say No to "Blind Investing"

Supports price, MACD, RSI, TD and other technical triggers—truly activating at key points, not wasting any opportunity to build positions.

✅ 3. Complete Risk Control

Take profit, stop loss, trading volume filtering, maximum holding period, automatic closing—all available. Set your rules, and it executes automatically.

✅ 4. Profit Reinvestment and Compound Growth

Profits are automatically rolled into the next round, achieving the compounding effect of "letting profits generate more profits."

✅ 5. Cloud Operation, No Interruption When Offline

The AiCoin APP supports cloud hosting of strategies. Even if you shut down or lose connection, the DCA strategy continues to run. Experience it now >> .

This entire mechanism upgrades DCA from a "lazy investment method" to a true strategic tool. It's not a "mindless buying loop," but a complete system that can achieve smart buying at lows and taking profits at highs amid volatility.

IV. Conclusion: Stop Staring Blankly at the K-Line, Let DCA Execute Your Plan

Crashes amplify emotions, but discipline grows assets.

The DCA strategy won't make you rich overnight, but it will allow you to act when others are fearful and steadily harvest when others are greedy.

In this uncertain crypto market, execution is always more valuable than prediction.

Now is the time to execute. Open the AiCoin DCA Strategy Center, create your first "multi-coin spot DCA," let the system execute for you, and let time help you accumulate.

Because in the end, the winner is never the one who guesses right, but the one who executes to the end.

Recommended Reading:

1. Practical Guide: Common Questions about DCA Strategies

2. Eight Reasons to Use AiCoin's All-Coin DCA

For more content, feel free to join our community, discuss together, and become stronger together!