Circle denies plans to issue HKD-backed stablecoins

Stablecoin issuer Circle declares that it has no current plans to issue its own stablecoin pegged to the Hong Kong dollar. However, it is open to collaborating with other firms.

- Circle has no plans to launch a Hong Kong dollar-backed stablecoin, instead focusing on expanding the adoption of its U.S. dollar and euro-pegged stablecoins, USDC and EURC, across Asia.

- At the moment, Circle is the world’s second-largest stablecoin issuer, with USDC holding a market cap of $75.28 billion and EURC leading among euro-backed stablecoins.

According to an interview with the Hong Kong Economic Times, the stablecoin firm’s Vice President for the Asia-Pacific region, Chen Qinqi, stated that the company has no plans to issue their own stablecoin backed by the Hong Kong dollar. Instead, it is currently focusing its efforts on expanding the utilization of its U.S dollar-stablecoin USDC and its euro-backed stablecoin EURC.

Hong Kong has seen a major increase in companies expressing interest in obtaining a license to issue HKD-pegged stablecoins, especially since the region released its Stablecoin Ordinance bill, which came into effect on Aug. 1.

The Stablecoin Ordinance provides a legal framework for stablecoin operations in the administrative region and includes requirements that firms need to adhere to if they wish to obtain a stablecoin issuer license from the Hong Kong Monetary Authority.

At the moment, Chen Qinqi clarified that institutional investors in Hong Kong can use USDC in Hong Kong under the existing framework without additional regulation related to the Stablecoin Ordinance. Moreover, the company does currently hold a license from Singapore.

Institutional investors can obtain USDC ( USDC ) either directly from Circle or through their established partners, while retail investors must access it through partners.

Although Circle is not directly regulated in Japan, USDC became the first stablecoin that Japanese regulators have allowed licensed institutions to offer to the public. Both retail and professional investors in Japan can obtain USDC through partners.

Earlier in November, Circle CEO Jeremy Allaire hinted at a possible expansion into Hong Kong, as the company looks to hire more employees and open up a branch in the region. Allaire has also stated that the firm is considering applying for a license under the new framework in Hong Kong.

Chen stated that the company has yet to move forward with plans to open an office in Hong Kong and the team is still in the process of evaluating potential office locations. He refused to comment on any specific steps taken to obtain a license under the bill.

Circle’s stablecoin empire

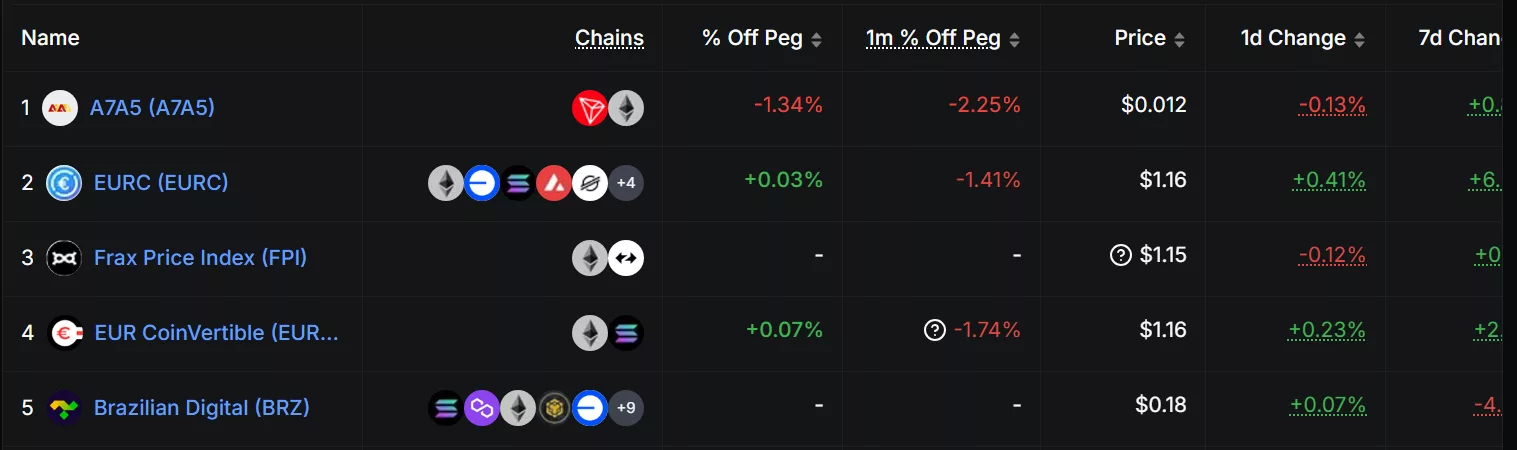

According to data from DeFi Llama, Circle’s USD-backed token, USDC is currently the second largest stablecoin by market cap. Falling behind only to Tether’s USDT ( USDT ), USDC has a market cap of $75.28 billion. However, it does have a faster daily growth rate than Tether, with a rise in market value by 0.41% compared to USDT’s 0.06%.

On the other hand, Circle is still the largest stablecoin issuer by market cap amongst the euro-backed stablecoins. The firm’s EURC ( EURC ) has a market cap of $266.5 million, contributing to more than 45% of the total $570 million market cap generated by euro-backed stablecoins.

Circle is one of the top five non-USD pegged stablecoins by market cap | Source: DeFi Llama

Circle is one of the top five non-USD pegged stablecoins by market cap | Source: DeFi Llama

With regards to non-USD backed stablecoins , EURC is still behind the ruble-backed A7A5. The ruble-backed stablecoin dominates the non-USD backed stablecoin market by more than 40%. Meanwhile, EURC still requires an additional $213 million if it wishes to surpass A7A5 as the largest non-USD pegged stablecoin issuer.

The stablecoin industry has been growing at an unprecedented pace, as it recently surpassed $300 billion in total market cap. JPMorgan’s latest report predicted that the stablecoin market is due for a massive increase, reaching $2 trillion within the next two years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: ETH Drops 12% While Institutions Acquire $1.37 Billion in Assets

- Ethereum fell 12% to $3,000 in November 2025, but institutions like BitMine aggressively bought 110,288 ETH ($400M) to expand holdings. - Over three days, eight major entities purchased 394,682 ETH ($1.37B), with a "Aave whale" acquiring 257,543 ETH ($896M) as prices dipped. - BitMine's $13.2B ETH treasury (2.9% of supply) and continued buying contrast with other firms scaling back, signaling growing institutional confidence amid low exchange reserves. - Analysts note BitMine's $200–300M/week purchases c

Quantum Computing and Blockchain Converge in the Quest to Safeguard Future Technologies

- IonQ and IBM advance in DARPA's QBI program, targeting 2M qubits by 2030 and fault-tolerant quantum systems. - D-Wave reports mixed Q3 results but raises 2025-2026 revenue forecasts after $1.8M German contract and analyst optimism. - Belden and WISeKey develop quantum-safe networking/satellite solutions to protect infrastructure from future quantum threats. - Crypto market surges 30-34% post-shutdown resolution, with institutional interest in cross-border payment tokens like HBAR/XLM. - Blaqclouds and ra

Ethereum News Update: Crypto Shares Rally Even as Ethereum Falls 12% with Whales Purchasing $1.37 Billion

- U.S. major stock indexes rose 0.23-1.5% on Nov 10, 2025, driven by crypto stocks like Coinbase (+4%) and Circle (+4.94%) amid renewed sector confidence. - Mercurity Fintech was added to MSCI Global Small Cap Indexes, enhancing institutional visibility and liquidity for its blockchain-powered fintech services. - Ethereum fell 12% to $3,000 but saw $1.37B in whale purchases, signaling long-term institutional confidence despite short-term price declines. - European indexes rebounded 0.47-1.22% as U.S. shutd

Bitcoin Updates: U.S. 10-Year Treasury Yield Ignores Downward Trends, Poised for Potential 6% Surge

- U.S. 10-year Treasury yields near 4% show bullish technical patterns mirroring Bitcoin's 2024 rally setup. - Divergence between bearish momentum indicators and price action suggests potential breakout to 6.25%. - Stacked SMAs and Ichimoku cloud confirm long-term uptrend, last seen in the 1950s. - Parallel to Bitcoin's $100k surge highlights market strength building beneath surface indicators. - Yield rise could pressure equities/cryptos but recent political stability may push Bitcoin toward $112k.